Introduction

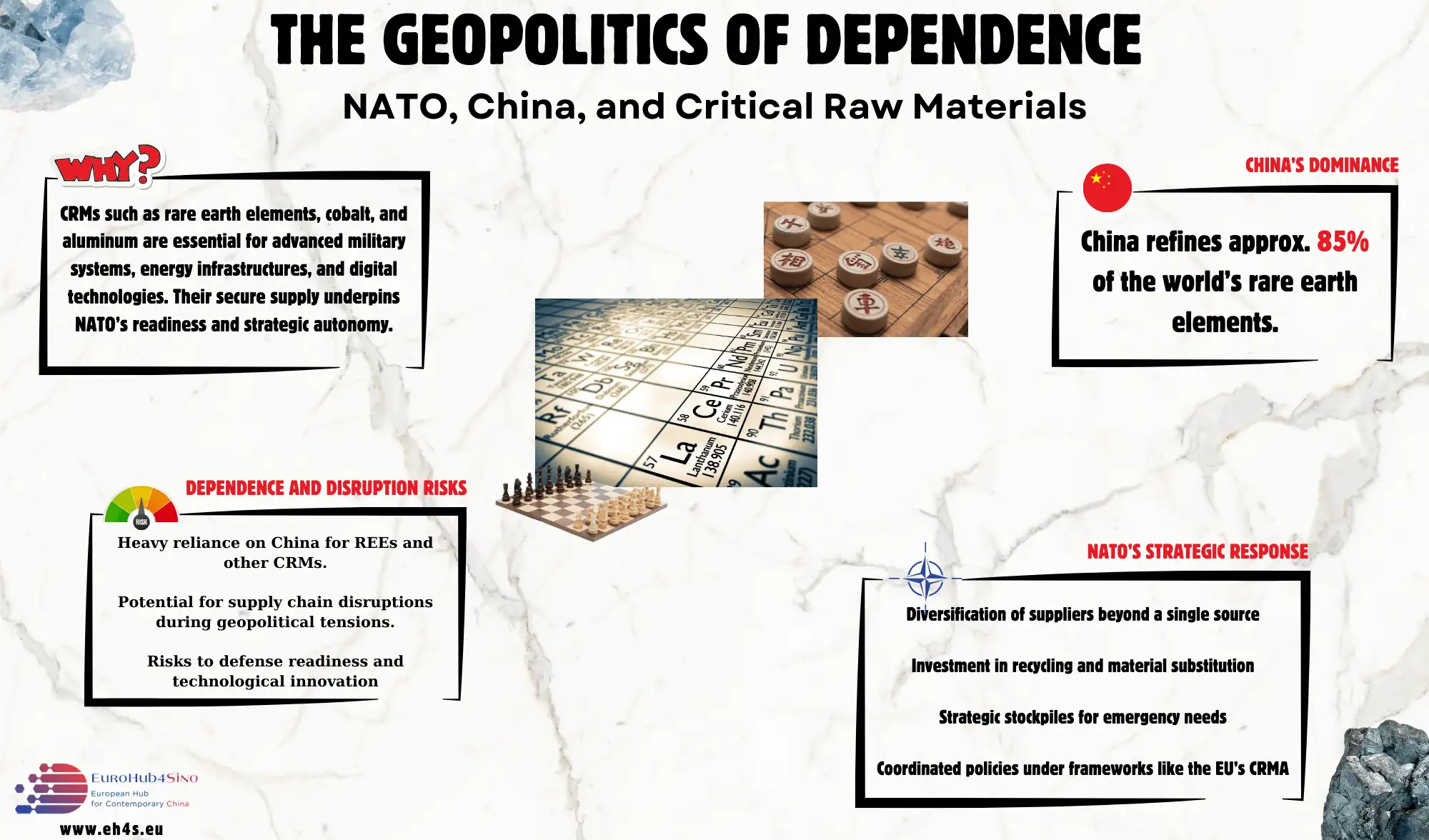

Critical raw materials (CRMs) underpin contemporary defense, energy, and technological capabilities. They lie at the heart of advanced military systems, support the expansion of clean energy infrastructures, and enable cutting-edge digital networks. As strategic competition intensifies, ensuring a reliable and secure supply of these materials has emerged as a pressing concern, particularly for NATO and its member states. Materials such as rare earth elements, aluminum, graphite, and cobalt serve as essential inputs for applications ranging from jet engines and radar systems to electric vehicles and renewable power grids, thereby shaping both the security environment and broader economic stability.

