09 MARCH 2026

This edition unfolds at a moment when developments far beyond the Indo-Pacific are exerting a growing influence on Asia’s strategic landscape. The escalating conflict involving Iran and the United States has sent shockwaves across the region, exposing the depth of Asia’s economic and security interdependence with the Middle East. From India’s acute vulnerability to disruptions in Gulf energy supplies to the wave of protests and instability in Pakistan, the repercussions illustrate how quickly distant crises can reverberate through Asia’s political and economic systems.

Yet while external shocks shape the strategic environment, the core dynamics of great-power competition in Asia continue to evolve in parallel. Beijing’s annual parliamentary meetings have laid out an ambitious technological and industrial agenda, emphasizing artificial intelligence, advanced manufacturing, and strategic supply-chain resilience as central pillars of China’s long-term development strategy. These initiatives reflect a broader effort to shift the country’s economic model toward innovation-driven growth while reinforcing technological self-reliance in the face of tightening Western restrictions. At the same time, preparations for a summit between U.S. President Donald Trump and Chinese President Xi Jinping—and tentative discussions on reviving bilateral investment flows—suggest that even amid deep strategic rivalry, the two powers remain locked in a complex cycle of competition and selective engagement.

Across the region, middle powers are also recalibrating their strategic positions with growing urgency. Canada’s diplomatic outreach across the Indo-Pacific, renewed cooperation on critical minerals and energy supply chains, and expanding defence coordination among U.S. allies all point to a broader pattern of diversification and hedging. Governments are seeking to strengthen economic resilience, secure access to strategic resources, and reinforce partnerships capable of navigating an increasingly uncertain geopolitical environment.

Taken together, the developments in this issue highlight a region operating under mounting strategic pressure yet marked by active adaptation. External crises, technological competition, and shifting alliance dynamics are increasingly intertwined, shaping policy decisions from energy security to defence planning. Asia on the Horizon continues to track these intersecting currents—connecting immediate events to the broader strategic transformations reshaping power, policy, and stability across Asia and the wider global system.

- Key Developments

- Statistics of the Week

- Map of the Week

- Photo of the Week

- Infographic of the Week

- Regional Alliances

- Analysis

Seoul Urges Renewed Dialogue as Inter-Korean Tensions Persist

South Korean President Lee Jae Myung called on North Korea to resume dialogue, urging Pyongyang to move beyond confrontation and return to diplomatic engagement on the Korean Peninsula. Speaking on March 1 during a ceremony marking the anniversary of Korea’s independence movement against Japanese colonial rule, Lee emphasized that his administration seeks peaceful coexistence and respects North Korea’s political system. He reiterated that Seoul has no intention of pursuing “unification by absorption” or hostile policies, framing renewed dialogue as essential to reducing tensions and ultimately replacing the 1953 armistice with a permanent peace arrangement.

The appeal comes amid hardened rhetoric from Pyongyang, which has recently rejected Seoul’s overtures and portrayed South Korea as its “most hostile entity.” North Korean leader Kim Jong Un signalled at a recent party meeting that the North sees little basis for engagement with Seoul, even as he left open the possibility of improved relations with the United States if Washington acknowledges the North’s nuclear status. The exchange highlights the widening diplomatic gap between the two Koreas: while Seoul continues to pursue dialogue and confidence-building measures, Pyongyang appears increasingly focused on nuclear deterrence and strategic bargaining with major powers.

Beijing Calls for Ceasefire After U.S.–Israel Strikes on Iran

China has called for an immediate ceasefire following joint U.S. and Israeli strikes on Iran, warning that the escalation risks further destabilizing the Middle East. Chinese Foreign Minister Wang Yi condemned the attacks as “unacceptable” and urged all parties to halt military operations and return to dialogue, emphasizing that Iran’s sovereignty and territorial integrity should be respected. Beijing said it had not been informed in advance of the strikes and reiterated that disputes should be resolved through negotiations rather than unilateral military action.

The conflict has also directly affected Chinese nationals in the region. China’s foreign ministry reported that one Chinese citizen was killed in Tehran and that more than 3,000 Chinese nationals have been evacuated from Iran as fighting intensified. Beijing has advised its citizens to leave the country through neighbouring states and has mobilized diplomatic missions across the region to assist evacuations. The developments highlight both China’s growing exposure to Middle Eastern instability and its diplomatic positioning as a proponent of ceasefire and negotiated settlement amid a widening regional crisis.

Canada and India Reset Ties with Energy and Trade Agreements

Canadian Prime Minister Mark Carney met Indian Prime Minister Narendra Modi in New Delhi on March 2, marking a significant effort to restore and deepen bilateral relations after several years of diplomatic strain. The leaders announced a series of agreements aimed at expanding cooperation across energy, critical minerals, and trade, positioning economic partnership as the foundation of renewed engagement. Central to the visit was a C$2.6 billion uranium supply deal under which Canada’s Cameco will provide roughly 22 million pounds of uranium to support India’s nuclear energy programme, alongside additional memorandums covering energy cooperation and resource development.

Both governments also committed to accelerating negotiations toward a Comprehensive Economic Partnership Agreement, with the aim of concluding a free trade deal by the end of 2026 and expanding bilateral trade to around US$50 billion by 2030. The meeting reflects a broader diplomatic reset following tensions that erupted in 2023 over allegations linked to the killing of a Sikh activist in Canada, which had sharply strained relations. By emphasizing energy security, critical minerals, and commercial cooperation, the Carney–Modi summit signals a pragmatic shift toward rebuilding strategic and economic ties between two major middle powers amid shifting global supply chains and geopolitical competition.

Pakistan Deploys Military After Deadly Pro-Iran Protests

Pakistan deployed troops to the northern Gilgit-Baltistan region and imposed a nationwide ban on public gatherings after violent protests linked to the U.S.–Israeli strikes on Iran left at least 26 people dead across the country. Authorities ordered the military into the cities of Gilgit and Skardu—both in the Shi’ite-majority Himalayan region—and imposed a three-day curfew following clashes that included attacks on government buildings and the burning of a United Nations office. The unrest was driven by strong public anger over the strikes in Iran, which sparked demonstrations across several Pakistani cities.

