President Donald Trump’s second term has been marked by a renewed protectionist stance rooted in concerns over the United States’ economic and technological standing relative to China. This stance builds on long-brewing trends: China’s dramatic rise in manufacturing and advanced technology, alongside perceptions of U.S. relative decline in those domains. Focusing on U.S.-China dynamics, this analysis examines how America’s manufacturing erosion, China’s technological catch-up, and control of global supply chains have fueled Trump’s protectionism. Recent data from 2024–2025 and expert insights illustrate that U.S. policy is driven largely by the fear of losing economic primacy to China, even as broader global trade shifts play a secondary role in the backdrop.

U.S. Manufacturing Decline and Trade Imbalances

Over the past two decades, China has leapfrogged the U.S. to become the world’s manufacturing powerhouse. In 2023, China’s manufacturing value-added reached $4.66 trillion, accounting for about 29% of global manufacturing output – more than the next four largest producers (the U.S., Japan, Germany, and India) combined. By contrast, the United States now contributes roughly 15–16% of global manufacturing output (around $2.5 trillion). This represents a stark reversal from a generation ago, and it reflects what economists have termed the “China shock” – the surge of Chinese imports that hollowed out many U.S. factories beginning in the 2000s. As Chinese firms leveraged cheap labor and economies of scale to dominate industries, the U.S. manufacturing sector saw its global share erode and domestic employment shrink. Today, manufacturing makes up only 11% of U.S. GDP, down significantly from mid-20th century levels. This decline is viewed as a threat not just to jobs but to innovation and security: despite its smaller size, manufacturing still accounts for the majority of U.S. R&D and patents, underscoring its strategic importance.

