Key Takeaways

- China’s Dual Engagement Strategy Is Under Severe Strain

China’s long-standing approach of maintaining strong ties with both Iran and Israel—anchored in trade, technology, energy, and diplomacy—faces unprecedented pressure following the 2025 Israel–Iran war. Beijing’s alignment with Iran’s sovereignty narrative and criticism of Israeli military actions have strained its strategic relations with Tel Aviv, despite sustained economic interdependence. - China–Iran Relations Have Deepened Strategically and Economically

China views Iran as a cornerstone partner in its Belt and Road Initiative and a like-minded actor in counterbalancing Western influence. The 25-year cooperation agreement, robust energy trade, and growing defense exchanges have elevated the partnership to a strategic level, though Chinese firms remain wary of U.S. sanctions exposure. - Economic Ties with Israel Have Flourished but Are Politically Fragile

Despite frictions, Israel remains China’s second-largest trading partner in the Middle East, with significant Chinese investments in infrastructure and tech sectors. However, growing U.S. scrutiny and China’s pro-sovereignty stance in regional conflicts have eroded political trust and public sentiment in Israel. - China’s Stance in the 2025 War Revealed a Tilt Toward Iran

Beijing condemned Israel’s initial strike as a violation of sovereignty and endorsed Iran’s retaliatory response as self-defense, aligning rhetorically with Tehran and the Global South. This contrasted with the U.S.-led support for Israel and marked China’s attempt to project normative leadership while avoiding full alignment with either side militarily. - Beijing Faces Constraints in Mediating Regional Conflicts

Although China has signaled support for regional diplomacy and participated in post-war de-escalation efforts, its credibility as a neutral broker is limited. Israel perceives China as biased, while Iran sees it as a strategic partner—but one that remains cautious and noncommittal in times of crisis. - Strategic Interests at Risk: Energy Security and BRI Stability

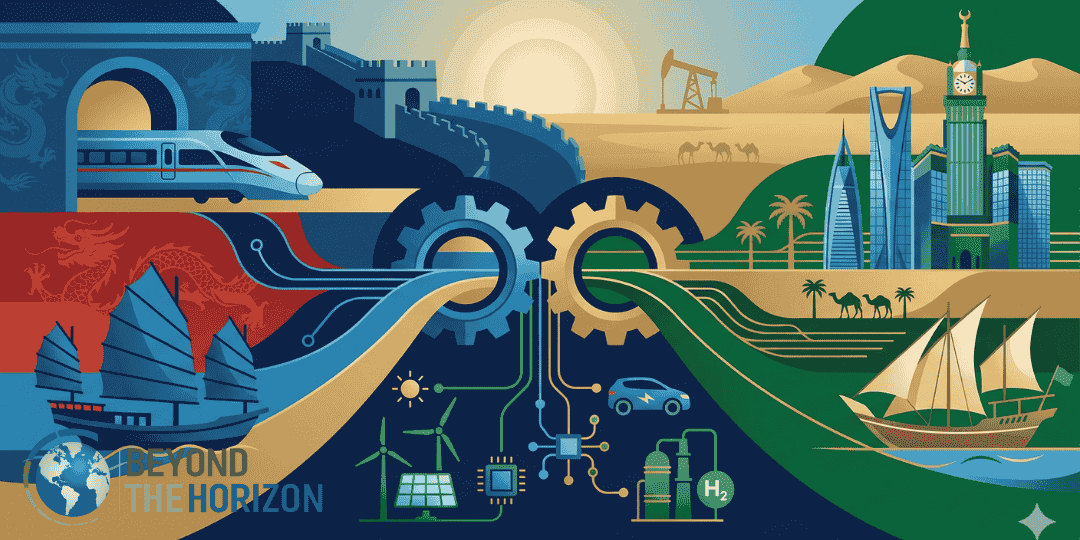

The war heightened risks to China’s energy imports from the Gulf and cast uncertainty over BRI-linked infrastructure in both Iran and Israel. Beijing’s active role in regional diplomacy is partly driven by the imperative to protect its commercial corridors and avoid conflict spillovers into broader Eurasian networks. - Great-Power Competition Shapes China’s Middle East Calculus

China’s differentiated stance on the conflict—opposing Israeli actions while calling for restraint—resonates with many in the Global South and positions it as a normative counterweight to the U.S. However, this approach risks alienating Washington and complicating China’s bid for broader global legitimacy. - China’s Middle East Strategy Is at an Inflection Point

The Israel–Iran war has exposed the limits of China’s non-alignment policy. If Beijing wants to emerge as a credible regional actor beyond economic engagement, it will need to evolve its diplomatic capabilities, take on more risk, and accept that neutrality may not always be viable in an era of sharpened regional fault lines.