Violence also spread beyond the north, most notably in Karachi where protesters stormed the U.S. consulate, resulting in multiple deaths during clashes with security forces. Additional protests were reported in Islamabad, Parachinar, Peshawar, and other cities, prompting heightened security around U.S. diplomatic missions and emergency restrictions on large public gatherings. While some demonstrations remained peaceful, the scale of unrest underscores Pakistan’s domestic sensitivity to developments involving Iran and the broader Middle East. The government’s deployment of troops and curfews reflects concern that sectarian solidarity and anti-Western sentiment could escalate further if regional tensions continue to intensify.

Iran Strikes Raise New Calculations for North Korea–U.S. Nuclear Diplomacy

The recent U.S. and Israeli military strikes on Iran have intensified debate over whether North Korea might reconsider returning to nuclear negotiations with Washington, particularly with U.S. President Donald Trump. Analysts say the attacks—carried out against a country without a nuclear deterrent—could reinforce Pyongyang’s longstanding belief that nuclear weapons are essential for regime survival. North Korean officials condemned the strikes as evidence of what they describe as U.S. “hegemonic” behaviour, while leader Kim Jong Un recently reiterated plans to expand the country’s nuclear arsenal at a ruling party meeting.

Despite this hardened rhetoric, the developments may also create incentives for renewed diplomacy. Experts note that Kim could seek to manage relations with Trump, with whom he previously held three summits between 2018 and 2019 before talks collapsed over sanctions and denuclearization disputes. Some analysts suggest the heightened threat perception from the Iran conflict could push Pyongyang to explore negotiations—potentially leveraging Kim’s personal rapport with Trump while continuing to advance its nuclear capabilities. However, North Korea is widely believed to possess around 50 nuclear warheads and significant missile capabilities, making any future talks likely to focus less on denuclearization and more on arms control or recognition of its nuclear status.

Carney’s Australia Visit Highlights Emerging “Middle Power” Coordination

Canadian Prime Minister Mark Carney arrived in Australia on March 3 as part of a broader Indo-Pacific tour aimed at strengthening cooperation among so-called “middle powers” amid intensifying geopolitical rivalry and global instability. During meetings with Australian Prime Minister Anthony Albanese and an address to Australia’s parliament, Carney emphasized that countries such as Canada and Australia must work more closely together to shape international rules rather than allow major powers to dictate outcomes. The visit follows earlier stops in India and precedes a planned trip to Japan, reflecting Ottawa’s strategy of deepening partnerships across the Indo-Pacific.

The talks focused on expanding collaboration in areas including defence, maritime security, trade, artificial intelligence, and particularly critical minerals—resources essential for semiconductors, clean energy technologies, and defence systems. Canada and Australia, both major producers of lithium, uranium, and iron ore, also discussed aligning supply-chain initiatives and strengthening cooperation through the G7 critical minerals alliance to reduce dependence on China-dominated supply chains. The visit underscores a broader effort by democratic middle powers to coordinate economic and strategic policies as competition among larger powers increasingly shapes global politics.

Pakistan–Afghanistan Border Fighting Intensifies, Civilians and Displacement Rise

Clashes between Pakistani forces and Afghanistan’s Taliban government have intensified along the countries’ 2,600-kilometer border, with fighting continuing for several days and showing little sign of de-escalation. The conflict was triggered by Pakistani airstrikes inside Afghanistan targeting what Islamabad described as militant bases linked to the Tehrik-e-Taliban Pakistan (TTP), which Pakistan accuses of staging cross-border attacks. Kabul condemned the strikes as a violation of its sovereignty and retaliated with attacks on Pakistani border posts, leading to exchanges of artillery fire and clashes across multiple frontier areas.

The humanitarian toll has risen sharply as the conflict expands. The United Nations Assistance Mission in Afghanistan reported that at least 42 Afghan civilians have been killed and more than 100 wounded, while UN agencies estimate that over 100,000 people have been displaced by the fighting along the frontier. Both sides claim significant battlefield losses for the other, though these reports remain difficult to verify. The United Nations has urged both governments to halt hostilities and protect civilians, warning that continued escalation risks worsening instability and humanitarian conditions in already fragile border regions.

Middle East Conflict Exposes India’s Energy Vulnerability

Analysts warn that India is among the most vulnerable major economies to prolonged disruptions in Middle Eastern oil supplies as regional tensions escalate following U.S. and Israeli strikes on Iran. India currently imports roughly 55% of its crude oil from the Middle East, a level that has risen to its highest share since 2022, increasing exposure to instability around key transit routes such as the Strait of Hormuz. Energy experts note that a sustained disruption to shipments from the Gulf could sharply impact India’s fuel supply and economic stability, particularly as global oil prices rise amid fears of supply shortages.

The country’s relatively limited strategic petroleum reserves compound this vulnerability. While China reportedly maintains oil stockpiles sufficient for roughly six months of consumption, India’s inventories currently cover only about 20–25 days, according to industry sources, though officials estimate broader reserves could last longer when including commercial storage. Analysts say the disparity leaves India less insulated from supply shocks, especially if disruptions in the Strait of Hormuz—through which around one-fifth of global oil trade normally passes—persist. The situation highlights the strategic importance of diversifying energy sources and expanding storage capacity as geopolitical tensions increasingly intersect with global energy security.

China’s Parliament Signals New Push in Technology Race with the West

China’s annual parliamentary session, the National People’s Congress (NPC), has outlined a strategic roadmap aimed at accelerating the country’s technological development and strengthening its position in the global competition with Western powers. The government’s agenda centres on advancing key sectors such as artificial intelligence, robotics, space technology, and advanced manufacturing, with policymakers expected to embed these priorities in the upcoming 15th Five-Year Plan (2026–2030) and related policy frameworks. Officials say the strategy will focus on translating recent technological breakthroughs into large-scale industrial applications while reinforcing China’s capacity for innovation amid tightening U.S. technology restrictions.

The policy direction reflects Beijing’s broader effort to shift its economic model toward high-tech growth and greater technological self-reliance. The new blueprint emphasizes expanding research and development investment, scaling computing infrastructure, and promoting what Chinese officials call “new quality productive forces,” including AI-enabled manufacturing and emerging digital industries. Analysts note that the initiative also seeks to secure supply chains in strategic sectors—from semiconductors to rare earths—while strengthening China’s industrial base in a period of intensifying geopolitical rivalry with the United States and its allies.

