Introduction

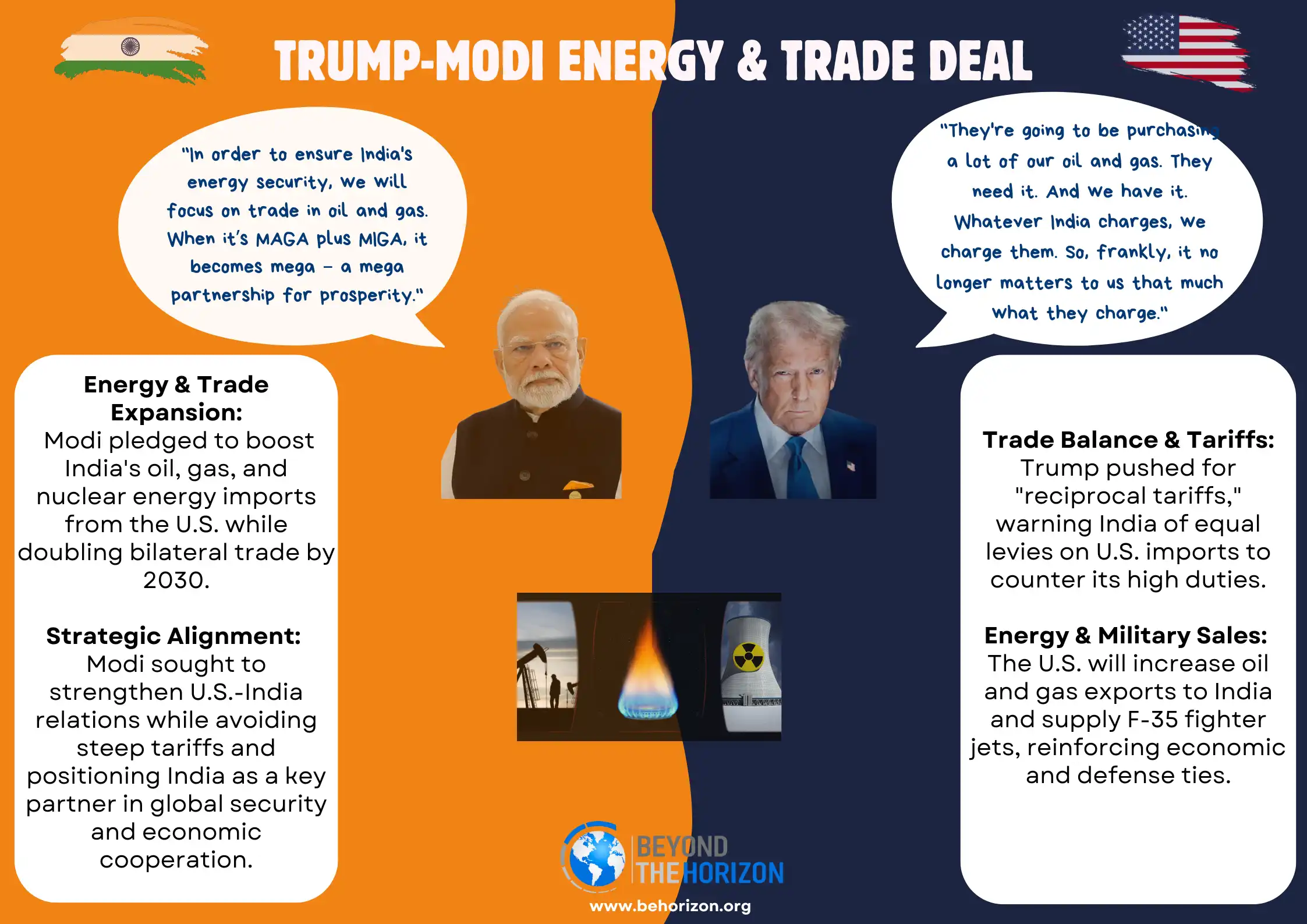

President Donald Trump’s return to the White House in January 2025 has brought a series of abrupt policy shifts that are reverberating across the NATO alliance. In a matter of weeks, longstanding U.S. approaches to European security have been upended. From U.S. troop deployments in Europe to the very premise of NATO’s mutual defense pledge, Trump’s decisions are testing transatlantic ties. Officials and analysts are scrambling to assess the impact of these moves on NATO’s unity and future. This analysis examines the key changes in U.S. policy – including military posture adjustments, statements on NATO’s Article 5 commitments, diplomatic dynamics with European allies, and intensified burden-sharing demands – and evaluates NATO’s response as well as potential long-term implications for the alliance.

