Sanctions have been considered by international relations scholars as states mechanisms to influence other governments on their policies. While the traditional view on sanctions implemented by J. Galtung and the Oslo Institute portrays sanctions as an instrument to “hurt the general public sufficiently that leaders are compelled to alter their behaviour as a result of pressure from the population”, empirical studies actually contradict this position on the grounds that in cases where sanctions have been implemented, results have generally been more coercion by the state vis-à-vis the population, and worsening economic situation for ordinary people. As for Russia, sanctions have been in force since April 2014. Yet, their efficiency has not been proven in curbing the Kremlin’s behaviour. It is arguable that fine-tuned, tough and harmonious Western sanctions could bear their fruits.

This article introduces sanctions as a “balance of risk” approach, where calculated action is required to punish without being counter-punished. Indeed, the West has been timorous with Russia following the annexation of Crimea owing to the economic interdependence between the EU and Russia. Nevertheless, the mixed outcomes resulting from sanctions could be offset through a broader degree of political implication from Western governments. Thus, this article will scrutinise how the West can manoeuvre to benefit from a positive balance of risk while dealing with Moscow.

Towards a new paradigm of sanctions after the failure of the existing model

At the dawn of the 60s, sanctions were perceived by the Oslo Institute as an efficient deterrence mechanism within greater cooperation at the international scale between states and the growth of International Organisations. In line with the “doux commerce” theory in the 17th century, inter-state exchange and trade create an economic interdependency between states which provides a framework for states to cooperate and play by the rules while doing so. A state which for one reason or another disrupts this order can be sanctioned or ostracized through a coalition of other states implementing trade restrictions or embargos. Therefore, the disrupting state would face pressure from its population to restore policies in line with the UN system and reestablish its status in the eyes of the world.

It must be noted that there exist different degrees of sanctions. They can be at any national or supranational level. Overall, banning from the SWIFT transfer system that will be scrutinised, later on, is usually considered as the culmination of economic sanctions.

In Iran for instance, we perceive a good picture of what sanctions look like and of their aftermaths. The Obama administration decided to isolate the mullah regime through freezing assets, forbidding financial institutions and firms to engage in cooperation with Iranian institutions, and denying its financial institutions to use the SWIFT transfer system. As a result of those sanctions, Iran lost half of its oil export revenues and experienced a plummet in its foreign trade. They drastically assisted the West to force Iran to the table of negotiation and implement the JCPOA in 2015.

Unfortunately, successful implementation of sanctions, as in the case of Iran does not always pay off and that reality does not always match the expectations.

It is evident that the sanctions implemented by both the US and the EU after the Russian annexation of Crimea in 2014 were inadequate to force Moscow to surrender and back off on Ukraine as is highlighted crudely by the Russian ambassador in Sweden in a recent interview. These sanctions consisted of freezing assets, suspension of visa allocation to go to the US and the EU for Russian persons or entities. But there was not full harmony on actions towards Iran. For example, the EU refused to uphold broader sanctions related to trade and limited itself to a list of 21 persons subject to this legislation.

In most cases, freezing assets are a symbolic manner to sanction a state and it is a flash in the pan for the Russian economy. Besides, the recent decade brought to light the massive and opaque tax avoidance at the global scale resulting from the absence of an international fiscal watchdog to control incomes and punish bad taxpayers. With regards to that, Russian oligarchs and elites are talented enough to slip through the net and get around sanctions thanks to dummy corporations for instance.

Not only did Russia survive sanctions, but it also came out stronger by developing a David and Goliath story in which Russia survived “oppression.” For the latter, most credit should be given to the half measures of sanctions rather than Russia.