Introduction

The outbreak of war between Israel and Iran in mid-2025 has put China’s Middle East diplomacy to the test. Beijing maintains significant relationships with both Tehran and Tel Aviv, built over decades of economic ties, strategic cooperation, and careful balancing. As fighting escalated in June 2025, China was compelled to respond to protect its interests – from energy security to Belt and Road investments – while navigating great-power competition with the United States. This policy briefing reviews the historical development of China’s relations with Iran and Israel, examines current economic and security links, analyzes China’s stance during the 2025 conflict, and assesses what the war means for Beijing’s broader strategic objectives in the Middle East. It concludes by evaluating how China is juggling its ties with two adversaries and whether it can play a stabilizing role.

China–Iran Relations: Historical Overview and Strategic Ties

Historical Background:

China and Iran share a long history of civilizational contact, but their modern diplomatic ties were formalized in 1971 when Iran (under the Shah) recognized the People’s Republic of China. After Iran’s 1979 Islamic Revolution, Beijing saw an opportunity to deepen relations as Iran distanced itself from the West. Throughout the 1980s, during the Iran–Iraq War, China emerged as a crucial arms supplier to Iran. Chinese weapons – from tanks to anti-ship missiles – flowed into Iran, with an estimated $1–2 billion worth of arms sales between 1984 and 1986 alone. This military cooperation laid the groundwork for a lasting security relationship. In the 1990s, China also aided Iran’s nascent nuclear program by building research reactors and other facilities, until U.S. pressure in the mid-1990s led Beijing to curtail direct nuclear cooperation. Notwithstanding these pressures, China maintained a consistent policy of engagement with Iran, opposing Western isolation efforts. Beijing was an original participant in the 2015 Iran nuclear deal (JCPOA) and has generally blamed Washington’s withdrawal from that deal in 2018 for regional instability. Over the decades, Tehran and Beijing have cultivated what both sides call a strategic partnership, free of the historical grievances that complicate China’s ties with some other powers.

Comprehensive Strategic Partnership:

A milestone in the relationship was President Xi Jinping’s state visit to Tehran in 2016, when the two countries announced a Comprehensive Strategic Partnership. This signaled high-level commitment to long-term cooperation across economic, political, and defense realms. In March 2021, China and Iran went on to sign a sweeping 25-year cooperation agreement, often described as a roadmap for massive Chinese investments (potentially $400 billion) in Iranian infrastructure and energy in exchange for a steady supply of Iranian oil. While many details remain opaque, the agreement explicitly links Iran with China’s Belt and Road Initiative (BRI) by envisioning new transport and energy projects. Chinese leaders hailed this as a “strategic” shift of Iran’s orientation “from the West to the East,” reinforcing Iran’s role as a key partner in China’s vision for Eurasian connectivity. Tehran, for its part, sees Beijing as an “all-weather” ally and source of economic relief amid U.S. sanctions. President Ebrahim Raisi has called the friendship with China an “ancient tree” with deep roots, vowing to unwaveringly expand strategic cooperation with Beijing. This diplomatic rhetoric underscores that by the 2020s, China-Iran ties have been elevated to their highest level in history.

Economic and Energy Cooperation:

Energy is the linchpin of China’s relationship with Iran. China has long been Iran’s top oil customer, especially during periods of Western sanctions when few other major buyers are willing to risk U.S. penalties. Even after the re-imposition of U.S. sanctions in 2018, Chinese imports of Iranian oil continued (often via indirect channels), underscoring Beijing’s interest in Iran’s vast petroleum reserves for its own energy security. In turn, oil revenue from China provides a lifeline to Iran’s economy. Beyond oil, China and Iran trade a range of goods – Chinese manufactured products and infrastructure services in exchange for Iranian hydrocarbons and minerals. Bilateral trade has grown significantly in the 21st century, though it fluctuates with sanctions cycles. Iran also features in China’s BRI plans for overland connectivity. One flagship project under discussion is a high-speed rail linking Tehran with Mashhad (a route that could eventually connect to China via Central Asia). Such projects illustrate China’s dual interest: securing transport corridors and bolstering Iran’s role as a transit hub between Asia and the Middle East. However, the full promise of the 25-year partnership has yet to materialize; Chinese enterprises remain cautious due to Iran’s sanctions-related financial risks. Still, smaller-scale investments have progressed – for example, Chinese firms have helped develop Iranian ports and manufacturing zones. The economic component of the partnership thus centers on long-term connectivity and energy deals, which China views as part of diversifying its oil supply and extending BRI into the Middle East.