U.S. Military Commitments in Europe

Troop Withdrawals and Redeployments: President Trump has moved swiftly to reconsider the U.S. force posture on the continent. In early March 2025, reports emerged that he is “weighing up withdrawing some 35,000” U.S. troops from Germany – essentially a near-total pullout – and redeploying them to Eastern Europe. The plan appears aimed at concentrating U.S. forces in NATO countries that meet defense spending targets, as Trump “is said to be considering repositioning” troops to countries that have “upped their defence spending to meet GDP targets”, favoring allies he deems more responsible. This would represent a dramatic reshaping of U.S. basing in Europe and has already raised concerns about souring U.S.-Europe relations.

Reversing Prior Deployments: These moves build on Trump’s long-held skepticism of stationing U.S. forces abroad in wealthy allied nations. He has for years argued that countries like Germany benefit from U.S. protection without paying their share. During his first term, he even ordered the withdrawal of nearly 12,000 troops from Germany, a move halted by the subsequent administration amid congressional backlash. Now, emboldened by a second term, Trump appears poised to follow through on an even larger drawdown. U.S. Defense officials have not formally announced the 35,000-troop withdrawal, but they acknowledge that “the redeployment of troops around the world” is under consideration to best address current threats. Notably, the U.S. Vice-President, J.D. Vance, has floated linking the remaining U.S. military presence in Germany to unrelated issues like Berlin’s domestic policies, questioning whether American taxpayers should support Germany’s defense “if you get thrown in jail in Germany for posting a mean tweet”. Such rhetoric underscores the administration’s transactional view of troop basing.