U.S. and China Explore Reviving Investment Ties Ahead of Trump Visit

Officials from the United States and China have begun discussions on reviving reciprocal investment flows as both governments prepare for U.S. President Donald Trump’s planned visit to Beijing from March 31 to April 2. Working-level talks have explored potential frameworks for renewed cross-border investment, which could become one of the few concrete economic deliverables from the upcoming summit between Trump and Chinese President Xi Jinping. The discussions come amid years of declining bilateral investment driven by trade tensions, national-security restrictions, and tighter regulatory scrutiny in both countries.

The potential revival of investment ties remains preliminary, with negotiators still debating the scale and structure of possible deals. Chinese officials have reportedly emphasized stronger protections for their companies operating in the United States, while Washington is seeking improved market access for American firms in China. Any agreement would unfold against a backdrop of persistent strategic competition, including disputes over tariffs, technology controls, and supply-chain security. Nevertheless, renewed investment dialogue signals that both sides are exploring limited economic cooperation even as broader geopolitical rivalry continues to shape the U.S.–China relationship.

France and China Coordinate Diplomatic Push to De-escalate Iran War

France and China have agreed to cooperate on diplomatic efforts to de-escalate the ongoing conflict involving Iran, highlighting a rare convergence between a European power and Beijing amid rising Middle East tensions. French Foreign Minister Jean-Noël Barrot discussed the situation with Chinese Foreign Minister Wang Yi on March 2, with both sides emphasizing the need for restraint and a political solution that would ensure collective regional security. The two ministers also underscored the importance of international institutions and dialogue in managing the crisis, signalling support for a multilateral approach to prevent further escalation.

During the exchange, Barrot reiterated that France had no involvement or prior knowledge of the recent U.S. and Israeli military strikes on Iran, while criticizing Tehran for escalating tensions through regional attacks and for failing to comply with United Nations Security Council resolutions related to its nuclear and missile programs. Both sides agreed to maintain ongoing consultations as the conflict evolves. The coordination reflects broader international concern that the fighting could expand into a wider regional confrontation, prompting diplomatic efforts by multiple powers to contain the crisis and encourage negotiations.

China Reaffirms Support for Iran Amid Escalating Middle East Conflict

China reaffirmed its diplomatic support for Iran during a phone call between Chinese Foreign Minister Wang Yi and his Iranian counterpart Abbas Araghchi, as tensions in the Middle East intensified following U.S. and Israeli military strikes. Wang stated that Beijing supports Iran in safeguarding its sovereignty, security, territorial integrity, and national dignity, while emphasizing that Tehran should also consider the legitimate concerns of neighbouring countries. He urged the United States and Israel to immediately halt military operations and prevent further escalation, warning that continued conflict could destabilize the broader region.

The exchange reflects China’s broader diplomatic response to the expanding regional crisis, combining criticism of military action with calls for restraint and negotiations. Chinese officials have repeatedly stressed that the use of force risks widening the conflict and undermining diplomatic efforts already underway. At the same time, Beijing has intensified outreach to multiple regional actors through a series of diplomatic calls and consultations aimed at easing tensions. The latest engagement underscores China’s effort to position itself as a supporter of Iran’s rights while advocating dialogue and regional stability amid growing geopolitical uncertainty in the Middle East.

Asian Allies Worry Iran War Could Dilute U.S. Deterrence in Indo-Pacific

U.S. allies in Asia are increasingly concerned that Washington’s military involvement in the conflict with Iran could weaken American deterrence capabilities in the Indo-Pacific, particularly against China. Officials and analysts in countries such as Japan, South Korea, and Taiwan warn that if the conflict in the Middle East becomes prolonged, the United States may be forced to divert naval forces, missile defences, and munitions away from Asia. The region already hosts critical U.S. bases that support deterrence against China and North Korea, and policymakers fear that redeploying assets could create gaps in regional defence architecture.

Military analysts also note that the United States may face growing logistical strain if operations against Iran expand. Roughly 40% of operational U.S. naval ships are reportedly already positioned around the Middle East, while the only U.S. aircraft carrier currently assigned to the Indo-Pacific is undergoing maintenance. At the same time, the conflict risks accelerating the depletion of precision munitions stockpiles that are considered essential for potential contingencies involving China, particularly around Taiwan. Although President Donald Trump has suggested the Middle East campaign will be limited in duration, Asian partners remain wary that an extended conflict could distract Washington and create strategic opportunities for Beijing to increase pressure in the region.

U.S. and China Prepare Trade Talks Ahead of Trump–Xi Summit

Senior U.S. and Chinese trade officials are expected to meet in Paris in mid-March for high-level economic talks ahead of a planned summit between U.S. President Donald Trump and Chinese President Xi Jinping later this month. The meeting will bring together U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, signalling that preparations for the leaders’ meeting remain on track despite heightened geopolitical tensions, including the ongoing conflict involving Iran.

The discussions are expected to focus on a range of economic issues, including potential Chinese purchases of U.S. aircraft and agricultural products such as soybeans, as well as broader trade and investment concerns. Negotiators are also likely to address tariffs and market access, reflecting ongoing efforts to stabilize commercial ties after years of economic friction between the two powers. While the talks remain preliminary, the Paris meeting could help shape the agenda for the Trump–Xi summit, offering a possible pathway toward limited economic cooperation even as strategic rivalry between Washington and Beijing persists.

China Urges Israel to Halt Strikes on Iran Amid Escalating Conflict

China has called on Israel to immediately halt military strikes on Iran, as Beijing intensifies diplomatic efforts to contain the widening Middle East conflict. In a phone call with Israeli Foreign Minister Gideon Saar on March 3, Chinese Foreign Minister Wang Yi warned that continued attacks risk deepening instability and producing broader regional consequences. Wang emphasized that the use of force would only exacerbate tensions and urged all parties to resolve disputes through dialogue and negotiation rather than military escalation.

The appeal forms part of a broader Chinese diplomatic push following the U.S.–Israeli military campaign against Iran, which has triggered regional retaliation and global concern over energy supplies and security. Beijing has condemned the strikes as unacceptable and reiterated support for respecting Iran’s sovereignty while calling for an immediate ceasefire and renewed political negotiations. Chinese officials have also held a series of phone calls with counterparts from multiple countries, signaling Beijing’s attempt to position itself as a diplomatic actor advocating de-escalation while avoiding deeper military involvement in the crisis.