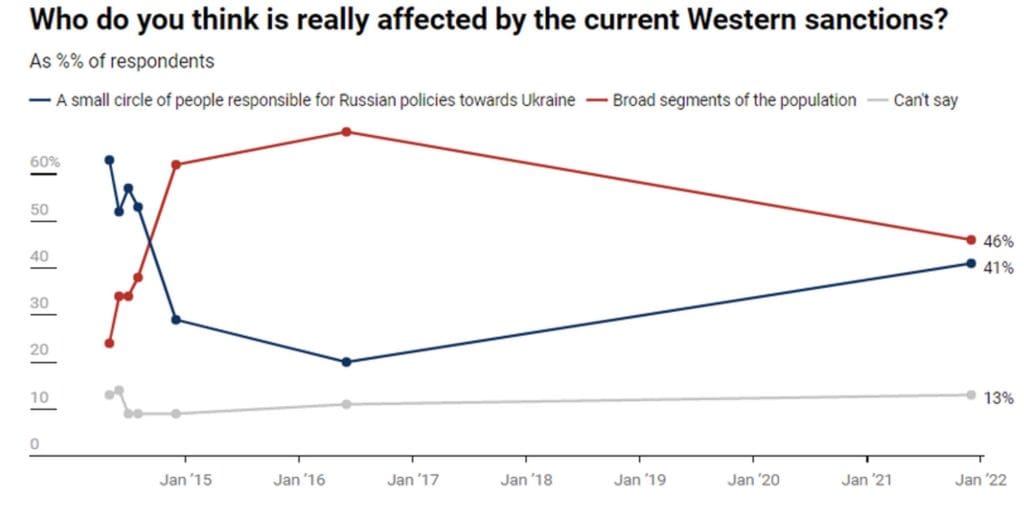

Accordingly, the Russian population do not feel concerned about sanctions due to the fact that they have not seen any particular change in their daily life in previous cases. Indeed, in March 2014, a survey conducted by the Levada centre concluded that 53% of the respondents felt concerned about western sanctions. The rate of respondents not feeling concerned about sanctions dwindled to only 32% in a survey conducted in December 2021.

Inversely, according to 41% of respondents of the survey in December 2021, the Russian elites were the target of sanctions and this group would be the most affected.

From Soviets to Oligarchs: Inequality and Property in Russia, 1905-2016, by F. Novokmet, T. Piketty & G. Zucman 2017