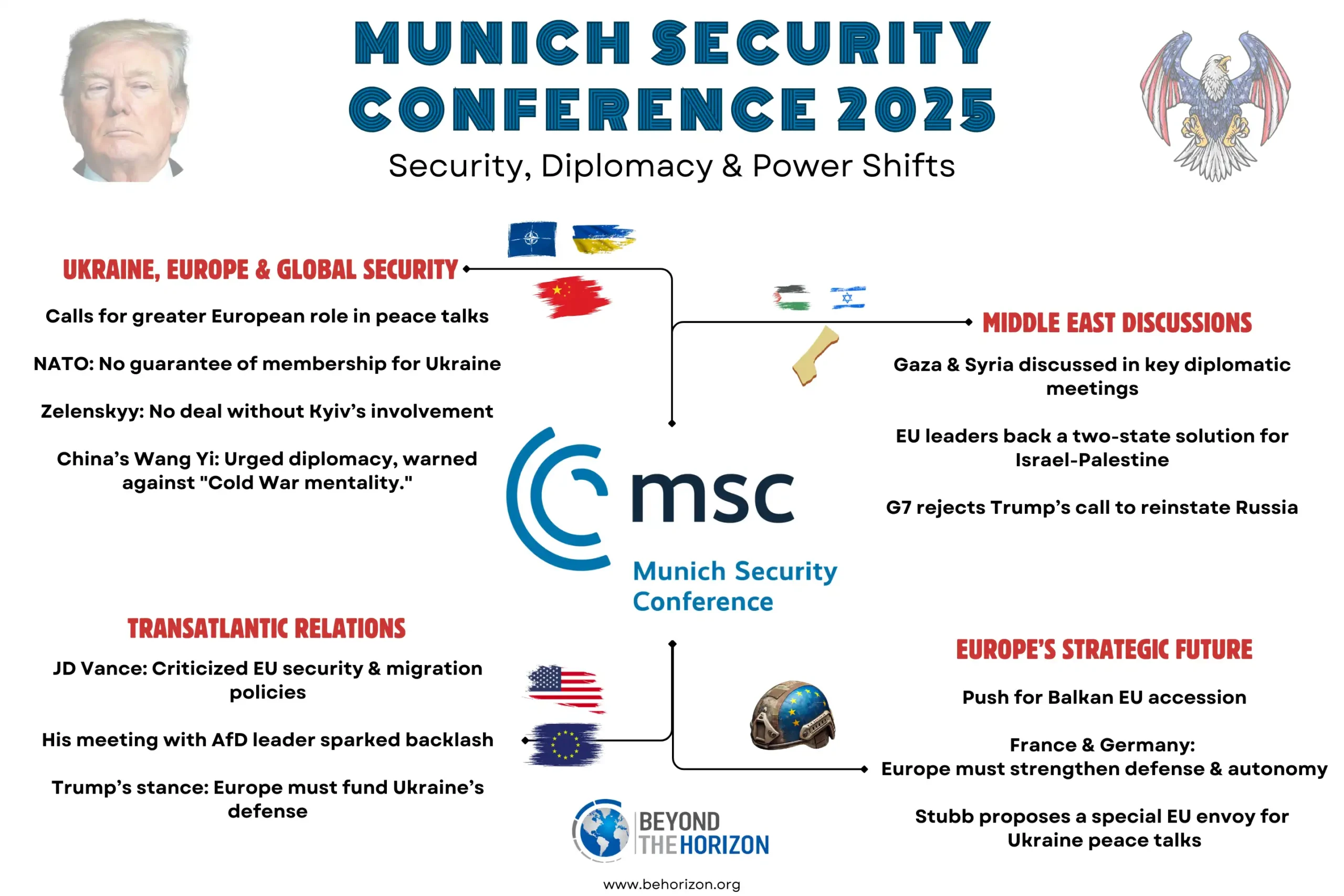

Eastern Flank and New Alignments: In tandem with potential withdrawals, Trump is seeking to realign U.S. forces toward NATO’s eastern flank – but in a selective way. Administration sources indicate he is considering relocating troops to partners he views as more friendly or burden-sharing, with speculation about deployments to Central-Eastern Europe, including Hungary. Hungary’s inclusion is striking: Hungarian Prime Minister Viktor Orbán maintains close ties with Moscow and has obstructed EU support for Ukraine. Trump’s interest in Hungary suggests he prioritizes political alignment and defense spending over traditional strategic logic, since Hungary has increased defense outlays but has been at odds with NATO’s consensus on Russia. Overall, the message from Washington is that U.S. troops will be allocated to Europe on America’s terms – rewarding those allies that “have upped their defence spending” and potentially penalizing those that have not. European officials, meanwhile, are bracing for an official announcement. On the eve of the Munich Security Conference in February, the conference head, Christoph Heusgen, warned “the US will likely announce a massive withdrawal of American soldiers from Europe” – a prediction that now appears to be coming true.

Allied Reactions – Security Fears: NATO governments have viewed the prospect of U.S. troop reductions with alarm. Washington’s European partners have long feared being “cut adrift” by a Trump-led America, and those fears prompted urgent consultations as the new U.S. policy direction became clear. In early March, as news of the potential Germany drawdown spread, European defense ministers convened emergency talks to “beef up their own security” arrangements. There is talk of strengthening European defense capabilities independently: for example, British Prime Minister Keir Starmer has rallied a group of about 20 countries – mostly European and Commonwealth partners – to discuss a “coalition of the willing” that could deploy peacekeepers to Ukraine as part of a future settlement, demonstrating Europe’s resolve to act even if U.S. engagement wanes. Britain and France are leading this effort, signaling that the major European powers are exploring ways to uphold security in Europe (and its neighborhood) with less U.S. involvement. While these initiatives are nascent, they underscore a growing realization in Europe that it may need to take on a larger security role if U.S. forces draw back. Still, any significant American withdrawal from Europe would mark a historic shift – one that NATO collectively has not faced since its early Cold War days – and allies worry about creating a security vacuum that adversaries could exploit.