NATO’s increasing emphasis on CRMs reflects a recognition that supply chain vulnerabilities affecting its member states’ defense industries must be addressed. For example, the Alliance’s 2024 defense-critical supply chain roadmap identifies key materials whose uninterrupted availability is essential to sustain deterrence and defense capabilities. Even a modest disruption could impede the timely production and deployment of critical equipment, compromising operational readiness and technological advantages.

Central to this challenge is China’s dominant role in the CRM market. China maintains a substantial share in mining and refining—controlling approximately 85% of the world’s refined Rare Earth Elements (REEs)—and has, on multiple occasions, employed its leverage for geopolitical gain. This reality is evident in China’s 2010 rare earth export ban targeting Japan and in its December 2024 export restrictions on gallium, germanium, and antimony destined for the United States. Such measures underscore Beijing’s capacity to exploit CRM dependence as a form of strategic coercion, raising concerns for NATO and its allies.

In response, NATO members and partners have begun advancing initiatives designed to diversify supply sources, create strategic reserves, enhance recycling capabilities, and invest in material substitutes. The European Union’s Critical Raw Materials Act (CRMA) augments these efforts by introducing systematic targets for extraction, processing, and recycling within the EU. By examining NATO’s vulnerabilities, China’s market dominance, and ongoing mitigation strategies, this analysis assesses how the Alliance can navigate complex resource dynamics and safeguard its technological and operational advantages in a rapidly evolving geopolitical context.

The Importance of CRMs for NATO’s Defense Capabilities

CRMs are integral to NATO member states’ ability to maintain a technological edge, ensure readiness, and support modern defense industries across operational domains. Their significance extends to a broad range of systems, platforms, and support architectures, yet the geographic concentration and relative scarcity of these materials pose enduring strategic challenges.

The Role of CRMs in Modern Defence Systems

NATO has identified 12 CRMs —aluminum, beryllium, cobalt, gallium, germanium, graphite, lithium, manganese, platinum, REEs, titanium, and tungsten—as vital to defense production and capability development. Each contributes to the performance and resilience of advanced military systems:

- Aluminum: Its light weight and durability make it indispensable for aircraft frames, missiles, and other aerospace components, ensuring both agility and fuel efficiency.

- Graphite: Its thermal stability and structural qualities help reduce acoustic and radar signatures in submarines and armored vehicles, enhancing stealth capabilities.

- Cobalt: Found in high-temperature superalloys, cobalt strengthens jet engines, missile parts, and naval platforms, allowing them to withstand extreme operational conditions.

- Rare Earth Elements: Essential for precision-guided munitions, advanced optics, radar systems, and cutting-edge electronics, REEs drive the sophisticated functionalities that define modern military technologies.

Collectively, these materials support NATO’s ability to outpace adversaries in precision, mobility, and adaptability—core attributes of credible deterrence and defense.

Strategic Vulnerabilities and Dependencies

The reliance of NATO member states on a concentrated pool of external suppliers introduces several strategic risks. Most prominently, China’s dominant role affords it significant leverage over CRM value chains. Its prior export bans, including the recent restrictions affecting gallium, germanium, and antimony, illustrate how access can be politicized and weaponized.

Furthermore, natural disasters, pandemics, trade conflicts, and market manipulations can all disrupt the timely flow of CRMs. The complexity of global supply chains complicates efforts to mitigate these risks, as dependencies extend from raw extraction to refining and advanced processing. A single chokepoint can halt production lines for critical defense equipment, diminish readiness, and delay the introduction of next-generation capabilities.

Applications Across NATO’s defense Architecture

CRMs are embedded in many domains:

- Air Power: Aluminum and titanium support lighter, more efficient aircraft and enhance the performance of fighter jets and transport planes.

- Naval Superiority: Graphite improves stealth in submarines, while cobalt enhances critical propulsion components, contributing to quiet and reliable naval operations.

- Advanced Electronics: REEs and other CRMs enable sophisticated radar, sensor, and communication systems, ensuring superior situational awareness in contested environments.

- Energy and Mobility: Lithium and manganese improve energy storage solutions for UAVs, mobile command posts, and electromagnetic warfare platforms, bolstering endurance and responsiveness.

Securing steady CRM access is thus imperative for sustaining NATO’s advantage. Without reliable supplies, critical systems may falter, undermining deterrence and crisis-response capacities.

