I would first of all like to thank the organizers for inviting me to participate here. The title of this session is “Political and Geopolitical Issues in the Short and Medium Term”. I should clarify that I understand the short term to refer to one to four years, and the medium term to refer to five to 12 years. So, the short term is the period from today until the end of 2022, while the middle term is from 2023 through the end of 2030.

1. Introduction

With this in mind, I have been asked to discuss energy and geopolitical security issues concerning the resources of the Caspian Sea basin, the importance of this region and its risks and opportunities for Europe. It is necessary first to sketch briefly how events evolved until now, to produce the current situation.

Reality has proven wrong the sceptics who, during the 1990s, insisted that it was not worthwhile even to look at the energy resources of the Caspian Sea basin. In fact, thanks to the highly qualified work of Soviet engineers and technicians before 1991, we always knew not only where to look but where to find. The USSR simply did not possess the technology necessary for exploiting the Caspian Sea that those engineers and technicians had identified. Because we knew where to find, the costs necessary after 1991 to develop those resources, such Azerbaijan’s offshore oil, were almost automatically lower than many other places in the world.

The so-called “contract of the century” for that oil in the mid-1990s was an act of great political will. It led to the construction of the first pipeline in the history of the oil industry to cross three countries: Azerbaijan the producer, Georgia the transit supplier, and Turkey the final exporter. The implementation of this Baku-Tbilisi-Ceyhan (BTC) pipeline in turn motivated many legal, technical, and administrative innovations that are now transferred as “best practices” (and even further improved) around the world in other projects.