Shifts in U.S. Policy on NATO’s Collective Defense

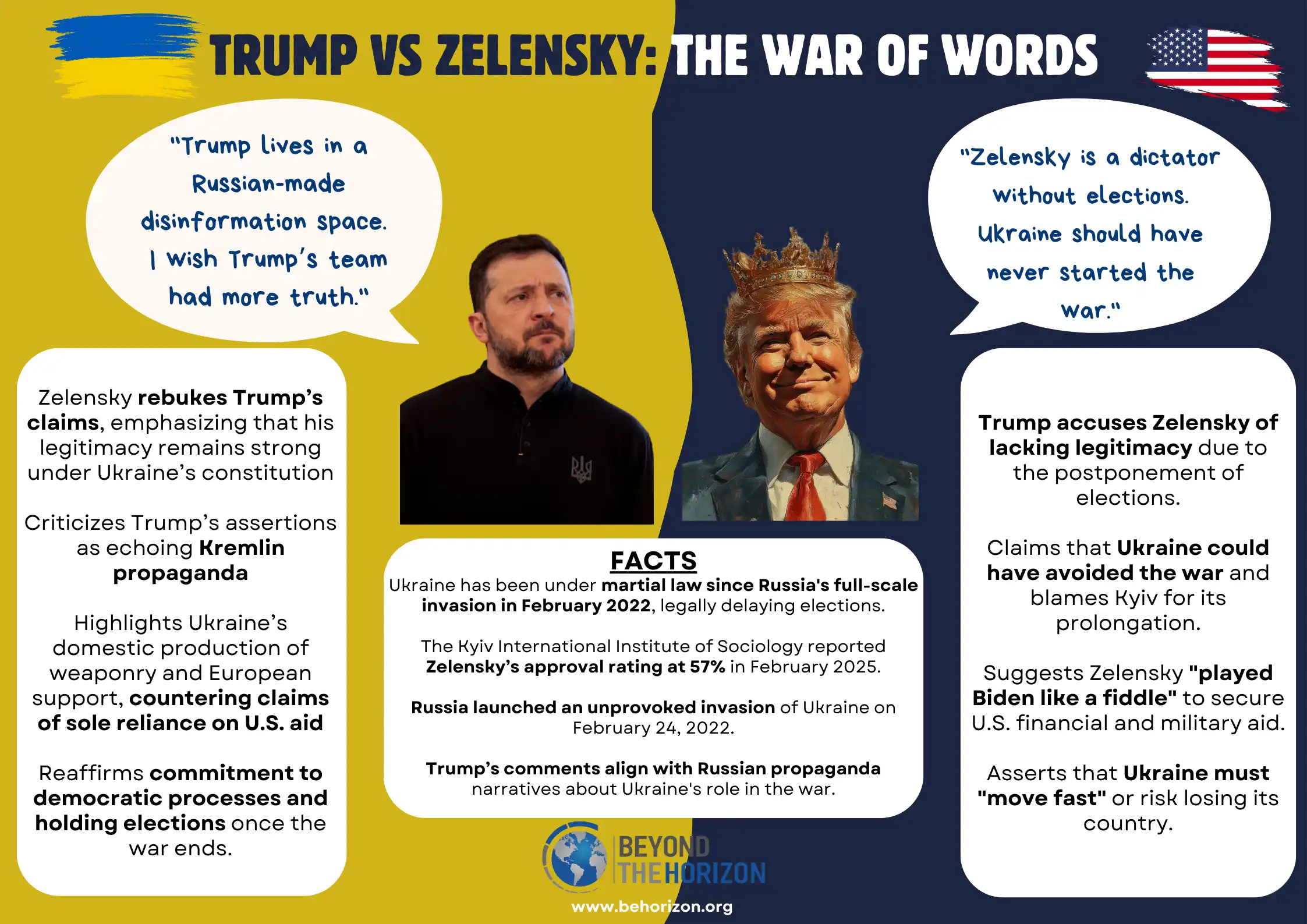

Article 5 Under Question: Perhaps the most jarring change has been President Trump’s open equivocation on NATO’s Article 5 mutual defense guarantee. In a break from over 70 years of U.S. policy, Trump has explicitly cast doubt on whether the United States will honor the pledge to defend any and all NATO allies if they are attacked. “If they don’t pay, I’m not going to defend them,” he told reporters bluntly in March, referring to allies he views as spending too little on defense. This rhetoric effectively makes American protection conditional, undermining the spirit of Article 5, which treats an attack on one as an attack on all. The remarks sent shockwaves through European capitals, where leaders have been “already worried about a withdrawal of U.S. security support” and now hear the U.S. President openly threatening to withhold defense. Coming on the heels of Trump’s clash with Ukraine’s President Zelenskyy and his overtures to Russia’s Vladimir Putin, these statements feed a narrative that Washington might abandon allies in a crisis.