India Rations Gas Supplies to Industry After Qatar LNG Disruption

India has begun reducing natural gas supplies to industrial consumers after a sudden disruption in liquefied natural gas (LNG) production and shipments from Qatar, the country’s largest supplier. The supply cut follows escalating conflict in the Middle East that halted energy shipments through the Strait of Hormuz and disrupted operations at key LNG facilities. State-linked energy companies, including GAIL and Indian Oil Corporation, notified customers of reductions ranging from 10% to 30% in gas deliveries as they attempt to manage tightening supply while maintaining contractual obligations.

The shortfall reflects India’s heavy reliance on Gulf energy imports, with Qatar accounting for a significant share of its LNG supplies. Energy firms including Petronet LNG, India’s largest LNG importer, have been forced to adjust distribution to prioritize essential sectors while exploring emergency purchases on the spot market. However, sourcing replacement cargoes may prove difficult due to sharply rising global LNG prices, shipping costs, and insurance premiums linked to the regional conflict. The episode highlights India’s vulnerability to disruptions in Middle Eastern energy flows and the broader geopolitical risks facing Asian import-dependent economies.

China’s “Two Sessions” Outline Economic and Strategic Priorities

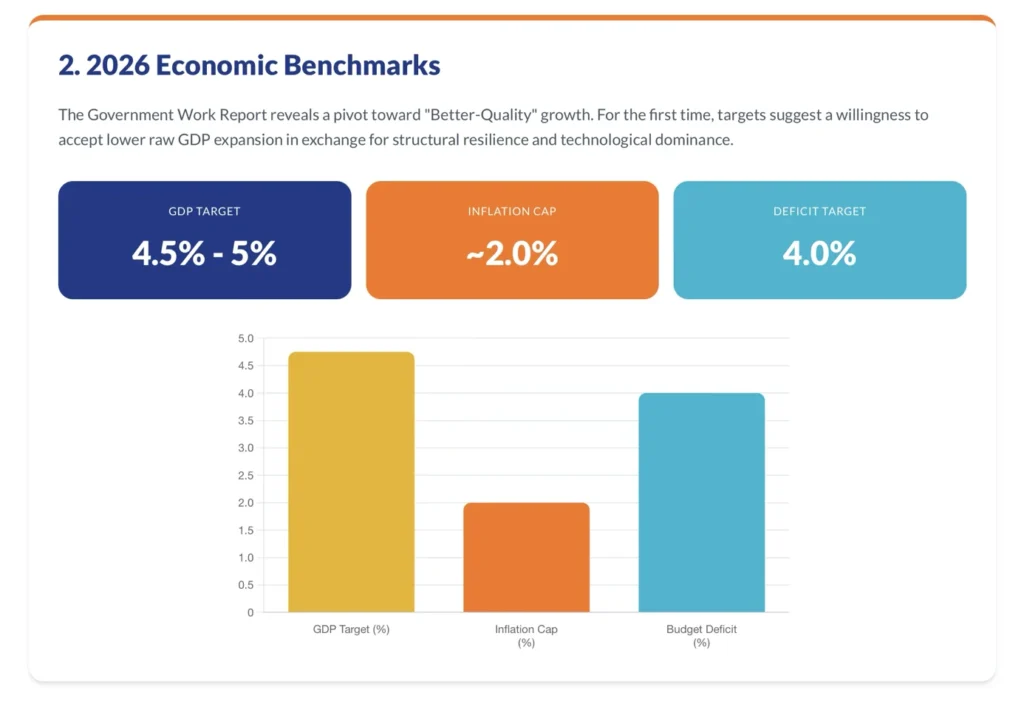

China’s annual parliamentary meetings—the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference—have unveiled Beijing’s economic and political priorities for the coming year and the broader 2026–2030 planning cycle. In his government work report, Premier Li Qiang set a GDP growth target of 4.5–5% for 2026, slightly below last year’s roughly 5% expansion, reflecting a more cautious outlook amid domestic economic challenges and global uncertainty. The government also signalled continued fiscal support, including maintaining a higher budget deficit to sustain growth while targeting the creation of more than 12 million urban jobs and keeping inflation around 2%.

Beyond macroeconomic targets, the policy blueprint emphasizes technological self-reliance and industrial modernization as central pillars of China’s long-term strategy. Officials highlighted investment in sectors such as artificial intelligence, advanced manufacturing, quantum computing, and robotics, reflecting Beijing’s effort to compete more effectively with Western technological leadership. The plan also includes a 7% increase in defence spending and measures aimed at strengthening food security, managing financial risks, and addressing demographic decline through pro-family policies. Together, the initiatives signal China’s attempt to balance slower economic growth with strategic industrial upgrading and greater resilience amid intensifying geopolitical competition.

India Seeks Dutch Semiconductor Expertise to Accelerate Chip Industry

India is expanding international cooperation to support its ambitions of building a domestic semiconductor industry, sending a trade delegation to the Dutch technology hub of Eindhoven to explore partnerships with leading chip firms and equipment suppliers. The visit focused on attracting investment and technical expertise from companies in the Netherlands, including those based in the region surrounding ASML and NXP Semiconductors, as New Delhi intensifies efforts to develop its semiconductor manufacturing ecosystem. The initiative reflects India’s broader strategy to reduce reliance on imported chips while strengthening its role in global technology supply chains.

The outreach comes as India offers substantial government incentives to attract semiconductor manufacturers. Authorities have pledged billions of dollars in subsidies—covering up to 50% of project costs—to encourage fabrication plants and related manufacturing, with eight chip-sector projects already underway, including a $14 billion Tata Electronics facility in Gujarat. Dutch firms are also showing interest as they seek new markets and diversification opportunities amid export controls and geopolitical tensions linked to U.S.–China technology competition. The engagement highlights a convergence of interests: India aims to build domestic capacity, while European technology firms look to expand manufacturing and partnerships beyond traditional markets.

India Seeks Dutch Semiconductor Expertise to Accelerate Chip Industry

India is expanding international cooperation to support its ambitions of building a domestic semiconductor industry, sending a trade delegation to the Dutch technology hub of Eindhoven to explore partnerships with leading chip firms and equipment suppliers. The visit focused on attracting investment and technical expertise from companies in the Netherlands, including those based in the region surrounding ASML and NXP Semiconductors, as New Delhi intensifies efforts to develop its semiconductor manufacturing ecosystem. The initiative reflects India’s broader strategy to reduce reliance on imported chips while strengthening its role in global technology supply chains.