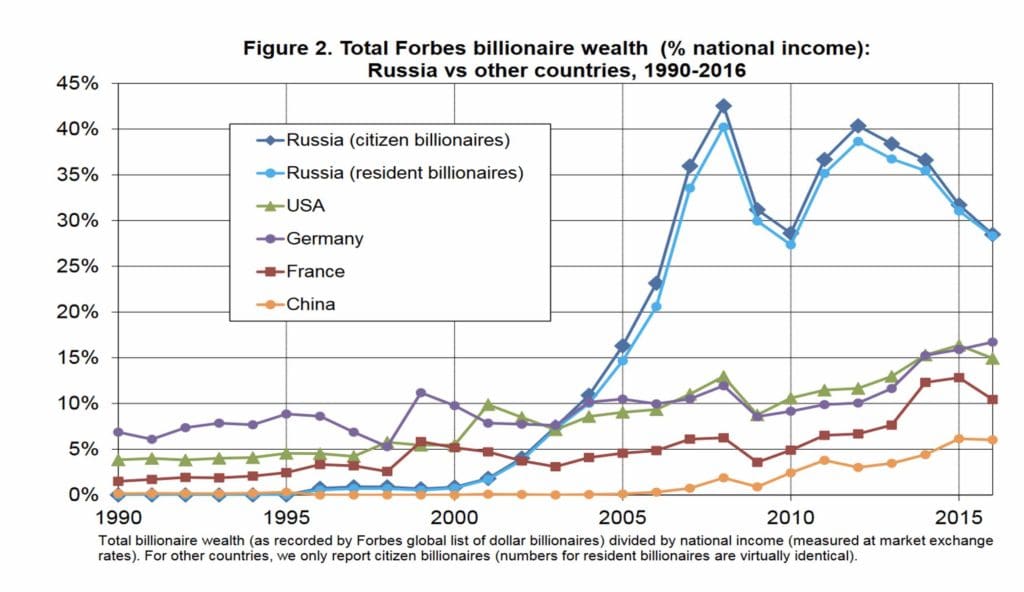

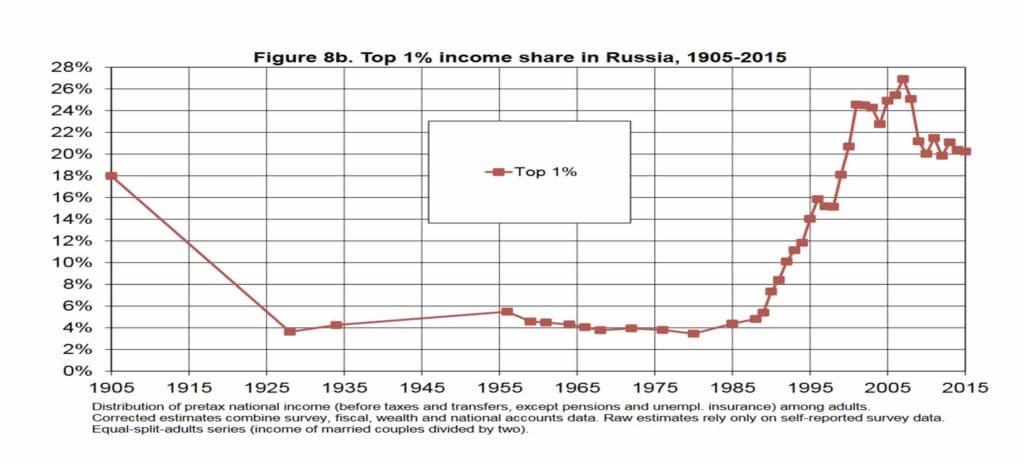

Sanctions have the potential for greater impact if they are implemented in harmony and full force. Germany for instance has been denounced for its permissiveness towards Russia, its refusal to send arms, or not showing “stick” on the fate of Nord Stream 2 in the early stages in case of Russian aggression. Even if the EU-US efforts to sanction Russian elites are praiseworthy, they are genuinely insufficient. The Russian economy is characterized by its exponential inequalities since the fall of the USSR and many billionaires came to the surface during Putin’s time in power. His entourage is therefore the ones who benefited the most from the Kremlin and inversely the ones who can influence him in the good direction if their fortune is jeopardized.

Revisiting the theory of J. Galtung, Russian oligarchs and wealth-producing international entities, in face of a net crash of their assets would push the Kremlin to listen to reason. Notwithstanding the unprecedented boom they enjoyed within Putin-era, the risk of immense losses would motivate them to get him to his senses.

From Soviets to Oligarchs: Inequality and Property in Russia, 1905-2016, by F. Novokmet, T. Piketty & G. Zucman 2017

How to make the Kremlin return to senses?

In a recent article in Le Monde, T. Piketty, a renowned economist followed by figures such as G. Zucman or B. Milanovic, offered an array of suggestions to compel Moscow to stop its actions towards Ukraine. Basically, Piketty recommended targeting the 0,02% most opulent in Russia. He came to the conclusion that even if polls, surveys indicate that the Russian population supports their leader’s actions, the structure of Putin’s power is in the hands of the oligarchs. Russia is not as repressive as China towards its elite. Therefore, the oligarchs are in a comfort zone and western sanctions have not pushed them out yet. They found a way to get around sanctions and this status quo suits them well. However, if Western countries succeed to make them accountable for their actions and deprive them of their bread and butter, they might find a way to put a halt to Putin’s actions and make his ears burn.

From Soviets to Oligarchs: Inequality and Property in Russia, 1905-2016, by F. Novokmet, T. Piketty & G. Zucman 2017