“America First” vs. NATO Solidarity: Trump’s stance reflects a transactional view of alliances. He sees NATO’s value as contingent on allies meeting U.S. demands – primarily financial. In his words, NATO could be “potentially good” for the U.S., but only “if… the spending issue could be fixed”. Otherwise, he views allies as freeloaders who “are screwing us on trade” while enjoying U.S. military protection. This intertwining of defense guarantees with trade grudges is a significant shift in strategic posture. It suggests the U.S. commitment to Europe’s defense might be leveraged as a bargaining chip in broader disputes, rather than upheld as an inviolable principle. Such comments sow doubt about the mutual trust that underpins NATO’s deterrence. They also ignore the history of NATO allies coming to America’s aid – for instance, the European troop contributions in Afghanistan after 9/11, which French President Emmanuel Macron pointedly reminded Washington of in response to Trump. Macron noted that Europeans were there for the United States in its time of need, implicitly chiding Trump for undermining that solidarity.

Official NATO Response – Reassurance: NATO’s leadership has been quick to respond publicly in an effort to contain the damage of Washington’s wavering. Secretary-General Mark Rutte has taken a diplomatic approach – “laying on the praise” for Trump’s influence on allied defense budgets while carefully reaffirming the U.S. commitment. Standing beside Trump at the White House, Rutte emphasized that the “Transatlantic partnership remains the bedrock of our Alliance” and noted that President Trump has personally“ made clear the commitment of the U.S.” to NATO. At the same time, Rutte acknowledged Trump’s “expectation that we in Europe must do more” on defense spending. This dual message – reassuring allies that Article 5 still stands, while validating Trump’s demands – reflects NATO’s attempt to keep the U.S. engaged. Privately, NATO officials and European diplomats are far more concerned. A former Baltic foreign minister, witnessing the U.S. signals, commented that this may mark “the twilight of NATO”, especially if Washington follows through by pulling thousands of troops out of Europe. U.S. Defense Secretary Pete Hegseth’s remarks in Brussels amplified those fears: he warned European allies that “realities” will prevent the U.S. from being Europe’s security guarantor indefinitely. In other words, the American backstop that Europe has relied on for decades cannot be taken for granted. Such statements from the U.S. defense establishment – coupled with Trump’s own words – have forced NATO countries to contemplate a once-unthinkable scenario: a NATO where U.S. security guarantees are no longer assured.

Strategic Posture Adjustments: Beyond the rhetoric, U.S. strategic priorities under Trump 2.0 have shifted in ways that affect NATO’s collective defense posture. The administration has shown less enthusiasm for confronting Russia and more interest in pursuing “peace” in Ukraine on terms that worry many allies. Trump’s 90-minute phone call with Putin and the dispatch of his envoy to Moscow to seek a 30-day ceasefire in Ukraine are examples of a new approach. While ending the war is a shared goal, European allies fear Trump might accept a deal favorable to Moscow – a form of “appeasement” reminiscent of past missteps with authoritarian powers. This has direct implications for NATO’s stance toward Russian aggression. If the U.S. is seen as prioritizing a quick settlement over a just one, NATO’s united front in supporting Ukraine (and deterring Russia) could fracture. Moreover, by hinting that U.S. support is conditional, Trump risks emboldening Russia. Analysts note that Russian officials have reacted with jubilation to U.S. statements in Munich 2025, interpreting them to mean Article 5 could be rendered meaningless going forward. The credibility of NATO’s deterrent – which hinges on the certainty of U.S.-led retaliation to any attack – is thus under unprecedented strain.