The outreach comes as India offers substantial government incentives to attract semiconductor manufacturers. Authorities have pledged billions of dollars in subsidies—covering up to 50% of project costs—to encourage fabrication plants and related manufacturing, with eight chip-sector projects already underway, including a $14 billion Tata Electronics facility in Gujarat. Dutch firms are also showing interest as they seek new markets and diversification opportunities amid export controls and geopolitical tensions linked to U.S.–China technology competition. The engagement highlights a convergence of interests: India aims to build domestic capacity, while European technology firms look to expand manufacturing and partnerships beyond traditional markets.

Australians Aboard U.S. Submarine That Sank Iranian Warship

Australian Prime Minister Anthony Albanese confirmed that three Australian Defence Force personnel were aboard a U.S. Navy submarine that torpedoed and sank an Iranian warship in the Indian Ocean earlier in the week. The Iranian frigate was struck by a torpedo while sailing in international waters near southern Sri Lanka, resulting in significant casualties among the crew. Albanese stated that the Australians were present as part of a training rotation with U.S. submarines, but stressed that they did not participate in the attack or any offensive action during the operation.

The incident occurred amid the widening conflict involving Iran and U.S.–Israeli military operations in the region. The Australians were reportedly on board the submarine as part of cooperation under the AUKUS security partnership, which involves joint training and technology sharing ahead of Australia’s planned acquisition of nuclear-powered submarines. The episode has drawn attention in Australia due to concerns about potential entanglement in U.S.-led military operations, even as Canberra maintains that its personnel complied fully with Australian and international law.

Indian Refiners Turn to Russian Oil as Middle East Supply Tightens

Indian refiners have begun purchasing large volumes of prompt Russian crude cargoes as disruptions linked to the Iran conflict strain energy supplies from the Middle East. According to industry sources, refiners in India have already secured around 20 million barrels of Russian oil, including Urals crude, to compensate for reduced availability of Gulf supplies. Several major refiners—including Indian Oil Corp, Bharat Petroleum, Hindustan Petroleum, MRPL, and Reliance Industries—are involved in the purchases, with some cargoes sourced from tankers already positioned near Indian waters to ensure quick delivery.

The shift reflects India’s heavy dependence on Middle Eastern energy flows, with roughly 40% of its crude imports typically sourced from the region through the Strait of Hormuz, which has been disrupted by the conflict. Traders report that Russian oil is now being sold to Indian buyers at a $4–$5 per barrel premium to Brent, reversing the steep discounts previously offered earlier this year as supply shortages push buyers to prioritize availability over price. Analysts say the renewed demand underscores how geopolitical shocks in the Gulf can quickly reshape Asian crude trade patterns, with Russia emerging as a key alternative supplier during periods of supply disruption.

China Announces 7% Increase in Defence Spending for 2026

China has announced a 7% increase in its defence budget for 2026, continuing the steady expansion of military spending as Beijing pursues long-term modernization of the People’s Liberation Army (PLA). The official defence allocation will reach about 1.9 trillion yuan (approximately $275–277 billion), maintaining China’s position as the world’s second-largest military spender after the United States. The increase, revealed during the annual National People’s Congress, is slightly lower than the 7.2% growth recorded in 2025, marking the slowest pace in five years but still outpacing China’s projected economic growth.

Chinese officials say the additional funding will support continued modernization of the armed forces, including upgrades to advanced weaponry, training, and combat readiness as Beijing aims to build a “world-class military” by 2035. Analysts note the budget increase comes amid heightened regional tensions—particularly around Taiwan and in the South China Sea—as well as ongoing reforms and anti-corruption campaigns within the military leadership. While the increase reflects China’s attempt to balance strategic ambitions with economic pressures at home, the steady expansion of defence spending continues to draw concern from neighboring countries wary of Beijing’s growing military capabilities.

China Unveils New Five-Year Plan at National People’s Congress

China has unveiled the framework of its 15th Five-Year Plan (2026–2030) during the annual National People’s Congress in Beijing, setting the policy direction for the country’s economic and technological development over the next half decade. The plan, one of the Chinese government’s most important planning documents, outlines priorities ranging from economic reform and industrial upgrading to national security and social development. Officials are expected to target annual GDP growth of around 4.5–5%, reflecting a more cautious outlook as China confronts slower domestic growth, demographic pressures, and an uncertain global economic environment.

A central focus of the plan is accelerating technological self-reliance and industrial modernization amid intensifying strategic competition with the West. Beijing aims to expand investment in sectors such as artificial intelligence, semiconductors, robotics, and advanced manufacturing, while promoting innovation-driven productivity and reducing dependence on foreign technology. The blueprint also highlights goals to boost domestic consumption, strengthen supply chains, and advance emerging industries that Chinese policymakers describe as “new quality productive forces.” Together, the priorities signal Beijing’s effort to rebalance its economy toward high-tech growth and long-term strategic resilience through the end of the decade.

China’s 2026 Economic Targets Signal Shift Toward “Quality Growth”

China’s 2026 Government Work Report, presented during the annual “Two Sessions” parliamentary meetings, sets a series of economic benchmarks that reflect Beijing’s evolving development strategy. Authorities announced a GDP growth target of 4.5–5%, paired with an inflation ceiling of roughly 2% and a budget deficit target of 4% of GDP. Together, these figures suggest a deliberate policy shift: Chinese policymakers appear increasingly willing to accept slightly slower headline growth in exchange for greater economic resilience, fiscal flexibility, and long-term industrial competitiveness.

The benchmarks highlight Beijing’s effort to stabilize the economy while supporting structural transformation. A higher deficit target signals expanded fiscal support for strategic sectors, infrastructure, and technology development, while the moderate inflation cap reflects continued caution about price stability amid uncertain global conditions. Analysts note that these targets align with China’s broader push to cultivate what officials describe as “high-quality growth,” prioritizing innovation, industrial upgrading, and technological self-reliance rather than relying solely on rapid GDP expansion as the primary measure of economic performance.