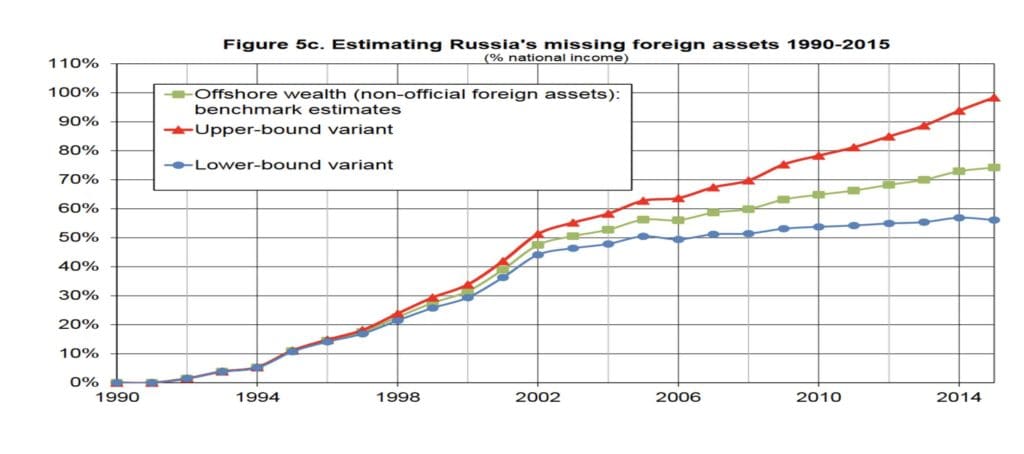

Nonetheless, the international financial system as it is, makes this assumption utopian. Russian oligarchs are safe as long as the international community does not implement new instruments to prevent tax avoidance. Many Russian billionaires own assets in European or American banks and tax havens. Functional control mechanisms could genuinely put pressure on these opulent persons. For example, it is considered that the offshore wealth of Russian citizens reach between 55 and 100% of the Russian national income. No doubt, freezing or draining of this wealth by the Western capitals could encourage the Russian elites to move in the direction of peace.

From Soviets to Oligarchs: Inequality and Property in Russia, 1905-2016, by F. Novokmet, T. Piketty & G. Zucman 2017

SWIFT: A frightening acronym for Moscow

These recent months burst the idea of exclusion of Russia from SWIFT, a Brussel-based interbank transfer system. SWIFT allows financial institutions to make transactions with one another and it has no alternative. Exclusion from SWIFT is seen by Moscow as the worst-case scenario and the ultimate degree of sanctions at the West’s disposal. This sanction proved its efficacy in the case of Iran, and in 2014 the Russian Finance Minister estimated the cost of a SWIFT eviction would be a loss of 5% of the national GDP.

If its efficacy is so well documented, then why does the West is not so eager to use it against Russia, especially knowing that it was open for discussion among western chancelleries. Well, the answer is that Europeans would shoot themselves in the foot doing that. They would also jeopardize the bilateral trade with Russia, which is more significant than the trade between the US and Russia.

The US more actively advocates Russian expulsion from SWIFT than its European allies. The US companies and financial institutions are not particularly linked to the Russian economy. France, for instance, has more than 10 billion $ bilateral trade with Russia and 160.000 French jobs are implicated in this bilateral trade.

Moreover, Russia is not Iran, although they both revert to China to keep their economies afloat in case of drastic sanctions implemented by the West. Of course, Russian financial institutions are broadly embedded in international trade and the exclusion from the SWIFT system would be a heavy blow for the country. However, since 2014, Russia has forecasted this eventuality and developed its own system named SPFS (System for transfer of financial messages) in addition to a national payment card system (MIR) that should prevent western sanctions to have a colossal impact on its economy over time. These mechanisms are still in their early stages and predictions about the ability to resist an exclusion of the SWIFT system are vague. Although the SPFS was adjoined to all Russian banks, and it is increasingly used and endorsed by the Russian government, it only represents 20% of all domestic transfers. Tariffs for transactions are higher than through the SWIFT system. Ultimately, Russia could join the CIPS (Chinese cross-borders interbank payment system) as a counter-model for SWIFT, but the Kremlin is unlikely to hit the panic button and put its economic independence in Beijing’s hands.

Why are Western actors so reluctant to impose drastic sanctions?

If we draw a comparison between European sanctions against Russia made in 2014 and then in 2022, we might come to the same conclusion, Europe and to a lesser degree, the US are not willing to implement tougher sanctions against Russia. As an example, we took the European Council decision made on the 17th March 2014 and the new version of the Sanctions and anti-money laundering Act made the 10th February 2022. The lexicon is more or less the same, somehow monotonous, individuals, entities involved in destabilizing Ukraine, or people obtaining a benefit from or supporting the Government of Russia are the targets of sanctions that remain the same over time. Eyeing the failure of the previous sanctions, one would ask why Europe does not change its methods.

According to Piketty, economic interdependence plays a significant role in the decision of Europe to back-pedal on sanctions. Especially Germany, and to a lesser degree Italy, would be in trouble due to important volumes of gas imports from Russia. His premise explains well why Germany plays particularly the diplomatic card, refuses to send arms to Ukraine, and disregard critiques of the Nord Stream 2.