Transatlantic Relations and European Leaders’ Reactions

Diplomatic Engagements: Transatlantic diplomacy in 2025 has been a mix of conciliation and contention. European leaders have engaged with the Trump administration but also braced themselves for unpredictable shifts. NATO’s Secretary-General Rutte visited Washington in March and carefully flattered Trump, crediting him with “newly invigorating” the alliance and highlighting European defense initiatives that align with U.S. priorities. By emphasizing actions like the European Commission’s call for €800 billion in new defense spending and increases by the UK and Germany, Rutte aimed to show Trump that allies are heeding his message. This approach is designed to keep diplomatic channels positive and dissuade Trump from further drastic measures. Likewise, British Prime Minister Keir Starmer – whose country traditionally acts as a bridge between Washington and Europe – has been active in engaging the U.S. In a joint press conference in February, Starmer secured Trump’s verbal affirmation of the U.S. commitment to NATO’s mutual defense (though Trump’s commitment wavered soon after). Other leaders have made their points more pointedly: France’s Emmanuel Macron, for instance, used a Brussels meeting to pointedly remind everyone that Europeans fought alongside Americans in Afghanistan, underlining that Europe has been a faithful U.S. ally. This was a direct retort to Trump’s suggestion that NATO is a one-way street. The varying styles – private flattery, public reminders of solidarity – reflect European leaders’ efforts to manage Trump’s temperament and preserve the alliance.

European Alarm and Public Response: Despite diplomatic niceties, many European officials are deeply uneasy. Behind closed doors, some speak with unprecedented candor about the U.S. President. “We’ve now got an alliance between a Russian president who wants to destroy Europe and an American president who also wants to destroy Europe,” one diplomat lamented, capturing the anxiety in European capitals. While hyperbolic, this quote underscores the sense of betrayal felt by some allies. The term “appeasement” is on the lips of officials who compare Trump’s outreach to Putin over Ukraine with Neville Chamberlain’s ill-fated concessions to Hitler in 1938. Former UK Defense Minister Ben Wallace noted the uncomfortable “echo of Munich” in 2025. This historical analogy illustrates how seriously Europe views the potential abandonment of Ukraine and the weakening of NATO’s deterrence. Central and Eastern European members, in particular, are sounding the alarm. They have bitter memories of Soviet domination and view a strong U.S. commitment as indispensable. Lithuania’s former foreign minister, Gabrielius Landsbergis, warned that the end of unquestioned American support “may well mark the advent of the twilight of NATO” if Europe does not swiftly reinforce its own defenses. In countries like Poland, Latvia, and Estonia, leaders are likely recalibrating their security plans to account for a possibly less-reliable American shield.

Europe Rallies and Recalibrates: Importantly, Trump’s stance has also spurred European nations to close ranks among themselves. Rather than capitulating to division, many allies have publicly recommitted to NATO’s core ideals in the face of U.S. ambiguity. NATO members large and small have repeatedly pledged to stand by Ukraine and continue sanctions on Russia, even as the U.S. explores a rapprochement. When Hungary’s Orbán vetoed an EU commitment to aid Ukraine, the rest of Europe swiftly condemned the move and reasserted support for Kyiv. This unity is in part to show Washington – and Moscow – that the alliance’s resolve is not so easily broken. Additionally, European leaders are accelerating efforts towards greater self-reliance. The European Commission in early March unveiled a broad “rearmament plan” for the EU, with a White Paper on defense to follow shortly. Initiatives that once moved slowly are now being fast-tracked: Germany, for example, has loosened its stringent budget limits to enable a massive €1 trillion investment in defense and infrastructure. This move, unthinkable a few years ago in Germany’s debt-averse political culture, was driven by the recognition that Europe must fortify itself. Likewise, as noted, the UK and France are convening coalitions for Ukraine and exploring new defense collaborations. These steps, while not a replacement for U.S. capabilities, indicate a strategic shift in Europe – a “stirring” of European defense empowerment in direct response to uncertainty in Washington. However, this recalibration is not without friction: allies like Poland and the Baltic states prioritize keeping the U.S. engaged at almost any cost, whereas France (and to some extent Germany) see an opening to build “European strategic autonomy”. NATO’s European members thus face the challenge of boosting their collective defense both within the NATO framework and through EU or ad-hoc efforts, all while trying to keep the United States from disengaging further.