The Strategic Imperative for Securing CRMs

To address these vulnerabilities, NATO prioritizes supporting its member states’ efforts to enhance supply chain security and sustainability. Key initiatives include diversifying supply sources, building strategic reserves, advancing recycling technologies, and working closely with partners such as the EU. Collectively, these strategies aim to reduce dependencies, promote flexibility, and ensure that NATO’s technological and operational advantages are preserved amidst growing geopolitical uncertainties.

China’s Dominance in the CRM Market and Its Implications

China’s ascendancy in CRM markets is no accident. Over the past two decades, Beijing has leveraged resource abundance, state-led investment, and strategic policymaking to dominate extraction, processing, and refining. This vertical integration yields immense geopolitical influence, allowing China to shape global price structures and access conditions. By one estimate, China’s share of refined REEs is about 85%, granting it the power to influence the production and affordability of essential military, industrial, and consumer technologies worldwide.

This degree of control raises profound challenges for NATO and its allies. Beyond the immediate risk of supply chain disruptions, China’s ability to use CRMs as political tools complicates alliance cohesion and strategic planning. Dependence on a single, potentially adversarial supplier can stifle innovation, deter investment in alternative supply chains, and erode the Alliance’s long-term readiness. Under such circumstances, CRM vulnerabilities become intertwined with broader security concerns, from energy independence to economic resilience.

The Extent of China’s Control

China’s leadership in the CRM market can be attributed to a combination of resource abundance, state investment, and strategic policymaking:

- Resource Abundance: China possesses some of the world’s largest reserves of REEs, graphite, and other CRMs.

- State-Led Strategy: Through targeted subsidies, investments, and export controls, the Chinese government has fostered a competitive CRM industry capable of dominating global markets.

- Processing Capacity: Beyond extraction, China controls over 70% of global processing for key CRMs, refining raw materials into high-value products required for advanced technologies.

For example, China produces 85% of the world’s refined REEs, which are indispensable for military technologies, clean energy, and consumer electronics. This vertical integration allows China to set prices, influence market access, and exert pressure on countries dependent on its supply.

Geopolitical Implications

China’s dominance in the CRM market presents strategic and economic challenges for NATO allies:

- Supply Chain Vulnerabilities: Dependence on Chinese CRMs exposes NATO to disruptions from trade conflicts or export bans. The 2024 restrictions demonstrate the potential for critical disruptions in Western technological and military advancements.

- Weaponization of Resources: China’s 2010 REE export ban on Japan and the recent gallium and germanium restrictions highlight its willingness to leverage CRMs for geopolitical purposes.

- Market Manipulation: By flooding global markets with low-cost CRMs, China has undercut competitors, discouraging investment in alternative supply chains and processing capabilities.

The strategic implications are profound. A disruption in CRM supply could impede NATO’s ability to produce critical defense equipment, undermining its operational readiness and technological superiority. Additionally, China’s control over CRMs complicates NATO’s efforts to achieve energy security and technological independence.

NATO’s Strategic Responses to CRM Dependence

NATO has recognized the critical vulnerabilities posed by its reliance on limited and geopolitically sensitive sources of CRMs. To address these challenges, the Alliance and its member states have adopted a comprehensive strategy that combines diversification of supply chains, technological innovation, international collaboration, and policy measures. These responses are geared towards securing a sustainable and resilient CRM supply chain to support defense readiness and technological superiority.

Diversifying Supply Chains

Reducing dependence on a single supplier, especially China, is paramount for NATO’s strategic autonomy. Key efforts include:

- Partnering with Resource-Rich Countries: NATO and its member states are forging partnerships with like-minded nations such as Australia, Canada, and African countries. These partnerships aim to secure access to untapped or underutilized CRM resources while promoting mutual economic and security interests.

- Encouraging Domestic Production: Member states are incentivized to develop their own mining and processing capacities. For instance, countries with CRM reserves, such as Sweden (rare earth elements) and Poland (coking coal and copper), are enhancing local production to reduce NATO’s reliance on external sources.

- Developing Strategic Trade Agreements: NATO encourages its member states to pursue trade agreements that focus on securing reliable access to CRMs. For example, multilateral arrangements within the European Union’s Critical Raw Materials Act (CRMA) align with NATO’s objectives by aiming to limit reliance on a single source for over 65% of CRM imports.

Promoting Recycling and Circular Economy

To reduce dependence on newly mined CRMs, NATO is promoting a circular economy approach that includes recycling, reuse, and substitution of critical materials.

- Advanced Recycling Technologies: Investments are being made in recycling systems capable of recovering CRMs from obsolete defense equipment, such as batteries, aircraft components, and radar systems. These technologies ensure that a higher percentage of materials can be reused within NATO’s supply chain.