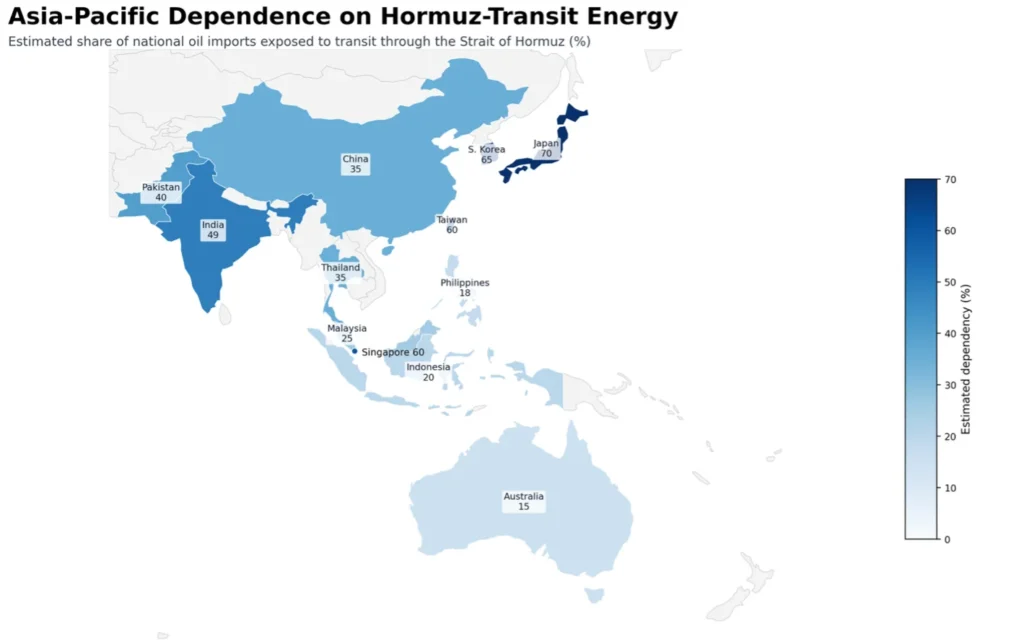

Asia-Pacific Dependence on Hormuz Transit Energy

This week’s map highlights the Asia-Pacific region’s dependence on oil imports that transit through the Strait of Hormuz, one of the world’s most critical energy chokepoints. The visualization illustrates the estimated share of national oil imports exposed to this route, revealing particularly high reliance among Northeast Asian economies. Japan (around 70%) and South Korea (about 65%) stand out as the most exposed, while Taiwan and Singapore each approach roughly 60% dependence. Large emerging economies such as India (around 49%) and Pakistan (about 40%) also rely heavily on energy shipments moving through the Persian Gulf corridor.

The map underscores the strategic implications of instability in the Middle East for Indo-Pacific energy security. Even countries with lower direct exposure—such as China (around 35%) or Southeast Asian states like Indonesia and Malaysia—remain vulnerable to market disruptions caused by any blockade or conflict affecting Hormuz. Because the strait serves as a primary conduit for Gulf crude exports to Asia, any sustained disruption could quickly ripple across the region’s energy markets, amplifying price volatility and forcing governments to draw on strategic reserves or seek alternative supply routes.

Carney–Modi Meeting Highlights India–Canada Diplomatic Reset

This week’s image captures Canadian Prime Minister Mark Carney meeting with Indian Prime Minister Narendra Modi in New Delhi, a moment that reflects the gradual normalization of relations between the two countries after a period of diplomatic tension. Seated across a small table during their bilateral meeting, the two leaders appear engaged in discussion in a formal setting that emphasizes both protocol and renewed engagement. The meeting formed a central part of Carney’s Indo-Pacific tour and signaled a mutual willingness to restore political dialogue and rebuild trust following strains that emerged in bilateral relations in recent years.

Beyond symbolism, the encounter carries strategic implications. Ottawa and New Delhi discussed expanding cooperation in energy, critical minerals, trade, and technology, areas increasingly tied to supply-chain resilience and geopolitical competition. The visual composition—two leaders in close conversation amid a carefully staged diplomatic environment—underscores how both governments are attempting to shift the relationship from confrontation back toward pragmatic cooperation, reflecting broader efforts by middle powers to recalibrate partnerships in a rapidly evolving global order.

The Great Power Energy Pressure Test: Strategic Implications of the 2026 Iran Crisis

This week’s infographic examines how the 2026 Iran crisis is testing the resilience of global energy systems and exposing the strategic vulnerabilities of major powers. At the center lies the Strait of Hormuz, the critical maritime chokepoint through which roughly one-fifth of global oil supplies transit. The visual highlights how limited bypass pipelines—capable of carrying only a fraction of normal flows—create a systemic bottleneck for global energy markets. A prolonged disruption could therefore produce cascading effects across supply chains, potentially driving oil prices toward extreme levels and triggering broader economic instability.

The infographic also maps how major actors experience the crisis differently. China’s vulnerability lies in its heavy dependence on imported energy, despite large strategic reserves, while the United States faces price exposure even though its direct physical reliance on Hormuz flows is limited. The European Union’s shift from Russian pipeline gas to LNG imports introduces new maritime risks, and Russia emerges as a potential opportunistic beneficiary, able to profit from higher prices and expanded demand for its exports. Taken together, the visual underscores a central geopolitical reality: energy infrastructure and supply routes remain a critical arena where strategic competition, economic security, and global crises intersect.

𝗧𝗵𝗲 𝗦𝘁𝗿𝗮𝗶𝘁 𝗧𝗵𝗮𝘁 𝗣𝗼𝘄𝗲𝗿𝘀 𝘁𝗵𝗲 𝗪𝗼𝗿𝗹𝗱: 𝗪𝗵𝘆 𝗛𝗼𝗿𝗺𝘂𝘇 𝗦𝘁𝗶𝗹𝗹 𝗗𝗲𝗰𝗶𝗱𝗲𝘀 𝗚𝗹𝗼𝗯𝗮𝗹 𝗘𝗻𝗲𝗿𝗴𝘆 𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆

The global energy system still hinges on a narrow maritime chokepoint. Nearly 20–27% of the world’s oil trade and ~𝟮𝟬% 𝗼𝗳… pic.twitter.com/8x96ECPBbp

— Beyond the Horizon (@BehorizonOrg) March 6, 2026

Indo-Pacific Allies in the Shadow of the U.S.–Iran Conflict

Introduction: The Strategic Shock of March 2026

The first week of March 2026 represents a watershed strategic shock that has fundamentally recalibrated the global architecture of power. Following the high-intensity U.S.-Israeli operations “Epic Fury” and “Roaring Lion,” the death of Iranian Supreme Leader Ayatollah Ali Khamenei has plunged the Middle East into a volatile power vacuum. While Washington portrays these strikes as a surgical neutralization of a nuclear-aspirant regime and a blow against state-sponsored terror, the strategic reality is more precarious. This moment serves as the ultimate stress test for the American “Pivot to Asia.”

