Key Takeaways

Resilient Growth Amid Challenges: China achieved a respectable 5.3% GDP growth in the first half of 2025, surpassing market expectations despite facing internal and external challenges. The growth rate underscores economic resilience, driven primarily by robust manufacturing activity and export performance.

Manufacturing Strength and Sectoral Shifts: Manufacturing, particularly in high-tech and advanced equipment sectors, played a pivotal role in economic expansion, growing notably faster than the overall GDP. However, subdued profit margins and weak employment growth within manufacturing suggest deeper structural challenges remain.

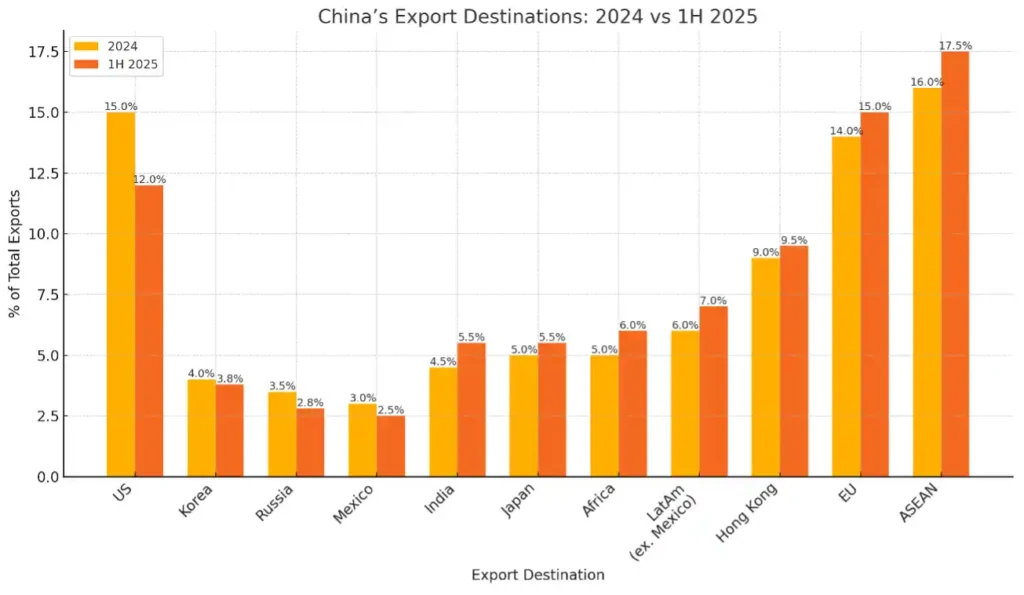

Trade Performance and Diversification: Exports significantly outperformed expectations, growing 7.2%, largely thanks to diversified markets beyond the U.S. This helped deliver a record-high trade surplus. Still, the sustainability of this performance is uncertain due to potential future tariff impacts and global demand fluctuations.

Weak Domestic Demand and Deflation Risks: Consumer spending, private investment, and real estate sectors underperformed markedly, with deflationary pressures emerging as consumer and producer prices stagnated or fell. Policymakers acknowledge these vulnerabilities, signaling a cautious outlook.

Policy Response and Stimulus Outlook: Chinese authorities adopted incremental, targeted stimulus measures, avoiding extensive interventions to balance economic support with financial prudence. However, ongoing weaknesses in domestic demand may necessitate stronger policy interventions in the second half of 2025.

Global Economic Implications: China’s stable growth in H1 2025 provided crucial support to global markets, particularly commodity and export-dependent economies. Yet potential slowdown risks in H2 pose significant uncertainties, impacting global inflation, supply chains, and investor sentiment worldwide.

Introduction

China’s economy remained resilient in the first half of 2025 (H1 2025) despite significant headwinds. Key indicators for growth, industrial activity, trade, and monetary policy reveal a mixed picture of robust output and exports alongside softer domestic demand. This analysis reviews GDP growth, manufacturing performance, international trade trends, and monetary policy in H1 2025, using the latest official data and reports. We then discuss the policy implications for China and potential impacts on global markets.