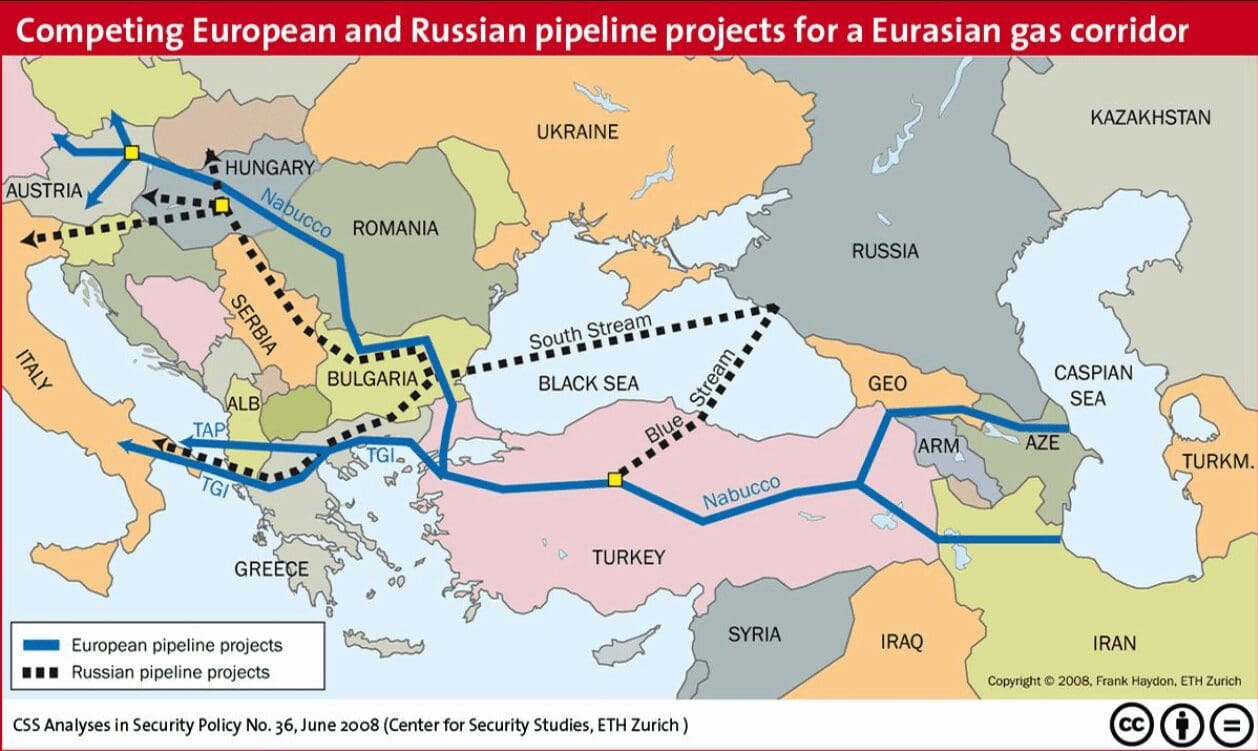

On the basis of that trilateral experience, the three countries cooperated in the construction of the South Caucasus Pipeline (SCP) for natural gas, after it was unexpectedly discovered instead of crude oil in the offshore Azerbaijani deposit Shah Deniz. The discovery of that natural gas made Turkmen gas unnecessary to fill the SCP. Consequently, the first plans for the Trans-Caspian Pipeline (TCP), in the late 1990s, were not realized. Also, Russia’s Blue Stream gas pipeline, proposed and then built to run across the bottom of the Black Sea to Turkey, provided the latter with quantities that Turkmenistan would have provided through the TCP. The Blue Stream pipeline operated for a number of years at a loss before reaching maximum flow.

Map 1. The Blue Stream, Nabucco & South Stream Projects (CSS Analyses in Security Policy)

Ten years later, towards the end of the first decade of the new century, plans for the TCP were revived during discussions about how to provide supply for the Nabucco gas pipeline project. Just as Russia had proposed the Blue Stream pipeline project to block the TCP the first time, this time it proposed the South Stream pipeline project to block it again. However, the second time, the TCP failed not due to Russian machinations but rather due to the poor institutional design of the Caspian Development Corporation, which the EU had proposed to be the sole purchaser of Turkmen gas, bundling European orders together. Also, in the end, the Nabucco project could not identify, with the precision necessary, either the final buyers or the actual sources of the gas for sale.

The SCP remains a great success. It is now being expanded in order to transmit still greater volumes of gas, as development of the second phase of the Shah Deniz deposit gets under way. The SCP connects to the trans-Anatolian natural gas pipeline TANAP, which in turn feeds the Trans-Adriatic Pipeline (TAP), completing the Southern Gas Corridor (SGC) for Europe’s imports of gas from the Caspian Sea basin, and from Azerbaijan in the first place.

2. The Short Term (2019-2022)

With that background, allow me now to address the short term, i.e. the period from the present day through the end of 2022.

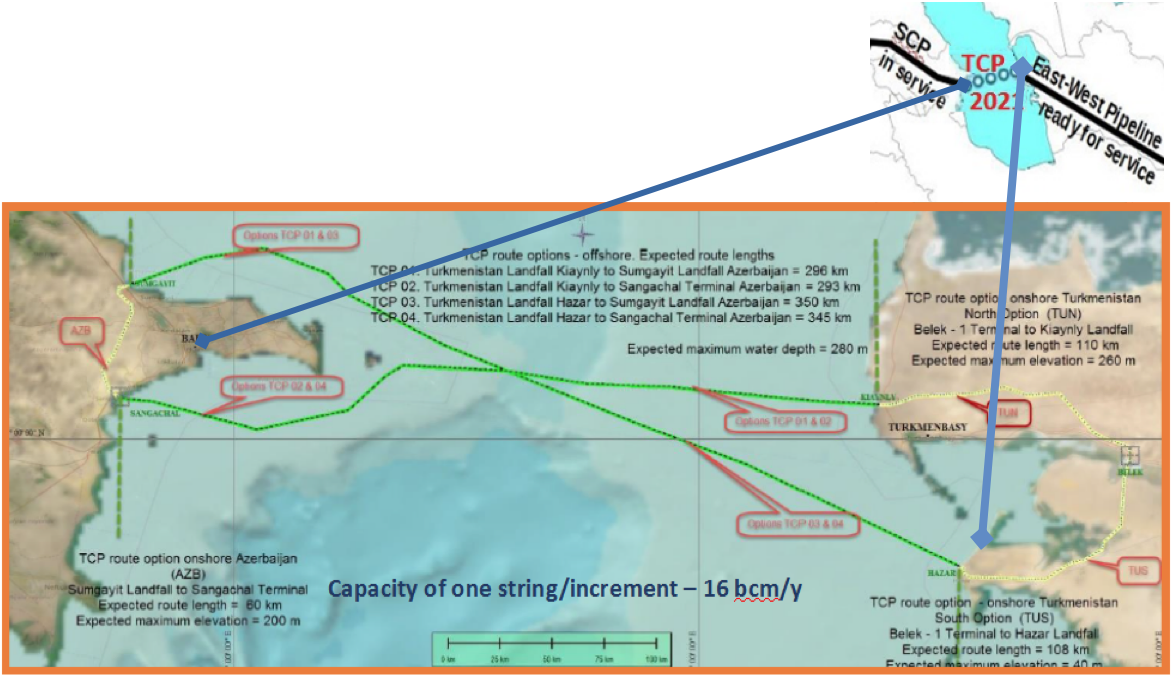

Map 2. The Trans-Caspian Pipeline (TCP)

The TCP project has been reborn and, this time, it is finally being realized, with hardly anyone noticing, including the sceptics from two decades ago who continue to pretend the idea is a pipe-dream, as if to apologize for their inability to realize it when they had the opportunity.