The central thesis of this crisis is clear: while the strikes may yield a tactical victory in Tehran, they risk hollowing out Indo-Pacific deterrence and gifting Beijing a generational window of opportunity. The United States is not merely stretched; it is increasingly over-extended by design in a manner that favours its primary revisionist competitor. The immediate military success in the Middle East has birthed a long-term resource dilemma in the West, where the pursuit of regional stability in the Gulf threatens to compromise the security of the Pacific.

The Logistics of Distraction: Evaluating the “Hollowed Out” Indo-Pacific

For over a decade, U.S. grand strategy has rested on the maintenance of a robust naval and missile presence in East Asia to deter Chinese expansionism and North Korean provocation. However, the escalation in Iran has necessitated a massive redeployment, leaving the Indo-Pacific’s defense architecture dangerously thin. Military analysts warn that the current fleet is insufficient to sustain a steady presence across two simultaneous theaters of high-intensity conflict.

The following table details the resulting imbalance in U.S. naval and logistical posture:

|

Feature |

Middle East Deployment |

Indo-Pacific Deficits |

|

Operational Vessel Share |

~40% of immediate-ready U.S. Navy ships |

Critical gaps in patrol; “stretched thin” posture |

|

Aircraft Carriers |

USS Abraham Lincoln (Active) |

USS George Washington (Under maintenance in Yokosuka) |

|

Destroyer Support |

Six missile destroyers (Pacific-origin) |

Depleted surface fleet in Western Pacific |

|

Munitions Status |

High rate of fire; “burning through” stocks |

Delays in Tomahawk deliveries; years to rebuild |

The strategic implications are profound. The six destroyers currently operating in the Middle East were diverted from Pacific ports in California, Hawaii, and Japan, directly hollowing out the Western Pacific’s screen. For Taipei, Tokyo, and Seoul, the “So What?” factor is existential: a prolonged entanglement in Iran emboldens Beijing to accelerate coercion in the South China Sea and the Taiwan Strait. With the only U.S. carrier in Asia sidelined for maintenance, the temporary vacuum in the Pacific creates a window for opportunistic military activity by adversaries.

The Energy Achilles’ Heel: Strategic Vulnerability in the Strait of Hormuz

While military assets are diverted, the industrial engines of North Asia face a tightening noose. For these economies, the Strait of Hormuz is not merely a waterway; it is a jugular vein. Facilitating 20% of the global oil supply, the Strait has seen a catastrophic 86% drop in transit volumes following the initial strikes, presenting an existential threat to trade-dependent powers.

The economic fallout is radiating across the continent:

- Japan & South Korea: These industrial giants are uniquely exposed, with Japan importing 95% and South Korea 70% of their crude oil from the Middle East. While their strategic reserves (254 and 210 days, respectively) provide a temporary buffer, they cannot sustain the industrial viability of these nations against a prolonged regional war.

- Southeast Asia: The contagion was instantaneous. Thailand’s stock market plunged 8%, forcing early closures, while Myanmar has resorted to fuel rationing for private vehicles.

- Singapore: Acting as a “voice of reason,” the city-state has warned of a “highly uncertain global climate” and the potential collapse of the rules-based order, while bracing for a sustained spike in maritime insurance premiums and energy costs.

The Diplomatic Tightrope: Pragmatism and Dissent in the Global South

Asian nations are not aligning in lockstep with Washington; instead, they are adopting a “high-alert pragmatism” to navigate the fallout. This cautious tone reflects a deep-seated anxiety regarding the erosion of international law, specifically the UN Charter’s prohibition on the use of force—a concern amplified by the parallel U.S. actions in Venezuela at the start of 2026.

- The Protesters: Malaysia has led the dissent. Prime Minister Anwar Ibrahim denounced the strikes as a “vile attempt” to sabotage peace and characterized Western rhetoric as “hypocrisy,” signaling a strategic pivot toward Tehran in a historic show of parliamentary unity.

- The Mediators: Indonesia’s President Prabowo is performing a delicate balancing act. Despite committing 8,000 troops to the U.S.-led “Board of Peace” in Gaza, he has offered to personally travel to Tehran to mediate, attempting to pacify domestic Islamic pressure while maintaining ties with the Trump administration.

- The Protectorates: For the Philippines, the conflict hit home with the death of a Filipina worker in the initial crossfire. Manila now views the Gulf as an “economic fault line,” focusing entirely on the safety and repatriation of its 2.4 million migrant workers.

- The Strategic Balancer: India has engaged in feverish “telephone diplomacy.” Prime Minister Modi, while expressing solidarity with the UAE President (referring to him as his “brother”), faces the vulnerability of 10 million Indian nationals in the Gulf. New Delhi fears that regime change in Iran will permanently derail its investments in the Chabahar Port and the India-Middle East-Europe Economic Corridor (IMEEC).

The China Calculus: Strategic Gain vs. Energy Risk

Beijing’s response has been a calculated, “muted” performance of grand strategy. By positioning itself as a “voice of stability” against what it characterizes as a “reckless and fickle” American superpower, China seeks to leverage the crisis to its advantage.

The Chinese position is defined by a sharp paradox:

- Strategic Gain: U.S. distraction in the Middle East dilutes the “Pivot to Asia.” As Washington expends political capital and depletes its precision munitions, Beijing gains space for “rapid militarization” in the South China Sea, mirroring the window of opportunity it exploited during the Afghanistan war.

- Strategic Risk: As the world’s largest oil importer, China is hypersensitive to the 86% drop in Hormuz transit. However, Beijing maintains a sober realism; despite its “comprehensive strategic partnership” with Tehran, it has refused to commit to what it views as a “sinking ship” regarding the Iranian regime, instead acting as a pragmatic economic lifeline to ensure its own energy interests are protected during the transition.

Conclusion: The Sustainability of Global Hegemony

The events of March 2026 illustrate the widening chasm between short-term tactical success and long-term strategic reliability. While “Epic Fury” may have decapitated a regional adversary, the cost is the accelerated erosion of the rules-based order. The perceived violation of the UN Charter—coupled with the precedent of the strikes on Venezuela earlier this year—has signalled to the Indo-Pacific that the United States is increasingly operating outside the norms it once championed.