- Developing Substitutes: NATO’s innovation programs support research into alternative materials that can replace traditional CRMs without compromising performance in defense systems. For example, graphene-based composites are being explored as substitutes for rare earth elements in high-performance electronics.

Strategic Stockpiling

To safeguard against potential supply chain disruptions, NATO is working with member states to build and manage strategic stockpiles of CRMs.

- National Reserves: Member states are establishing or expanding their CRM reserves to ensure adequate supplies for critical defense production needs during emergencies.

- Coordinated Stockpiling Policies: NATO facilitates coordination among allies to optimize stockpiling efforts and reduce redundancies. Shared policies also enhance the collective ability to respond to supply chain crises.

Strengthening Technological and Industrial Collaboration

Technological innovation and collaboration with industry are pivotal to reducing CRM dependencies.

- Innovation Hubs: NATO supports innovation hubs that bring together governments, private sector players, and academic institutions to develop new technologies for CRM extraction, refining, and recycling.

- Public-Private Partnerships: Collaboration with the private sector ensures that NATO benefits from industry expertise and cutting-edge technologies. Companies specializing in rare earth processing and advanced manufacturing are being incentivized to expand operations within NATO member states.

Enhancing Supply Chain Resilience through Policy and Governance

Policy frameworks are being strengthened to ensure long-term CRM supply chain stability.

- The Critical Raw Materials Club: NATO and its member states are actively involved in the establishment of the CRMs Club, a coalition of allied nations that focuses on shared investments, coordinated trade policies, and collective risk management for CRM supply chains.

- Streamlining Permitting Processes: Governments are reforming permitting and regulatory processes to expedite CRM mining and refining projects. For instance, under the CRMA, extraction projects in the EU are granted streamlined approval timelines.

- Combatting Market Manipulation: NATO allies are coordinating efforts to counteract China’s market manipulation tactics, such as price dumping, which discourage investments in alternative CRM supply chains.

Leveraging Strategic Alliances

NATO is leveraging its partnerships with international organizations and frameworks to amplify its CRM strategy.

- EU-NATO Cooperation: Close collaboration between NATO and the European Union ensures alignment of CRM-related strategies, such as those outlined in the CRMA and the Green Deal Industrial Plan.

- Engagement with the Minerals Security Partnership (MSP): NATO supports the MSP, which promotes secure and sustainable global CRM supply chains among democratic nations.

- G7 and G20 Initiatives: NATO allies are participating in global forums to establish norms and standards for CRM sourcing, emphasizing environmental sustainability and fair labor practices.

Mitigating Geopolitical Risks

Given China’s dominant role in the CRM market, NATO is supporting its member states in managing geopolitical risks associated with CRM dependencies.

- Scenario Planning and Simulations: NATO conducts regular exercises to anticipate and mitigate the impact of potential supply chain disruptions, such as export bans or embargoes.

- Counter-Coercion Measures: The Alliance is developing measures to respond to CRM-related coercion, including trade retaliation and the establishment of alternative supply routes.

Conclusion

Critical raw materials are indispensable for NATO’s ability to maintain technological superiority, operational readiness, and strategic autonomy in an increasingly contested global landscape. These materials underpin a wide range of defense systems, energy technologies, and digital infrastructure, making their secure and sustainable supply a strategic imperative for the Alliance.

NATO member states’ dependence on CRMs, particularly those controlled by China, exposes the Alliance to significant risks, including supply chain disruptions, geopolitical leverage, and economic vulnerabilities. China’s dominant position in the mining, processing, and export of CRMs highlights the urgent need for NATO to develop a comprehensive strategy to mitigate these risks and reduce its reliance on a single supplier.

The Alliance has already taken significant steps to address these challenges, including diversifying supply chains, advancing recycling technologies, and fostering collaboration with like-minded nations. Initiatives such as strategic stockpiling, multilateral agreements, and investment in innovation are critical to enhancing the resilience and sustainability of NATO’s CRM supply chains.

Looking ahead, NATO must prioritize strategic autonomy while maintaining strong partnerships with global allies. A proactive approach that combines technological innovation, robust policy frameworks, and ethical sourcing practices will ensure the Alliance remains prepared to meet the challenges of the future. By turning CRM dependence into an opportunity for collaboration and innovation, NATO can secure its position as a leader in global security and technology while safeguarding the stability and prosperity of its member states.

Related Infographics