Diplomatic and Security Cooperation:

Politically, Beijing and Tehran often find themselves aligned in opposition to U.S. dominance. China routinely supports Iran’s positions in international forums when they relate to sovereignty and sanctions. For instance, China’s representatives have condemned unilateral U.S. sanctions on Iran as violations of international law. Beijing also consistently advocated for negotiations over Iran’s nuclear program rather than coercion, playing a constructive role in the multilateral talks that led to the JCPOA in 2015. Security ties between China and Iran, while not a formal alliance, are underpinned by arms sales and military exchanges. During the 1980s and 1990s, China supplied Iran with conventional weapons, including fighter aircraft and anti-ship missiles, enhancing Iran’s defensive capabilities. Notably, Chinese-supplied Silkworm (HY-2) anti-ship missiles were deployed by Iran to threaten shipping in the Persian Gulf in the late 1980s. In more recent years, arms transfers have been constrained by UN embargoes (now expired) and China’s desire not to overtly provoke the West; however, intelligence reports indicate Chinese entities have provided dual-use technology and even missile components to Iran over time. Joint naval drills and port calls have occasionally taken place, signaling a growing comfort in defense cooperation. Moreover, Iran was admitted as a full member of the Shanghai Cooperation Organization (SCO) in 2023, a China-led regional security forum – further institutionalizing strategic ties. Geopolitically, Iran serves China’s interest as a like-minded partner counterbalancing U.S. alliances in the Middle East. Analysts note that Beijing’s support for Tehran is partly aimed at undermining U.S. influence in the region. In summary, China-Iran relations today are characterized by deepening strategic trust and a shared interest in a multipolar order, even as China carefully calibrates the extent of its support to avoid entanglement in Iran’s conflicts.

China–Israel Relations: Historical Overview and Modern Dynamics

Historical Background:

In contrast to its ties with Iran, China’s official relationship with Israel is relatively young – formal diplomatic relations were only established in January 1992. During the Cold War, the People’s Republic of China kept its distance from Israel, aligning instead with the Arab and Palestinian causes. (Notably, Israel had recognized the PRC as early as 1950, the first Middle Eastern state to do so, but Beijing did not reciprocate due to Israel’s alignment with the U.S. bloc during that era.) It was only after the Cold War ended and the Soviet Union collapsed that China-Israel ties warmed rapidly. Even before 1992, quiet contacts existed: Israel had provided some military technology to China in the 1980s, seeing opportunity in China’s needs and the two countries’ mutual estrangement from Moscow. After normalization in 1992, the relationship blossomed remarkably fast on the economic and technological fronts – a trajectory often described as a “romance” or even, in Prime Minister Benjamin Netanyahu’s words, “a marriage made in heaven”. Netanyahu’s 2017 state visit to Beijing marked a high point, as the two countries agreed to elevate relations to an “Innovative Comprehensive Partnership,” emphasizing collaboration in high-tech innovation and R&D. Indeed, by the late 2010s, China had become Israel’s third-largest trading partner globally (and the largest in Asia). Bilateral trade leapt from just $50 million in 1992 to over $10 billion by 2013, and reached record highs around 2021–2022 (peaking at roughly $17–21 billion in total goods trade, depending on calculation). This surge was driven especially by Israel’s imports from China, which more than doubled in the decade up to 2022.

Economic and Technological Cooperation:

The economic relationship has been broad-based but is underpinned by two main pillars: trade in goods and investment/technology ties. China exports a vast array of consumer and industrial products to Israel (making China one of Israel’s top two sources of imports), while Israel exports technology-intensive goods to China, such as electronics, pharmaceuticals, and agricultural tech. Notably, China is a significant market for Israeli high-tech and innovation. Over the last 15 years, leading Chinese corporations and funds – from tech giants like Alibaba and Lenovo to state-owned enterprises – have invested in Israeli companies or set up R&D centers. Chinese investment in Israel soared between 2007 and 2020, heavily targeting the startup and tech ecosystem. This was facilitated by frameworks like the Israel-China Joint Committee for Innovation Cooperation (established 2015) to promote partnerships in fields such as artificial intelligence, cybersecurity, medical devices, and agriculture. Israeli firms have welcomed Chinese capital and market access, seeing China as a huge opportunity to scale up. In parallel, Chinese construction firms have won major infrastructure contracts in Israel, making Israel something of an exception as a developed economy that hosts numerous Chinese infrastructure projects. For example, Chinese state-owned enterprises built and now operate new port terminals in Haifa and Ashdod, enhancing Israel’s maritime trade capacity. Chinese companies are also digging tunnels for Tel Aviv’s light rail and have built power plants and highways in Israel. These projects often tie into the BRI vision – Israel’s strategic location linking Mediterranean trade routes to Asia made it a node of interest for China’s connectivity plans. Israeli officials initially embraced such cooperation; as former Transportation Minister Merav Michaeli said at the Haifa Port inauguration in 2021, the new Chinese-built port “opened a new gateway to the world” and would accelerate Israel’s development. Overall, economic interdependence grew markedly: by the early 2020s China was Israel’s second-largest trading partner after the United States, and over 30 Chinese companies operated in Israel creating thousands of local jobs.

Despite these positive trends, there have been limits and frictions. The United States has grown increasingly wary of China’s role in Israel’s economy, especially in sensitive sectors. American strategic concerns led Israel to tighten scrutiny of Chinese investments in high-tech and critical infrastructure around 2019–2020. For instance, under U.S. pressure, Israel established a review mechanism for foreign investments and reportedly excluded Chinese telecom firms from its 5G network buildout. High-profile infrastructure deals (like the Haifa port operation by Shanghai International Port Group) raised U.S. security objections due to the proximity of Chinese companies to facilities used by the U.S. Navy. Israel has had to perform a difficult balancing act: welcoming Chinese trade and technology while assuring its American ally that ties with Beijing won’t compromise Israeli security or U.S. interests. This unease has somewhat cooled the ardor of the “marriage” in recent years – a dynamic further exacerbated by geopolitical events since 2023.

Diplomatic and Security Aspects:

Diplomatically, China’s stance in the Israeli-Palestinian conflict has often put it at odds with Israel. Beijing has traditionally supported Palestinian self-determination at the United Nations – voting for resolutions favoring Palestinian rights and consistently siding against Israel in UN forums on issues like settlements and Gaza. For example, China supported the landmark UN General Assembly resolution 3379 in 1975 (equating Zionism with racism), and more recently, in 2023, China joined others in calling for a ceasefire in Gaza and criticizing Israeli military actions there. These positions stem from China’s principles on state sovereignty and a legacy of Third World solidarity, but they have led many in Israel to view China as unfriendly. Indeed, a 2024 Israeli public opinion poll showed a majority of Israelis considered China a hostile or unfriendly country, reflecting the deterioration in public sentiment after events like the October 2023 Hamas-Israel war. Chinese officials, for their part, have attempted to balance statements to avoid alienating Israel while not abandoning their pro-Palestinian tenor. In the security realm, direct military cooperation between China and Israel has been constrained by U.S. vetoes. In the 1990s, Israel was a significant source of military technology for China – it reportedly sold upwards of $4 billion in arms and upgrades, helping the PLA with systems like aircraft avionics and anti-missile technology. This covert cooperation came to a halt after the U.S. intervened to cancel major deals (such as the sale of the Phalcon AWACS radar system in 2000) by threatening Israel’s access to U.S. aid. The Phalcon episode and a later dispute in 2005 over Israeli Harpy drones (which Israel had sold to China and attempted to service) caused diplomatic rifts; Israel had to back out of agreements under U.S. pressure, and China expressed sharp displeasure. Since then, Israel has largely refrained from advanced arms transfers to China. Security exchanges today are minimal, limited to occasional counter-terror or police training dialogues. High-level strategic trust is also lacking – Israel remains fundamentally aligned with Washington, and China maintains defense ties with Israel’s adversaries (Iran, as well as others like Syria). Still, Israel appreciates that China has leverage over Iran and a stake in Middle East stability, so it has not cut off dialogue. Notably, there have been reciprocal visits by leaders: Prime Minister Netanyahu has visited China multiple times (2013 and 2017, for example), and Chinese foreign ministers have visited Israel, establishing communication channels. In 2017, China even proposed a “dual-track approach” to address both Israeli security and Palestinian statehood, offering to host peace talks – an initiative that underscored Beijing’s bid to be seen as a neutral peacemaker. However, Israel remained skeptical of China’s diplomatic overtures, given China’s parallel warmth with Iran. By 2025, the accumulating strains – U.S. strategic demands, China’s tilt toward the Palestinian/Iranian narrative, and Israel’s closer embrace of Washington – have tempered what was once a very optimistic partnership.