Without entering into a detailed explanation of the new situation that has allowed revival yet again of the TCP project, let me summarize the three new main elements that have created the new situation. This summary represents my exposition of the short-term situation, i.e. from today through the end of 2022.

The first new element is that Germany’s Ministry of Foreign Affairs has included Turkmen gas in its official strategic document for security of energy supply. It did so because the German government supports opening the EU market to new suppliers through new supply routes. That market opening will allow supply and demand to determine the competitiveness of different sources and routes of supply for the German energy market and for European energy markets more broadly.

The second new element is that the EU and Georgia have reached an agreement to finance jointly the “pre-FEED” (preliminary front-end engineering and design) studies for the TCP. These studies are needed to attract buyers and to facilitate the sales and purchase agreements that would lead to the pipeline’s construction. The main factor that had prevented development of the TCP, thus, was the absence of an actor that would cooperate with the EU on the funding of these studies.

Energy companies usually play this role, but they would not do this in the case of Turkmenistan, because Turkmenistan sells its gas at the border. Consequently, it would not sign production-sharing agreements with those companies, which the latter require in order to make the investments necessary for production and export of the energy resources.

The grant agreement that the European Commission signed with the TCP promoter company focuses on the implementation of the said pre-FEED studies. That agreement, for approximately € 4 million, is co-financed by the Georgian Oil and Gas Company (GOGC), of which the Government of Georgia is the sole shareholder.

Implementation was scheduled to begin in October 2017 but was delayed. However, that situation was unblocked in December 2018, and the financing agreement just signed, on 10 January 2019, provides the tangible guarantee that the studies will be executed without hindrance.

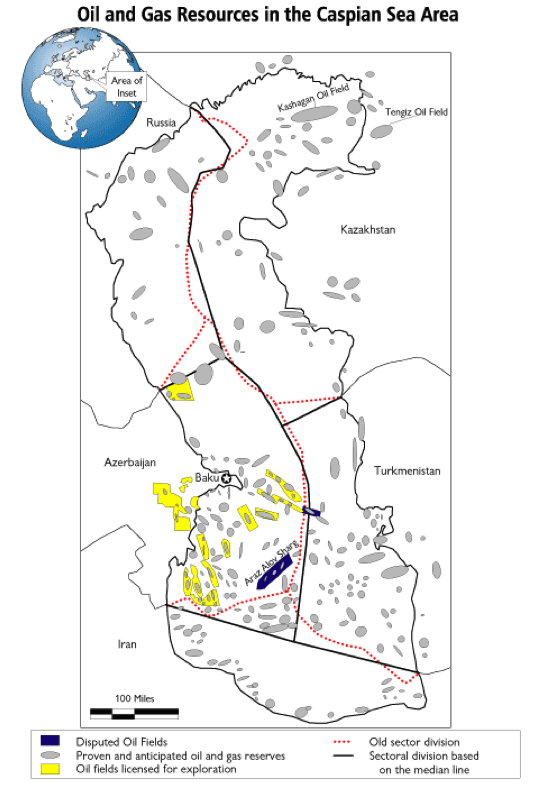

Map 3. The Division of the Caspian Sea (Source: The Economist)

The third new element is the signature of the Convention on the Status of the Caspian Sea, which has changed perceptions about the gas pipeline project in the eyes of market players. The agreed Convention stipulates that decisions on industrial projects and works will be taken directly by the countries on whose territory those projects and works are implemented. In the case of pipelines, this means only the countries (including their Caspian Sea sectors) through which the pipelines pass. For the TCP, therefore, Iran and Russia have the right to participate from the beginning in the design and evaluation of environmental measures, but they lack any means to block or delay construction.

So, Turkmenistan is interested in large-scale gas export to European consumers. Earlier in this decade, the country constructed at its own cost the domestic East-West Pipeline (EWP) necessary for such export, which will take gas produced in the east and transmit it right up to its Caspian Sea coast for onward transmission west, after the TCP is in place. The EWP’s capacity is 32 billion cubic metres per annum (bcma), equal to the projected capacity of the TCP’s two strings together.

Turkmenistan’s leadership has been saying publicly for two years that it wishes to share substantial benefits from the project with a partner that would take the risk to cooperate in the pre-FEED studies and facilitate the implementation of the infrastructure. This partner would thus benefit from the benefits usually enjoyed by oil companies benefiting from a production sharing agreement.