Then, Piketty further develops his suggestions, arguing Europe will not be able to sanction Moscow effectively until it does not equip itself with the right instruments. More precisely, Piketty talks about a “Global Financial Registry”, a centralized databank gathering all the relevant information about assets owned by the Russian individuals in Europe-US. Once completed, the registry would expose the Russian fortunes and leave them to the mercy of the sanctions. The main problem of his proposal is that it will not only expose Russians who resort to tax avoidance but also the European and American ones. The fortunes of the latter would be defenceless too. That’s why no one has an interest in implementing a Global Financial Registry of any kind. To follow a quote made by M. Snegovaya, “at some point, the West will have to sacrifice a little bit of its well-being if the goal is to deter Putin.” Inversely, as long as Europeans and Americans are unable and unwilling to implement some internal reforms, the sanction will remain an empty word.

Conclusion

Sanctions are mechanisms that have to be implemented very cautiously in order not to have repercussions on the population. The ideal of J. Galtung in which sanctions could make autocrats and leaders listen to reason is not what has happened in many cases. Leaders as in Haiti did not hesitate to cross the Rubicon while the word of the sanctions reverberated among their populations.

In order to avoid the population being the victim of sanctions, the EU- US seems to have reached a compromise favouring a sanction regime which on the one hand comes close to the suggestions of T. Piketty by application of more transparency on taxation within the globe, and on the other hand, refuses to put this transparency into practice for their own assets. Thus, to mitigate pernicious effects on the Western entities, a policy innovation has been made generally dubbed as smart or targeted sanctions. These sanctions are according to D. Drezner “designed to hurt elite supporters of the target regime, while imposing minimal hardship on the mass public”. In this regard, sanctions would no longer be a “Blunt instrument which hurt a large number of people who are not their primary target” as defined by the former Secretary-General of the UN K. Annan but would be only directed to people around V. Putin.

At this early stage, it is still early to make an exact calculation on the success or unsuccess of the targeted sanctions. Yet, some analysts are pessimistic, stating that Putin’s inner circle, oligarchs are not strong enough to challenge Kremlin’s Lordship. Clearly, after two decades in power, V. Putin has somehow freed hands regarding decision-making, as it was illustrated by the ludicrous episode with his foreign intelligence head, Sergei Naryshkin. However, if the West succeeds to find a consensus on sanctions, and to establish a registry of assets that would make sanctions more effective, as the US Department of the Treasury for instance (Specially Designed Nationals and Blocked Person List) did, this strategy could prevail and erode the omnipotence of V. Putin within his own border.

Martin Velly is currently following Master’s Program in Political Science at the Free University of Brussels (Université Libre de Bruxelles – ULB)

and is currently a research assistant intern at Beyond the Horizon ISSG.

Bibliography :

Susan.H. Allen & D. Lektzian, (2013). Economic sanctions a blunt instrument? Journal of peace research, vol 50 DOI:10.1177/0022343312456224

- Drezner, (2011). Sanctions sometimes smart: Targeted sanctions in theory and practice. International studies review, vol 13 https://www.jstor.org/stable/23016144

- Nougayrède, (2018). Towards a Global Financial Register? The case for end investor transparency in central securities depositories. Journal of Financial regulation vol 4 https://doi.org/10.1093/jfr/fjy003

- Peksen, (2009). Better or worse? The effects of economic sanctions on Human rights, Journal of peace research, vol 46 https://www.jstor.org/stable/27640799

- Shagina, (2021). How disastrous would disconnection from SWIFT be for Russia? Carnegie Moscow Center. https://www.russiamatters.org/analysis/how-disastrous-would-disconnection-swift-be-russia

Newspaper article:

https://www.levada.ru/en/2022/01/28/anti-russian-sanctions/

https://www.nytimes.com/2022/01/29/us/politics/russia-sanctions-economy.html

https://www.legislation.gov.uk/uksi/2022/123/made/data.pdf

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014D0145&rid=1

https://www.mirror.co.uk/news/world-news/vladimir-putin-bullies-russias-spy-26304679