Defense Spending and Burden-Sharing Tensions

Trump’s 5% Demand: Central to President Trump’s NATO policy is an aggressive push on allied defense spending. He has taken the longstanding U.S. complaint about burden-sharing to new extremes. At a press conference just before taking office, Trump called for NATO members to increase their military spending to 5% of GDP – far above the alliance’s current 2% guideline. This was a startling announcement: NATO’s official goal (agreed in 2014) is for each member to reach at least 2% of GDP on defense by 2024, a target many allies have struggled to meet. Yet Trump is now insisting on more than double that level, arguing that Europe must take “greater responsibility for its own security.”. For context, no NATO country currently spends 5% of its GDP on defense – even the United States hovers around 3.5%. Only a few nations globally (mostly in active conflict) reach or exceed 5%. Within NATO, the closest is Poland, which has boosted defense outlays to about 4% in response to the war in Ukraine and plans to go to 4.7% this year. Poland, along with the Baltic states, has been a special case: Lithuania and Estonia have even pledged to surpass 5% of GDP on defense starting next year in light of the Russian threat. But these are exceptions born of extraordinary circumstances. Trump’s blanket demand for 5% alliance-wide is therefore seen by many as unrealistic. It sets a bar that the majority of NATO members – including major economies like Germany, Italy, and Canada – are currently far from reaching. This has raised suspicions that the 5% figure is a negotiating tactic or even a pretext. As one expert observed, “My worry is that this 5 percent is actually setting up allies for failure,” potentially giving Trump an excuse down the road to claim NATO isn’t meeting its obligations and justify a U.S. withdrawal. In other words, if no one (or only a few) can hit 5%, Trump could say the alliance has let America down – a scenario that alarms NATO supporters.

NATO’s Response and Potential Long-Term Implications

Official Stance – Unity and Adaptation: NATO as an institution has responded to these U.S. policy shifts with a mix of public unity and quiet contingency planning. Secretary-General Mark Rutte and other senior NATO officials have consistently emphasized that the alliance remains strong and that the United States is not retreating from its commitments. Rutte’s statements, often flanked by President Trump or other U.S. leaders, underline that the transatlantic bond is still the “bedrock” of NATO and that collective defense remains in place. By highlighting Trump’s personal commitment (as Rutte did in Washington) and simultaneously agreeing that Europe will “do more,” NATO’s leadership hopes to satisfy U.S. demands enough to keep Trump engaged. In internal NATO meetings, U.S. representatives have not formally renounced Article 5 or blocked alliance activities, and NATO military cooperation continues on operational levels – for instance, U.S. forces are still participating in NATO exercises in the Baltics and Black Sea as of this spring, signaling that day-to-day deterrence work goes on. The alliance has also welcomed the increases in allied defense spending, framing them as a long-sought success of transatlantic security cooperation, not merely a concession to Trump. NATO communiqués note that the majority of allies are now meeting the 2% goal and that hundreds of billions in new European defense investments are planned in the coming years, which will enhance NATO’s overall capabilities. This narrative serves to show that NATO is moving in the right direction despite the political turbulence.

Building a European Pillar: At the same time, NATO and European leaders are pragmatically preparing for a future in which U.S. leadership might be less assured. There is a growing recognition that Europe must be ready to assume greater responsibility for its own defense within the NATO framework. Allied officials speak of strengthening the “European pillar” of NATO – meaning European members collectively improving their military readiness, interoperability, and ability to act if the U.S. is reluctant or slow to respond. The idea is not to replace the U.S. but to ensure NATO Europe can hold its own if needed. Steps in this direction include joint defense projects among European allies, increased defense budgets as discussed, and discussions about better coordinating European command structures with NATO’s command. Some have even floated revisiting the concept of a European Security Council or leveraging the EU’s defense mechanisms to complement NATO. France – long an advocate for European defense autonomy – has found its calls gaining more traction across Europe, now with the practical impetus of uncertain U.S. support. However, this push is delicately balanced so as not to alienate Atlanticist allies. Countries like Poland and Estonia insist that any European defense effort must not undermine NATO or the U.S. role, since they still see the American nuclear and conventional might as irreplaceable. NATO’s challenge will be integrating a stronger European defense identity in a way that reinforces the alliance. If done successfully, the alliance could emerge more balanced and resilient.

Alliance Cohesion at Risk: The most profound implication of Trump’s policies is the risk to NATO’s cohesion and credibility. NATO has weathered internal disputes before (from the Iraq War divisions in 2003 to Türkiye’s recent estrangement), but a wavering commitment from the United States strikes at the heart of the alliance. The “cumulative effect” of Trump’s denunciations and unilateral moves is “to further undermine NATO and faith in Article 5”, as one senior analyst observed. Unlike previous episodes of U.S. frustration with allies, this time allies hear the Commander-in-Chief explicitly question the core guarantee that underpins NATO’s deterrence. For an alliance “built on trust,” such doubts are corrosive. Adversaries are certainly taking note. Russian officials, as mentioned, are reportedly delighted by signs of transatlantic rift, with some even proclaiming that NATO’s Article 5 could be rendered null if the U.S. stance continues. This perception alone – even if Article 5 technically still stands – could embolden Russia or other hostile actors to test NATO’s resolve, whether through hybrid tactics or aggression against a vulnerable ally. The deterrent value of NATO lies as much in the belief that it will respond with one voice, as in its actual military assets. If that belief erodes, NATO’s preventive power is weakened. NATO’s response to this has been to reassert unity at every opportunity and quietly ensure that contingency plans are updated.