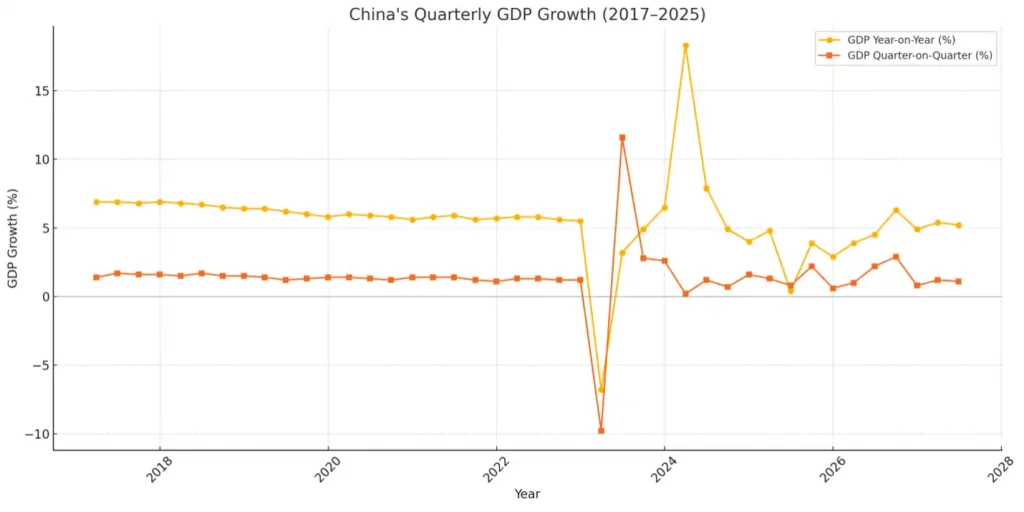

GDP Growth in H1 2025

China’s quarterly GDP growth (year-on-year) held above 5% in early 2025, though momentum eased slightly from Q1 to Q2. China’s gross domestic product grew 5.3% year-on-year in the first half of 2025, according to official data. Growth was 5.4% in the first quarter and 5.2% in the second quarter (year-on-year), indicating a slight deceleration in Q2. On a quarter-on-quarter basis, the economy expanded 1.1% in Q2, underscoring that China maintained a solid pace despite global uncertainties. This puts the country broadly on track to meet its full-year growth target of “around 5%” for 2025.

The GDP figures beat market expectations – a Reuters poll had forecast 5.1% growth for Q2 – thanks to surprising strength in external demand and industrial activity. The secondary sector (manufacturing and industry) led the expansion, rising 5.3% in H1. In particular, industrial output grew by a brisk 6.4% year-on-year in the first half, a point we examine further in the next section. The services sector also grew 5.5%, reflecting recovery in areas like travel and retail as China emerged from pandemic-era constraints. Meanwhile, agriculture expanded a more modest 3.7%, consistent with stable food production.

However, beneath the strong headline GDP numbers, domestic demand showed signs of weakness. Growth in consumer spending and private investment lagged behind overall GDP growth. For instance, retail sales – a proxy for consumer demand – rose only 5.0% year-on-year in H1 2025, suggesting that households remained cautious. Fixed asset investment grew just 2.8% in the first six months, dragged down by a persistent property market slump and sluggish infrastructure spending. Real estate investment fell sharply in H1 despite policy support measures, weighing on construction activity.

Another warning sign was disinflation turning to slight deflation. Consumer prices were essentially flat – the CPI edged down 0.1% year-on-year in H1– indicating very weak price pressures. Core inflation (excluding food and energy) was only +0.4% in the half. More strikingly, producer prices fell 2.8% on average, with June’s producer price index (PPI) plunging 3.6% year-on-year. Such declines in factory-gate prices point to entrenched deflationary pressures in the industrial sector, a sign of excess capacity and soft demand. Household incomes are growing only moderately (real disposable income +5.4% in H1), and consumer confidence remains fragile by many accounts. All of this has prompted Chinese policymakers to acknowledge that “domestic effective demand is insufficient” and the economic recovery’s foundation “needs to be further consolidated”.

In sum, China’s 5.3% GDP growth in the first half of 2025 represents a “hard-won achievement” under volatile global conditions. It highlights the economy’s resilience, aided by policy support and a rebound in external trade. Yet it also underscores a growing imbalance: industrial output and exports have been the main engines of growth, while consumer spending and private investment remain relatively subdued. This divergence poses a challenge for Beijing as it seeks to sustain momentum into the second half of 2025.