This partner is Georgia, a new major player that will facilitate the implementation of the project, and which is today assisting in the preliminary studies. Georgia is in fact the key to realizing the current roadmap. The TCP’s promoter company is organized by Georgians who have succeeded in having the pipeline designated as a Project of Common Interest (PCI) by the European Commission.

Why Georgia?

For Georgia, this is a classic “win-win” situation. By spending only a few million euros in the beginning, the country would allow Turkmen gas to cross its territory, play a role of strategic energy transmission, and ensure both large investments in infrastructure and significant volumes of gas for domestic consumption at cost-price. The latter availability of inexpensive gas will benefit those Georgian export industries benefiting from the Deep and Comprehensive Free Trade Agreement (DCFTA) with the European Union. Moreover, such arrangements will not entail any additional costs for European consumers, whether they are private individuals or industrial companies.

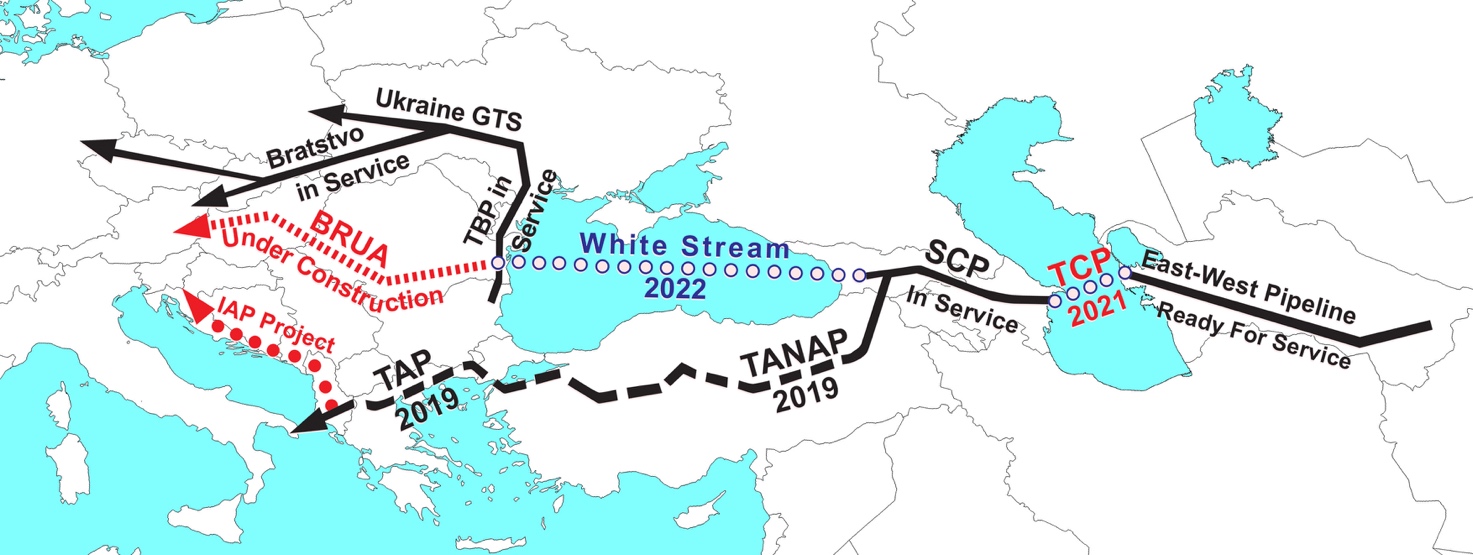

Map 4. The Trans-Caspian and White Stream Pipelines Complement the Southern Gas Corridor (Source: Trans-Caspian Pipeline)

Turkmenistan’s gas flow through the Caspian Sea will be organized in two stages. The first stage can coincide with the opening of the TANAP and TAP pipelines, which can transit that flow to Turkey and beyond.

The flow from the second stage (“String 2” of the TCP) can be channelled through the expanded Sangachal networks in Azerbaijan and the SCP, then through new infrastructure across the Black Sea, discharged into the Trans-Balkan Pipeline (TBP) to Ukraine and then to Baumgarten via the Bratstvo pipeline, which is the usual route through Ukraine and Slovakia. Other volumes may also be introduced into the BRUA pipeline (Bulgaria-Romania-Hungary-Austria, where the “U” stands for “Ungaria” in Romanian).