Long-Term Scenarios: Looking ahead, NATO’s future in light of Trump’s second-term policies could diverge along a few paths. In an optimistic scenario, the shock of Trump’s approach could accelerate reforms that make the alliance stronger. Europe’s awakening on defense might lead to a much more capable NATO European wing, better able to share burdens and respond to crises in its backyard. The United States, even if less omnipresent, might remain engaged through a new understanding that allows for more equitable burden-sharing – essentially a “new deal” within NATO where Europe takes on responsibilities it hadn’t before, satisfying U.S. calls for fairness while keeping the alliance intact. In this scenario, NATO could emerge more balanced and with clearer roles, and Trump (or a successor) could even claim victory for having spurred NATO to evolve.

On the other hand, a pessimistic scenario must also be considered. If Trump’s hard line continues or intensifies, allies might fail to meet his demands fast enough, triggering a real break – anything from the U.S. refusing to defend a non-paying ally in a crisis, to an open move by Washington to leave NATO. Such outcomes would be catastrophic for alliance security. Even short of formal rupture, a continued atmosphere of distrust could paralyze NATO’s decision-making or encourage individual nations to hedge their bets. The credibility problem could also become irreversible if not addressed; as one European official warned, “a NATO without U.S. leadership will be left rudderless” against threats like mounting Russian aggression. In that void, European nations would have to scramble to build a defense architecture nearly from scratch, an endeavor that would take years and carry high risks in the interim.

At present, NATO is responding with resilience – doubling down on unity in statements, quietly adjusting its strategies, and hoping that the transatlantic bond can be maintained. The alliance has been in crises before and adapted (Suez in 1956, France’s withdrawal from military command in 1966, etc.), but the current challenge is arguably more fundamental. It strikes at the question of whether NATO can survive if the United States, its founding pillar, turns ambivalent. Policymakers and analysts are watching European defense initiatives, U.S. political developments, and even the 2025 NATO summit later this year for clues to which direction things will go.

Conclusion

President Trump’s second-term policy decisions have undoubtedly jolted the NATO alliance, injecting uncertainty and forcing adaptation. U.S. troop deployments in Europe are being reordered with an eye toward rewarding higher-spending allies, and Trump’s skepticism about defending “delinquent” members has called into question the sanctity of Article 5. These shifts, coupled with a combative approach to burden-sharing, have tested transatlantic relations. European allies have responded with a mix of alarm and action – from emergency security talks and new defense spending pledges, to diplomatic efforts aimed at preserving U.S. engagement. NATO’s collective response has been to project unity and emphasize that the alliance can adjust to new realities. In the short term, NATO is seeking to reassure members and adversaries alike that the alliance’s deterrence and defense commitments remain credible. In the longer term, Trump’s policies may serve as an inflection point, spurring NATO to evolve. This could mean a stronger European defense role within NATO and more equitable burden-sharing – if the alliance manages to hold together through the storm. Conversely, failure to adapt could erode NATO’s effectiveness, a outcome that would delight Moscow and other foes. For now, policymakers on both sides of the Atlantic are focused on managing the immediate fallout: bolstering allied defense capabilities, keeping diplomatic channels open with Washington, and sending clear signals of resolve. Academics and analysts will continue to debate the implications of these developments, but one thing is clear – NATO is at a crossroads. The actions taken in response to President Trump’s recent decisions will shape not only transatlantic security, but also the future of the international order that NATO has underpinned for the past seven decades. Maintaining that order will require deft leadership, constructive burden-sharing, and above all a reaffirmation of the core principle that has kept NATO intact: that allies stand together, “all for one and one for all,” in defense of peace and common security.

Related Infographics