Manufacturing Performance and Industrial Output

Manufacturing activity was a bright spot in early 2025, powering much of China’s growth. Industrial production grew 6.4% year-on-year in the January–June period, outpacing GDP and marking an acceleration from the previous year. Within industry, manufacturing output surged by 7.0% – a clear sign that China’s factories were busy fulfilling orders. In fact, manufacturing was a key growth driver in H1, reflecting strong output of electronics, machinery, vehicles and other goods.

Crucially, the fastest growth came from high-tech and equipment manufacturing. Production of equipment rose 10.2% and high-tech manufacturing by 9.5% year-on-year in H1 – several percentage points faster than overall industrial growth. This indicates that China’s industrial mix continues to upgrade towards more advanced, value-added sectors. Output of products like new energy vehicles, industrial robots and 3D printing devices jumped 30-40% in volume terms, spurred by both domestic innovation and export demand. By ownership type, private firms and joint ventures saw output rise ~6–7%, while state-owned enterprises grew more slowly (~4%), suggesting broad-based gains led by the private sector.

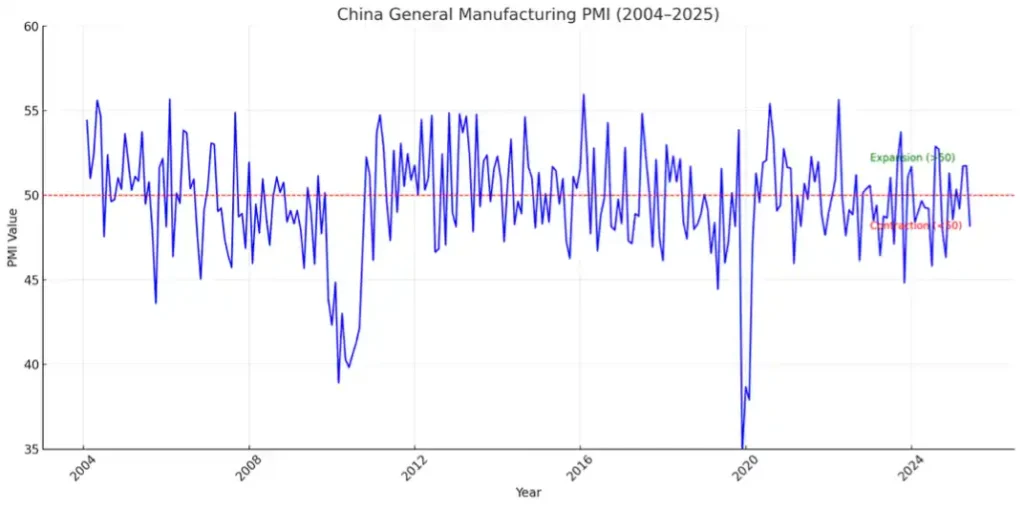

Monthly data show momentum picked up toward mid-year. In June alone, industrial output rose 6.8% year-on-year – the fastest pace since March – and even grew 0.5% month-on-month. This uptick hints at a modest acceleration heading into the second half. It aligns with other signs of stabilization in manufacturing. The official Manufacturing Purchasing Managers’ Index (PMI) in June inched up to 49.7 (from 49.5 in May), its highest in three months. While 49.7 is just below the 50.0 threshold (signaling a slight contraction), the improvement suggests downward pressure eased and manufacturers grew more optimistic. Indeed, the June production sub-index and the Production & Operation Expectation Index (a measure of business confidence) were above 52, indicating firms generally expect output to expand in the near term.

At the same time, other manufacturing indicators reveal lingering stresses. The private-sector Caixin manufacturing PMI, which often captures smaller exporters, swung from contraction earlier in the year to a marginal expansion (50.4) in June. New export orders remained in contraction territory (e.g. 47.7 in June) despite the rush of shipments in late Q2. And critically, industrial profits have been under pressure. Through the first five months of 2025, profits at large industrial firms were down 1.1% year-on-year. Compressed profit margins are a byproduct of falling output prices (PPI deflation) and still-high costs, and they signal that not all manufacturers are thriving even as production volumes grow. For example, China’s crude steel output in June fell over 9% from a year earlier as faltering demand led mills to cut production – a reminder that heavy industries tied to construction are struggling.