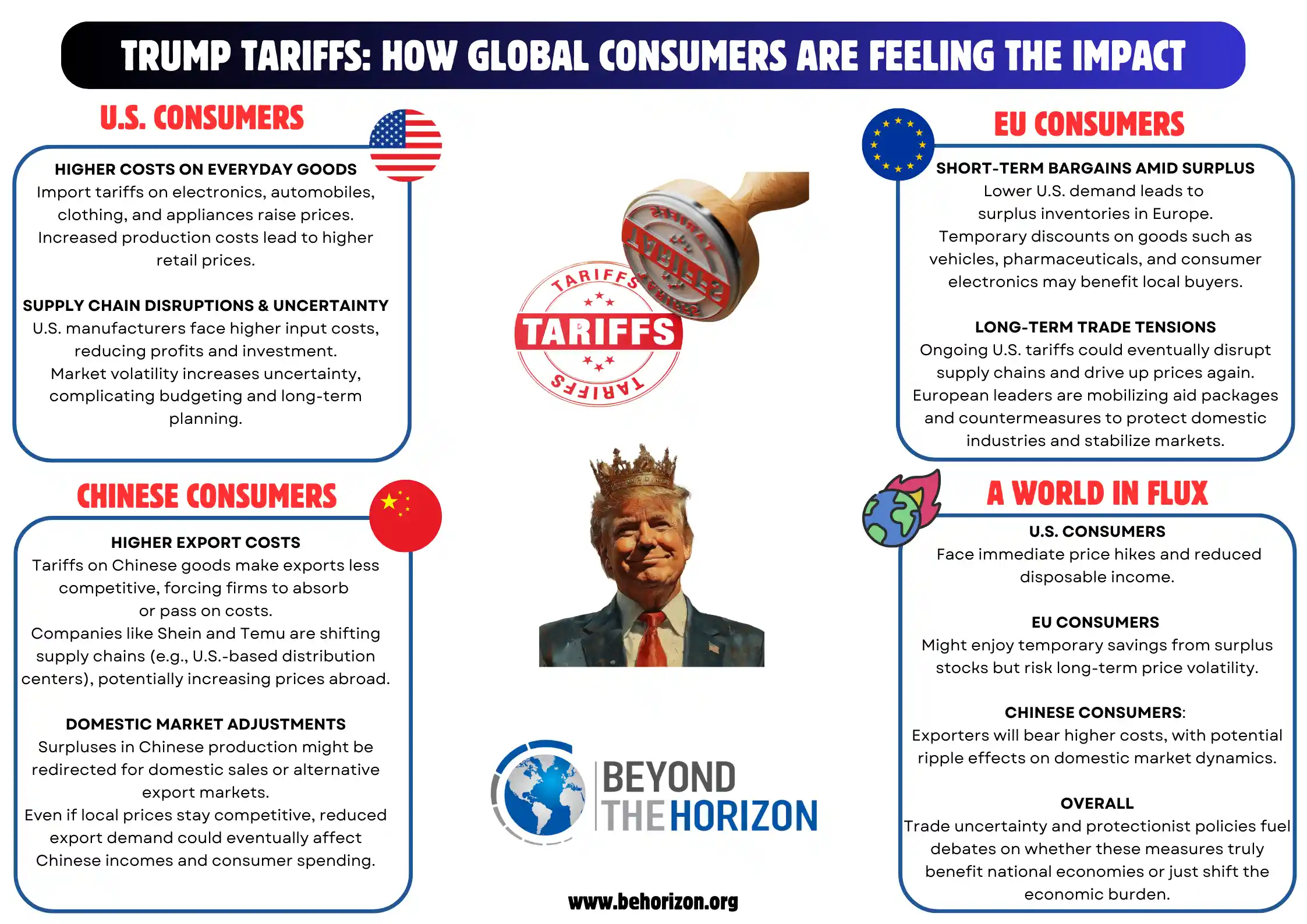

One clear manifestation of these imbalances is the persistent U.S. trade deficit, especially with China. The U.S. goods trade deficit with China was approximately $279 billion in 2023, still enormous albeit at its lowest level in over a decade. (By comparison, it had exceeded $350 billion in the late 2010s.) This decline reflects some diversification of supply chains – U.S. imports from other countries in Asia have risen – but the bilateral gap remains a point of contention. Overall, U.S. goods trade deficits hit a record $1.2 trillion in 2024, a level the Trump administration deemed a “national emergency” for America’s industrial base. White House reports in 2025 explicitly link these long-standing trade deficits to the “hollowing out of our manufacturing base”, loss of factory jobs, and even the weakening of the defense industrial base. In President Trump’s view, other nations (chiefly China) have exploited non-reciprocal trade arrangements – high foreign tariffs, market barriers, and unfair practices – to run up large surpluses at the United States’ expense. The result, according to a recent presidential memorandum, is diminished U.S. productive capacity and greater dependency on imports. This diagnosis has been a driving root cause of Trump’s protectionism: the administration argues that only aggressive measures (tariffs, import restrictions, and re-shoring of industry) can reverse the decline and restore a balance. Indeed, the political backlash to the China shock – especially in U.S. industrial states – has created an enduring appetite for tariffs and industrial policy, a trend now reflected in Trump’s hardline trade agenda.

Technological Competition and the R&D Race

At the core of U.S.-China tensions is a battle for supremacy in advanced technologies – from semiconductors and AI to clean energy. American policymakers increasingly see China’s technological rise as a strategic threat, especially as China closes the gap in innovation inputs and outputs. The United States still leads in many innovation metrics, but the margin is narrowing. Notably, the U.S. remains the top R&D spender at nearly $784 billion in 2023, yet China is a close second at $723 billion. These two countries utterly dominate global R&D expenditures, far outstripping any other economy. China’s surge is a historic shift – its share of worldwide R&D spending climbed from just 4% in 2000 to about 26% in 2023, while the U.S. share has fallen over the same period. Beijing’s sustained investments have brought Chinese R&D spending to roughly 92% of U.S. levels in 2023, and China’s R&D intensity (over 2% of GDP) continues to rise toward U.S. levels. This convergence alarms American strategists, who fear losing their long-held technological edge.

The competition is even more evident in innovation outputs like patents and scientific publications. China now far outstrips the U.S. in patent filings – Chinese inventors filed over 1.64 million patent applications in 2023, more than triple the U.S. total (519,000). This gap suggests a massive scale of innovative activity in China (though quantity does not directly equate to quality or global impact). In cutting-edge fields such as artificial intelligence, China’s progress has been rapid. Over the last decade, China reportedly filed six times more patents on certain AI technologies than the U.S., and Chinese researchers lead the world in AI research paper output. The U.S. still leads in many qualitative measures of AI leadership – for instance, a 2024 Stanford index ranks the U.S. as the top overall AI ecosystem, ahead of China. American firms also remain at the forefront in semiconductor design, software, and Nobel-caliber scientific research. However, China’s technological ambitions are backed by state-led campaigns (such as the “Made in China 2025” plan and AI strategic plan for 2030), which aim for self-reliance and global dominance in high-tech industries.