China’s Stance During the 2025 Israel-Iran War

When open warfare erupted between Israel and Iran in June 2025, China’s response was carefully calibrated but notable for its clear tilt toward defending Iranian sovereignty. Beijing’s immediate reaction was to condemn Israel’s initial airstrikes on Iran. At an emergency UN Security Council meeting convened on June 13, China’s Permanent Representative, Ambassador Fu Cong, “strongly denounced Israel’s violation of Iran’s sovereignty, security, and territorial integrity,” calling on Israel to halt “all risky military actions”. He warned against any further escalation of the conflict, stating that China “opposes the intensification of contradictions and the expansion of conflicts”. This emphatic condemnation, coming within hours of the strikes, was one of the clearest international rebukes of Israel’s operation. (Russia issued a similar condemnation; many Middle Eastern states also criticized Israel, though Western governments largely defended Israel’s right to act.) Notably, China’s UNSC statement did not balance its criticism with any equivalent censure of Iran’s subsequent missile retaliation. Instead, Chinese officials emphasized Iran’s position that it was acting in self-defense. In a readout of a call on April 16, 2024 (during a prior flare-up), Chinese Foreign Minister Wang Yi pointedly “noted Iran’s statement that its action… was an act of self-defense” following Israeli attacks. This foreshadowed Beijing’s 2025 stance: while urging restraint, China implicitly acknowledged Iran’s right to respond to Israeli aggression. Such a stance contrasted with Western capitals, which condemned Iran’s missile strikes; Beijing’s reluctance to criticize Tehran underscored its strategic leanings.

In diplomatic statements throughout the crisis, China consistently urged an immediate ceasefire and a return to dialogue. Chinese envoys stressed concern that the war could spiral into a broader regional conflagration. A key Chinese worry was the impact on the Iran nuclear issue: Ambassador Fu Cong told the UN that China was “deeply concerned” the hostilities would derail already-fragile negotiations on reviving the nuclear deal. Indeed, a sixth round of U.S.-Iran talks scheduled for mid-June 2025 was canceled as a direct result of the outbreak of war. China publicly lamented this diplomatic breakdown, having consistently supported a negotiated solution to Iran’s nuclear program. Foreign Ministry spokespeople in Beijing called for all parties to exercise maximum restraint, avoid targeting civilians, and abide by international law. However, China’s calls were not entirely impartial: Beijing’s statements highlighted Israeli actions as the trigger for the war and avoided assigning blame to Iran’s response. Chinese state media even noted that China was unique among major powers in openly endorsing Iran’s right to retaliate in self-defense.

At the United Nations, China worked (alongside Russia) to prevent any resolution that it perceived as one-sided against Iran. When some Western members floated a draft condemning Iran’s “aggression,” China threatened to veto, insisting that any Security Council statement must also take into account Israel’s initial “provocative” strike on Iran’s territory (a clear breach of the UN Charter in China’s view). Beijing’s UN ambassador argued that Israel’s attack was the root cause of the conflict and therefore must be condemned first, according to press reports. This reflects China’s long-standing position on international conflicts: a strict defense of state sovereignty and opposition to preemptive use of force. In line with this principle, China’s stance was that Israel’s Operation Rising Lion (as the Israeli campaign was codenamed) was illegitimate under international law, whereas Iran’s counter-attack could be seen as within its right to self-defense after an act of aggression.

Beyond statements, China took concrete measures to safeguard its interests and nationals during the war. The Chinese Foreign Ministry swiftly issued security advisories for Chinese citizens in both Israel and Iran, warning of a “complex and severe” situation and advising caution. PRC authorities coordinated contingency plans to evacuate Chinese expatriates if needed, especially from Israel where communities could be at risk from missile strikes. In fact, by late June, Chinese charter flights had quietly evacuated several hundred Chinese nationals from Tel Aviv as a precaution. These efforts were part of China’s broader stance of projecting itself as a responsible major power protecting its people and contributing to stability.

Regionally, China engaged in quiet diplomacy with key Middle East states. Given Beijing’s strong relations with Saudi Arabia and the Gulf countries, Chinese officials consulted those nations about de-escalation. (China had in 2023 brokered a Saudi-Iran rapprochement, giving it credibility as a mediator in the eyes of Gulf states.) Chinese Foreign Minister Wang Yi reportedly spoke with counterparts in Riyadh and Abu Dhabi to coordinate messages urging Iran and Israel to stand down. While not mediating between the belligerents directly (China lacks direct influence over Israel’s military decisions), Beijing signaled support for any international mediation efforts. For instance, when Russia proposed to broker talks to end the war – an idea the American side cautiously entertained in late June – China voiced approval and indicated it would “positively consider” participating in a multilateral peace mechanism.