The core warning remains: Washington must not let a tactical win in Tehran create a permanent strategic hole in the Indo-Pacific. The unipolar ability to maintain a steady presence in every theatre is no longer a given. If the United States remains bogged down in a prolonged Middle Eastern transition, 2026 will be remembered as the year the “Pivot to Asia” finally lost its momentum, marking the end of a reliable American presence in the world’s most critical economic theatre.

China’s 15th Five-Year Plan: Structural Re-engineering and the “New Quality” Pivot

Introduction: The Strategic Context of the 15th Five-Year Plan

The 15th Five-Year Plan (FYP), spanning 2026–2030, marks a decisive pivot from expansionary growth to strategic survival. Facing the “lowest expansion goal since 1991” with a GDP target of 4.5–5%, Beijing is signalling that the era of high-velocity development has ended. This roadmap is a critical contingency designed to navigate a global landscape fractured by the U.S.-Israel-Iran war, energy disruptions in the Strait of Hormuz, and the escalating Trump trade war.

The central objective is the forced transition from an “old growth model” dependent on property and infrastructure to “New Quality Productive Forces.” This is a security-first mandate intended to realize “socialist modernization” despite a shrinking labor force and rising external containment. Achieving this requires a fundamental reordering of China’s internal trade dynamics to absorb the weight of its massive industrial capacity.

Deciphering “Involution”: The Drive for a Unified National Market

China’s 15th Five-Year Plan: Structural Re-engineering and the “New Quality” Pivot

- Introduction: The Strategic Context of the 15th Five-Year Plan

The 15th Five-Year Plan (FYP), spanning 2026–2030, marks a decisive pivot from expansionary growth to strategic survival. Facing the “lowest expansion goal since 1991” with a GDP target of 4.5–5%, Beijing is signaling that the era of high-velocity development has ended. This roadmap is a critical contingency designed to navigate a global landscape fractured by the U.S.-Israel-Iran war, energy disruptions in the Strait of Hormuz, and the escalating Trump trade war.

The central objective is the forced transition from an “old growth model” dependent on property and infrastructure to “New Quality Productive Forces.” This is a security-first mandate intended to realize “socialist modernization” despite a shrinking labor force and rising external containment. Achieving this requires a fundamental reordering of China’s internal trade dynamics to absorb the weight of its massive industrial capacity.

Deciphering “Involution”: The Drive for a Unified National Market

To sustain domestic resilience, the CCP is prioritizing the creation of a “Unified National Market.” This strategy aims to curb “involution”—the cut-throat internal competition and price wars that have eroded industrial margins. The root of this fragmentation lies in the 1994 fiscal reform legacy, which forced local governments to act as “homegrown champion” protectors. Beijing now intends to “cut the Gordian knot” of local protectionism through the “Five Unifiers”:

- Legal Systems: Standardizing property rights and market entry.

- Fiscal Systems: Harmonizing tax incentives to prevent regional undercutting.

- Technological Systems: Aligning data standards and innovation platforms.

- Regulatory Systems: Repealing over 2,300 non-compliant local rules.

- Market Systems: Ensuring unified institutional rules for resource allocation.

The drive for unification is fueled by critical overcapacity. IEA and OECD datahighlight the imbalance: China’s hydrogen electrolyzer capacity (25 GW) is ten times its domestic demand (2.5 GW), while battery-cell production (3 TW-hours) triples global EV storage demand. Steel subsidies, currently ten times higher than OECD levels, continue to drive unviable investment. Consequently, international partners like the EU are adopting a “Two-Track” response, balancing a preference for cheap green imports with strategic stockpiling to protect their own industrial bases.

The “New Quality” Engine: High-Tech Sovereignty and AI Integration

Beijing views “industrial self-reliance” as the panacea for a slowing economy. High-tech innovation has moved from an economic goal to a national security mandate. The “AI Plus” action plan is the centerpiece, targeting 90% AI integration across the economy by 2030.

Strategic technological priorities include:

- Semiconductors: Prioritizing breakthroughs in 3–5nm and 7–10nm processes.

- Frontier Tech: Quantum technology, biomanufacturing, and 6G.

- Embodied AI: Scaling humanoid robotics (“Kung Fu BOT”) for industrial and “silver economy” applications.

In semiconductors, Beijing is intensifying capital allocation with an additional €60 billion (CNY 500 billion) subsidy plan. However, a pragmatic “mix-and-match” strategy has emerged: while Beijing allows the controlled use of high-end foreign chips (such as Nvidia’s H200) to maintain AI momentum, it simultaneously mandates a forced transition to domestic hardware to eliminate “chokehold” vulnerabilities.

The Energy-Climate Paradox: Synergies and Contradictions

The 15th FYP reveals a stark tension between climate ambition and the “energy security” necessitated by geopolitical volatility. While the plan sets a 17% carbon intensity reduction target, this figure is deceptive. By revising past data (adjusting the 14th FYP reduction from 12.4% to 17.7%), Beijing has “legalized” a path where absolute emissions can actually increase by 3–6% through 2030.

Energy security has clearly superseded idealism. The plan walks back 2021 commitments to reduce coal, instead targeting a “plateau” phase where coal remains a critical backup for a volatile renewable grid. To manage this transition, the state is scaling massive “Clean Energy Bases”:

- Northwestern Bases: Desert-based solar and wind hubs.

- Southwestern Bases: Integrated hydro-wind-solar clusters.

- New Type Power System: Built around 100GW of pumped hydro and massive battery storage.

Strategic Implications for Global Stakeholders and Foreign Business

The 15th FYP redefines the terms of engagement for foreign capital. While all restrictions on foreign investment in manufacturing have been “cleared,” the regulatory environment for sensitive sectors is tightening.

High-Growth Opportunities: The “Silver Economy” (with 24% of the population over 60) offers massive scale for healthcare and elder care. Similarly, green-tech and advanced materials remain open to “high-quality” foreign partners.

Structural Risks: Sectors involving sensitive data, AI, and healthcare services face stricter oversight. The forthcoming “Law on National Development Plan” will codify the CCP’s relationship with the private sector, making “localization” a legal requirement rather than a choice.

Synthesis: Foreign firms must transition from being “exporters to China” to “partners within China.” Success requires absolute alignment with Beijing’s state priorities. In an era of “unified” domestic markets and automated “New Quality” forces, the only path to viability is through deep localization and policy-driven integration.