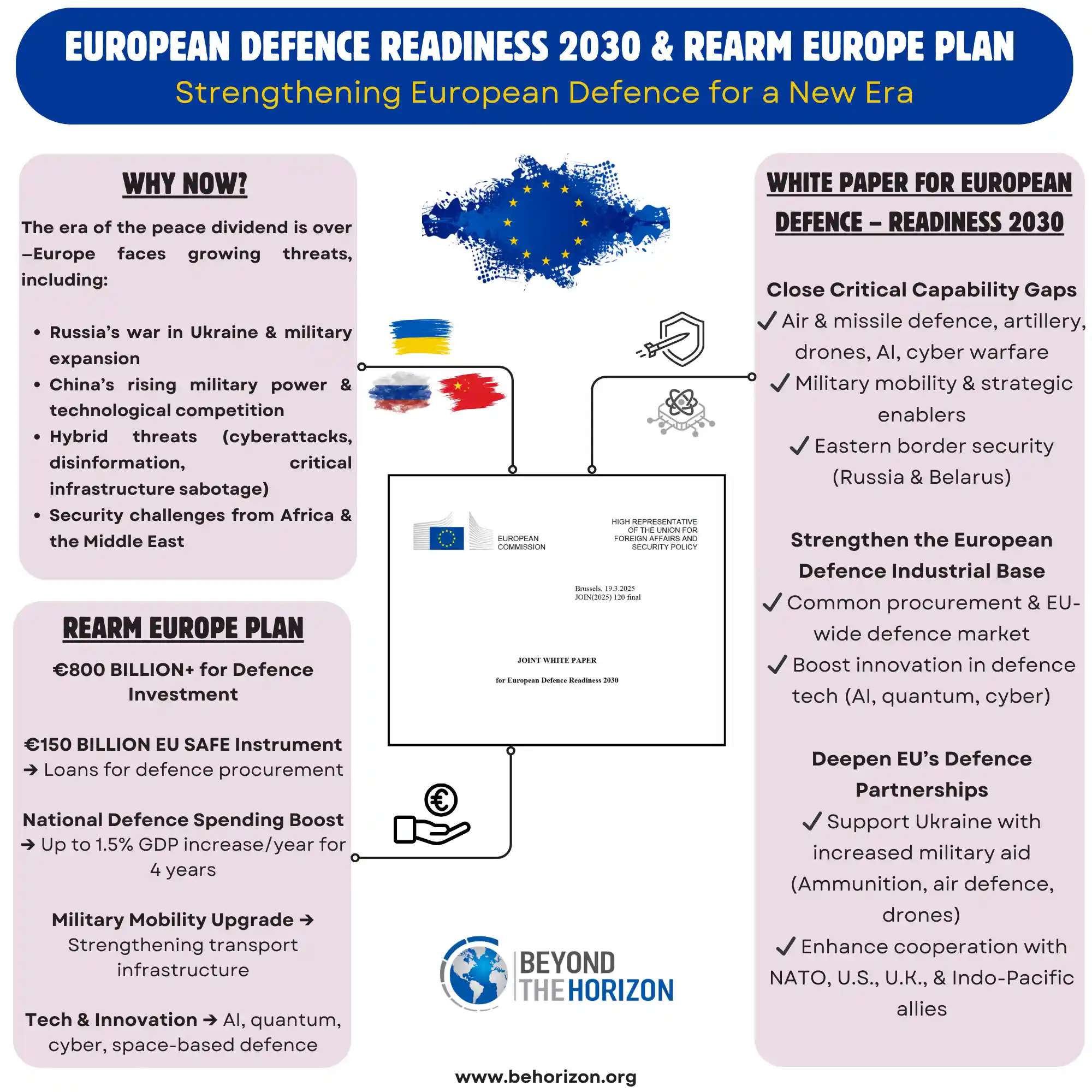

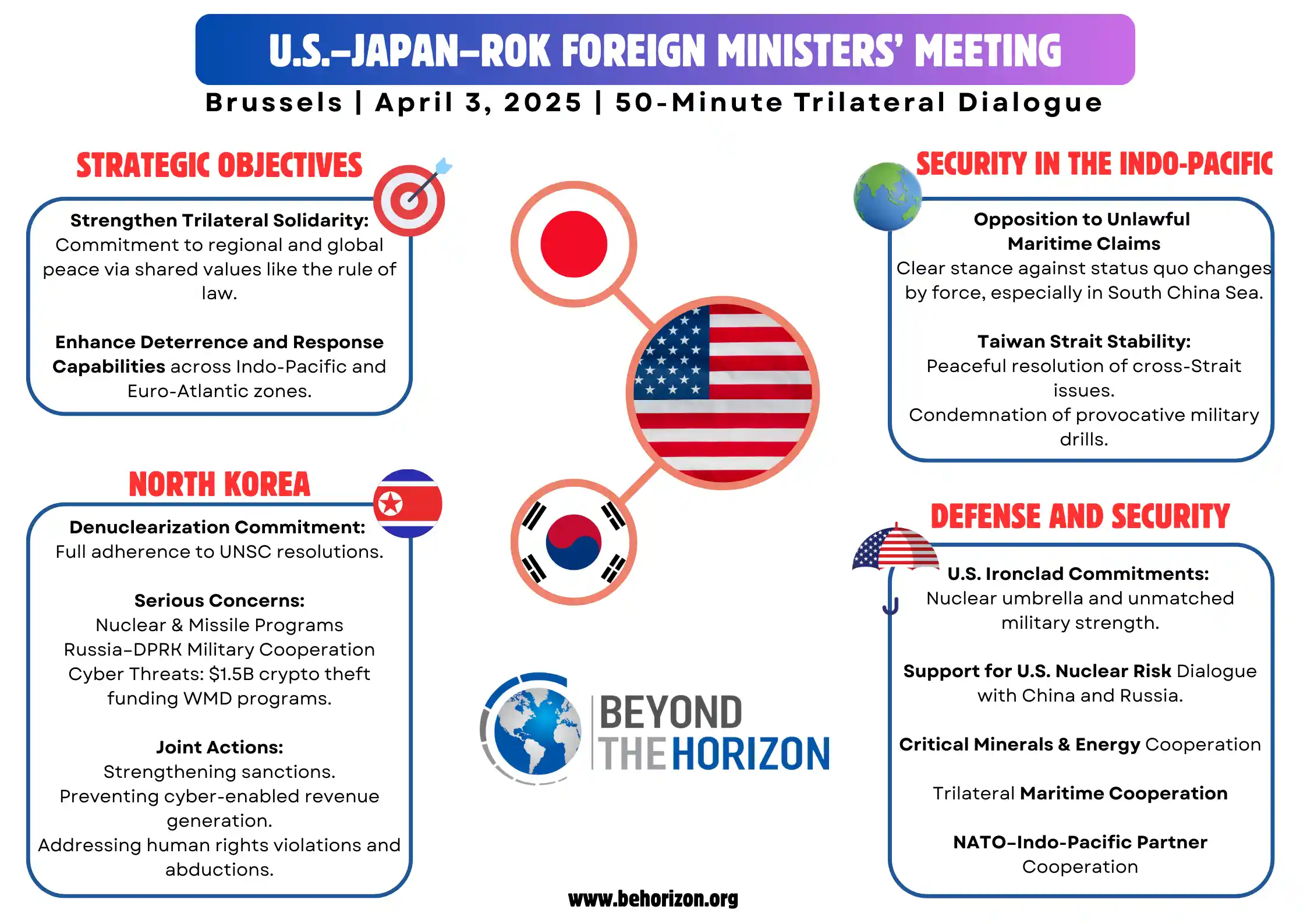

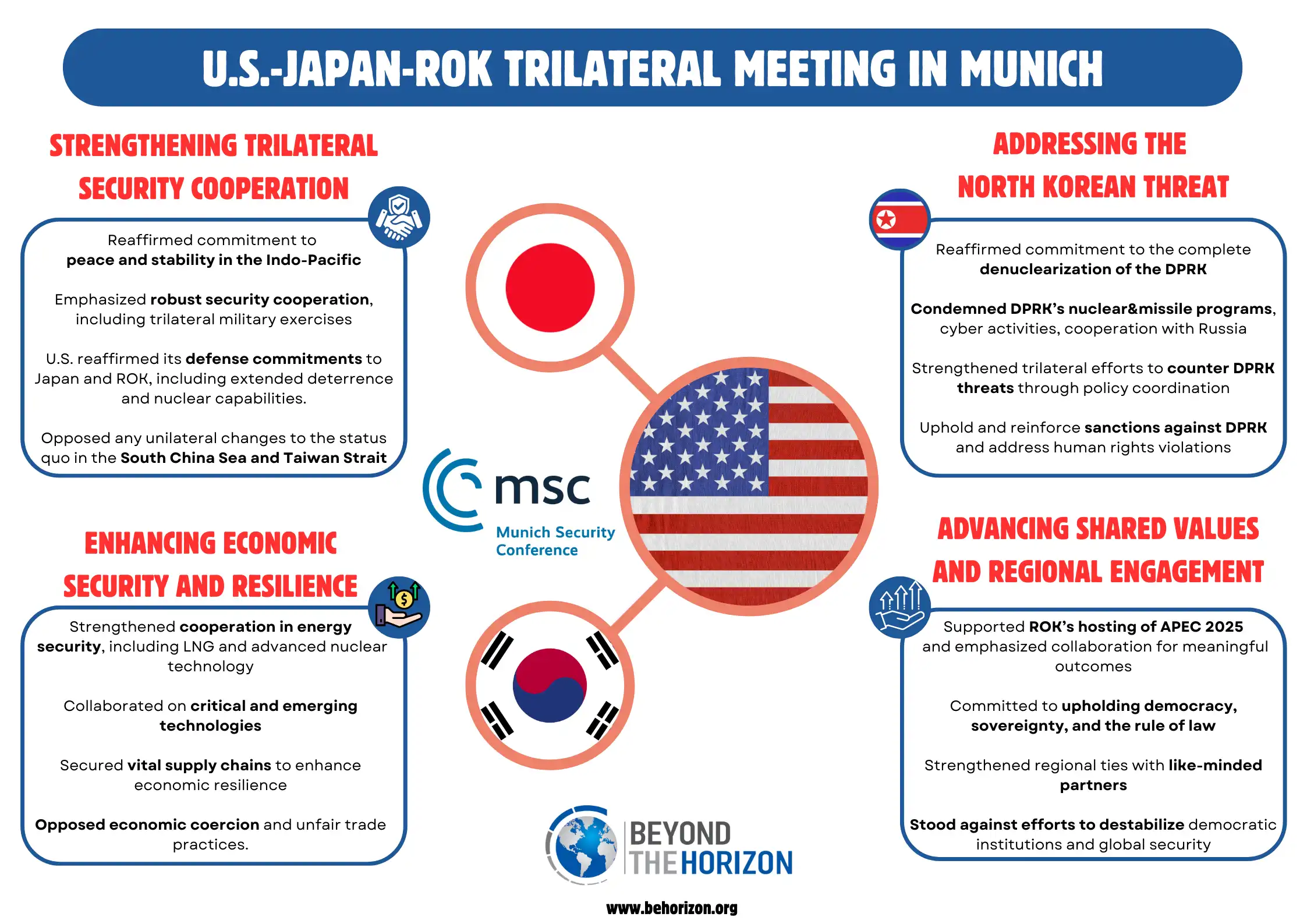

From Washington’s perspective, this technological catch-up by China erodes an important pillar of U.S. economic strength and national security. A U.S. Trade Representative report late in 2024 found evidence that China seeks to “dominate…global markets” in sectors like semiconductors through extensive state support, threatening U.S. competitiveness and supply chain resilience. The fear is that if China leads the next generation of technologies – whether AI, quantum computing, biotech, or advanced manufacturing – it could undercut U.S. industrial leadership and even military advantages. This anxiety has clearly informed President Trump’s protectionist stance. His administration views technology protection as integral to economic security, employing export controls, investment screening, and domestic subsidies to defend against China’s rise. For example, the U.S. has intensified restrictions on tech transfer to China (such as banning exports of cutting-edge semiconductor chips and tools) and is considering curbs on U.S. investments in Chinese tech sectors. These measures reflect a consensus in Washington that America’s relative tech decline must be arrested by decoupling in strategic areas. In short, China’s rapid gains in innovation have become a key rationale for Trump’s nationalist economics: to prevent the U.S. from falling behind, the administration is attempting to disentangle and bolster its own high-tech ecosystem.