In summary, during the 2025 Israel-Iran war China positioned itself as a stern critic of Israel’s offensive, a defender of Iranian sovereignty, and a proponent of an immediate ceasefire and renewed negotiations. It carefully synchronized its messaging with Russia and much of the Global South, in contrast to the unequivocal support for Israel from the United States. This stance was noted by observers as part of China’s broader Middle East “power play” – positioning Beijing as a counterweight to Washington’s regional agenda. Beijing’s handling of the crisis – condemning Israel, refusing to condemn Iran, and calling for talks – exemplified the diplomatic balancing act it seeks to maintain.

Conclusion: China’s Balancing Act at a Crossroads

The 2025 Israel–Iran war has underscored the complexity—and fragility—of China’s growing footprint in the Middle East. Long committed to a policy of non-intervention, economic engagement, and strategic ambiguity, Beijing now finds itself navigating an increasingly combustible region where neutrality is not always possible, and silence can be read as complicity. With deepening ties to both Tehran and Tel Aviv—each strategically important but fundamentally opposed—China’s attempt to position itself as a stabilizing force faces unprecedented strain.

China’s response to the conflict has revealed its core strategic calculus. By condemning Israel’s actions and affirming Iran’s sovereign right to retaliate, Beijing signaled its prioritization of state sovereignty, its alignment with non-Western norms, and its long-standing frustration with Western unilateralism. Yet China has stopped short of overt military or political alignment with Iran, maintaining open economic channels with Israel and limiting its role to diplomacy, evacuation operations, and UN-level positioning. This reflects Beijing’s desire to avoid direct entanglement in regional wars while safeguarding its energy corridors, commercial interests, and broader Belt and Road Initiative (BRI) ambitions.

The war, however, has narrowed the space for balanced engagement. Israeli perceptions of China have markedly deteriorated, as public and elite sentiment view Beijing’s stance as disproportionately favorable to Iran and hostile to Israel’s security concerns. Simultaneously, Iran’s leadership views China as a valuable partner in its anti-sanctions posture and its pivot toward Eurasian alliances. Yet even Tehran remains cautiously aware of China’s limits: its unwillingness to extend security guarantees or risk open confrontation with the West. In this environment, China’s ability to serve as a credible mediator—or even as an accepted interlocutor between warring parties—is increasingly uncertain.

More broadly, the crisis illuminates the constraints of China’s foreign policy doctrine in the post-unipolar world it seeks to shape. As Beijing expands its global influence, it cannot indefinitely rely on economic tools and rhetorical commitments to multilateralism. Regional actors in the Middle East are demanding more: clearer positions, deeper commitments, and tangible contributions to stability. China’s 2023 role in brokering a Saudi-Iran normalization agreement raised expectations that it could play a similarly constructive role elsewhere. The 2025 war, however, highlights that mediation in hot conflicts involving U.S. allies, non-state actors, and nuclear anxieties is a much taller order—one for which Beijing may not yet have the diplomatic infrastructure or political capital.

Nonetheless, the war may also serve as a catalyst for evolution. In defending Iran’s sovereignty while encouraging restraint, China has demonstrated that it can project normative leadership distinct from Washington’s alignment with Israel. This posture resonates with many states in the Global South, who see in China a counterweight to Western double standards. If Beijing can parley this into a coherent regional vision—rooted in multipolarity, shared development, and inclusive security dialogues—it may indeed emerge as a credible long-term actor in shaping the regional order. But doing so will require more than reactive diplomacy; it will demand sustained engagement, institutional innovation, and strategic risk-taking.

In the final analysis, the Israel–Iran war has exposed the twin ambitions and contradictions of China’s Middle East strategy. It seeks to be everywhere—economic partner, diplomatic mediator, and normative power—yet remain unentangled everywhere. As the region’s fault lines grow sharper, this posture may prove unsustainable. Whether Beijing can recalibrate its approach without undermining hard-earned trust in Tehran, losing strategic ground in Tel Aviv, or triggering backlash from Washington will define the next phase of its presence in the Middle East. The path forward will require not just balance, but boldness—and the willingness to accept that influence, once claimed, comes with costs.

Related Infographics