This two-stage approach will allow volumes of up to 32 bcma to cross the Caspian Sea. Of these 32 bcma, 15 bcma will arrive at Baumgarten. The first stage requires only the construction of the TCP’s first string, at a cost of about € 700 million, for 16 bcma. The second stage will require a second string costing only about € 660 million.

The White Stream pipeline from the Georgian Black Sea coast to Varna (Bulgaria), or more likely to Constanţa (Romania), will cost approximately € 3 billion, with a capacity of 16 bcma. Investments will be needed to increase capacity both at Azerbaijan’s Sangachal terminal and through the SCP, as well as for connections with the TBP. Nevertheless, this total should not exceed € 1.3 billion.

3. The Medium Term (2023-2030)

Totalling the figures, I have just mentioned, all these new investments to transport 32 bcma will not exceed € 6.2 billion, and they will encourage, in addition, new investment in the more expensive Azerbaijani gas, while providing it with a less expensive route to Central Europe.

Building on successful reforms in Georgia motivated by the BTC pipeline, the TCP will stabilize the economic and political situation in Georgia. In so doing, it will extend Western influence to the east coast of the Caspian Sea in a constructive manner. The TCP holds the promise of opening up horizons in Euro-Caspian energy development that will run through mid-century.

It is worthy of note, in this connection, that the expansion of production at Kazakhstan’s Kashagan and Tengiz deposits is scheduled finally to start in these pivotal years 2022–23, which mark the transition from the short term to the medium term as I have defined them.

Map 5. The Kazakhstan-Caspian Transport System (KCTS) and Trans-Caspian Oil Pipeline (TCOP) Projects (Source: Kafkassam)

Once the TCP is completed, the possibilities of the Trans-Caspian Oil Pipeline (TCOP) between Kazakhstan and Azerbaijan, discussed 12 years ago between Presidents Sarkozy and Nazarbayev, will be more promising. This TCOP would be fed by the Kazakhstan-Caspian Transport System (KCTS), an internal Kazakhstani pipeline running overland from the northwest of the country to the town of Kuryk on the Caspian Sea coast, not far from the port of Aktau. The TCOP will become necessary after production finally starts, quite soon, at the offshore Kashagan deposit, while at the same time existing routes will no longer suffice to carry all the production planned for the forthcoming expansion of works at the Tengiz deposit.

Map 6. The EurAsian Oil Transport Corridor (EAOTC) Project (Source: UKRTRANSNAFTA)

Once in Baku, this oil would also transit to the Georgian coast of the Black Sea, from where tankers would take it to Odessa, there to enter the EurAsian Oil Transport Corridor (EAOTC), currently under construction, finally arriving in the Polish port of Gdańsk for export to European and world markets. This oil could also be diverted from Baku to Ceyhan via the BTC pipeline, a version referred to as the ABC Pipeline (for Aktau-Baku-Ceyhan).

Such developments would allow Turkmenistan and Kazakhstan, even Uzbekistan, to rely, via Georgia, not only economically but also politically on Europe, thereby balancing the strategic encroachments of Russian, Chinese and Iranian influence. The Central Asian states, due to their geography, consciously follow a “multi-vector” foreign policy, seeking as many partners as possible to reduce the leverage of any one of them. In such a situation, constructive European political and security influences will be multiplied far beyond the economic investments developing these relations in the beginning.

4. Conclusion

It is difficult to underestimate the significance of the TCP for the medium term and even for the long term. Like the BTC oil export pipeline of 20 years ago, it is a demonstration project. The BTC, besides proving to be of great commercial benefit, established and strengthened the independence of its participating countries. More than that, it demonstrated and thus opened the possibility of building the SCP and SGC.

The TCP is likewise a unique opportunity to ensure Europe’s economic benefit and political influence in the region. Its construction will indicate to international financial institutions and investors that other trans-Caspian energy projects for the exploration, development and export of energy resources are possible. The TCP’s implementation will also consolidate Georgian economic reforms, to the later benefit of both Georgia and Europe. The TCP is thus a strategic project both for Europe and for Georgia.

*Non-resident Senior Research Fellow, Beyond the Horizon ISSG. Also Fellow, Canadian Energy Research Institute and Senior Researcher, Institute of European, Russian and Eurasian Studies, Carleton University

Profile: https://www.linkedin.com/in/robertmcutler/ Email: rmc@alum.mit.edu

This article is the English translated proceedings of “Le bassin de la mer Caspienne et la sécurité énergétique de l’Europe”, presented at the Saint-Louis University Conference Les récentes découvertes d’hydrocarbures dans les voisinages de l’UE; portée et conséquences (Session on “Les enjeux politiques et géopolitiques à court et à moyen terme”), Brussels, 31 January 2019.