Advanced Industries and Supply Chain Dependencies

Beyond broad indicators, the U.S.-China competition plays out in specific advanced industries critical to future economic power. Two areas stand out: semiconductors and green technologies. Semiconductors are often called the “oil” of the digital era – essential to everything from smartphones to military systems. For now, the U.S. (along with allies like Taiwan, South Korea, and Japan) maintains dominance in the most advanced chips. American companies lead in chip design and core intellectual property, and partners produce the cutting-edge 5nm and 3nm node chips that China cannot yet mass-produce. However, China has poured enormous investments into building its semiconductor sector and has made notable strides in mature-node chips and chip assembly. Importantly, China is the world’s largest semiconductor market – it consumes over a third of global chip output – giving it leverage in the industry. U.S. officials worry that China’s drive for semiconductor “indigenization and self-sufficiency” will eventually eliminate one of the last areas of U.S. tech superiority. This concern is a driving factor behind protectionist moves like the U.S. CHIPS Act (2022) which subsidizes domestic chip fabrication, and Trump’s continued use of tariffs and export controls targeting China’s chip materials and equipment. By shielding and nurturing its own semiconductor manufacturing, the U.S. aims to prevent China from leveraging global supply chains to its sole advantage.

A similar dynamic is unfolding in green technology, an arena that blends economic and geopolitical stakes. China has leveraged industrial policy to command unprecedented control over clean-energy supply chains, from solar panels to electric vehicle (EV) batteries. Today, China holds over 80% of the world’s solar photovoltaic manufacturing capacity, producing the vast majority of solar panels and key components. In the EV battery sector, China likewise dominates: about 65% of lithium-ion battery cells and nearly 80% of battery cathodes are made in China. This dominance means that as the world (including the U.S.) transitions to renewable energy and electric cars, it must rely heavily on Chinese-made inputs. Such reliance is deeply discomforting to U.S. policymakers. It not only represents a lost industrial opportunity (these are high-growth industries that could generate American jobs), but also a strategic vulnerability – critical energy technology supply could be subject to disruption or political leverage. This has prompted the U.S. to consider protectionist measures in the clean-tech space as well, from tariffs on solar imports (first imposed in Trump’s initial term) to strong domestic content rules and subsidies for EVs and batteries in recent legislation. The overriding goal is to rebalance supply chains away from China. Trump’s trade rhetoric in 2025 emphasizes regaining control of “critical supply chains” so that the U.S. is not dependent on an adversarial power for essentials.

Another facet of supply chain dependency is access to critical raw materials. A prominent example is rare earth elements, which are vital for high-tech magnets, electronics, and defense systems. China has a near-stranglehold on this supply: it currently mines about 60% of the world’s rare earths and processes nearly 90% of them, essentially monopolizing the refining stage. This monopoly means that even rare earth ore extracted in the U.S. or elsewhere often ends up in Chinese processing plants. U.S. defense planners have long warned that such dependence on China for strategic minerals could be an Achilles’ heel (China has previously hinted at export restrictions as a geopolitical tool). Trump’s protectionist posture addresses this by promoting domestic mining and processing and by cooperating with allies to develop non-Chinese supply chains. In sum, China’s control over key supply chains – from minerals to batteries to telecommunications equipment – has galvanized a U.S. policy of economic securitization. The protectionism of Trump’s second term is thus not only about tariffs on consumer goods; it is tightly linked to “de-risking” supply lines in industries deemed crucial for future prosperity and security. This trend parallels moves by other Western countries, but the U.S. approach under Trump is especially forceful in using trade tools to achieve supply-chain realignment.

Conclusion

President Trump’s revived protectionism in 2025 can be understood as a response to America’s perceived economic and technological decline relative to China. The loss of manufacturing dominance, the narrowing innovation gap, and heavy reliance on Chinese-centric supply chains all create powerful incentives for U.S. leaders to erect barriers and push for decoupling. By raising tariffs, invoking national security to reshape trade, and investing in domestic capacity, Trump is attempting to reverse structural trends that he and his advisors see as undermining U.S. power – namely, China’s rise at America’s expense. Recent developments in 2024–2025, from China’s expanding share of high-tech industries to record U.S. trade deficits, have only reinforced this narrative. While broader global factors (such as Europe’s own trade defenses or new trade blocs outside U.S. influence) provide additional context, they remain secondary. The driving force of current U.S. protectionism is the bilateral great-power economic rivalry: Washington’s bid to halt its relative decline against Beijing. Whether these measures will succeed in restoring American industrial primacy is debated, but their motivation is clear. As U.S.-China economic and technological competition intensifies, protectionism has become, in Trump’s view, a necessary strategy to safeguard America’s long-term prosperity and strategic leadership. The result is an American trade posture that is more defensive and nationalist than at any time in recent history – a direct product of the U.S.-China economic dynamics at the heart of today’s global order.

Related Infographics