Overall, manufacturing performance in H1 2025 was solid. Strong external orders and a shift toward high-tech manufacturing kept factories busy and output growth robust. The manufacturing sector’s resilience has been vital in buffering China’s economy against headwinds. However, the fact that manufacturing PMI hovered around 49–50 reflects that many firms (especially smaller ones) still face a challenging environment of weak domestic orders, rising uncertainties, and tight margins. Industrial growth has not translated into booming manufacturing employment or confidence across the board, in part because much of the growth is in highly automated sectors that add output without needing as many new workers. This dynamic – strong production but soft profits and flat hiring – underscores the need for broader demand recovery to complement the manufacturing upswing.

International Trade Trends (Exports, Imports, and Trade Balance)

China’s trade sector performed better than expected in the first half of 2025, providing critical support to the economy. Total goods trade (exports + imports) rose 2.9% year-on-year in H1 to reach ¥21.79 trillion (about US$3.04 trillion). This was a marked improvement from the start of the year – trade growth accelerated to +4.5% in the second quarter, up from roughly +1.3% in Q1. The strength came primarily from exports. Chinese exports surged 7.2% (in yuan terms) in January–June compared to a year earlier, totaling about ¥13.0 trillion. By contrast, imports fell 2.7% to ¥8.79 trillion, reflecting weak domestic demand and lower commodity prices. The result was an even larger trade surplus – about $586 billion in the first half, a record-high surplus for any half-year period.

Export growth in H1 2025 defied many analysts’ expectations of a downturn amid slowing global demand and new U.S. tariffs. In fact, exports rose at roughly the “same pace we saw in 2024,” demonstrating resilience. How did China pull this off? One factor was front-loaded shipments to the U.S. and other markets ahead of potential tariff deadlines. Chinese manufacturers rushed to export goods before additional tariffs (part of a “trade war 2.0”) could take effect – especially in the late Q2 period, thanks to a fragile trade truce that postponed some U.S. tariff hikes. This gave a temporary boost to export volumes in May and June. Another factor was market diversification. While exports to the United States slumped (China’s shipments to the U.S. contracted in H1 amid hefty tariffs), demand from other regions picked up. Exports to Southeast Asia (ASEAN), Europe, and Belt-and-Road partner countries all showed robust growth. For example, China’s trade with ASEAN jumped ~9.6% in H1. These gains helped offset the U.S. shortfall. Officials noted that China traded with over 190 countries in the half, and the number of active foreign trade firms rose to record levels – signs of diversified resilience.

The composition of exports also points to competitive strength. Exports of mechanical and electrical products (China’s largest export category) climbed 9.5% and accounted for 60% of total exports, as Chinese electronics, machinery, and high-tech goods continued to find buyers worldwide. Exports of vehicles and other high-value goods have also been strong, partly compensating for weaknesses in low-end manufacturing. This mix helped net exports make a positive contribution to GDP growth in H1 – adding an estimated 1.7 percentage points to growth, up from 1.5 points last year. In other words, external trade became a key growth driver for China in early 2025.

On the import side, the decline in headline import value (-2.7%) is attributable to both weak domestic demand and lower global commodity prices. Chinese imports of consumer goods and certain industrial inputs were sluggish as households and firms were cautious in spending. There were some silver linings: imports showed signs of recovery by late Q2, rising 2.3% year-on-year in June – the first monthly increase in 2025. This uptick was helped by policy measures to encourage purchases of equipment and consumer goods (for instance, government programs to spur “equipment upgrades and trade-in” of old appliances). Indeed, imports of capital goods like semiconductor components and specialized machinery recorded double-digit growth, and import volumes of essential commodities (oil, iron ore) actually increased, even though their value fell due to lower prices. These trends suggest China’s domestic demand, while soft, is not collapsing – and as stimulus measures take hold, import demand could stabilize.

China’s large trade surplus in H1 2025 has two sides. Domestically, the surplus (exports > imports) injects net demand into the economy, helping sustain industrial output and employment. It also means China accumulated foreign exchange, which can support the yuan’s stability even as U.S. interest rates remain high. Internationally, however, such a surplus means China is exporting more than it is importing, which can be a point of tension. In 2025, some of this surplus owes to tariff distortions (U.S. tariffs reducing China’s imports of American goods) and the uneven pandemic recovery (China’s consumer rebound lagging its production rebound). Chinese officials argue that the trade gains underscore the “resilience” of China’s trading sector against protectionist headwinds. They highlight expanding trade ties with emerging markets as evidence that China is supporting global commerce even as some countries “violate trade norms by imposing unreasonable tariffs”. Going forward, whether China’s export strength can be maintained is a key question – many analysts expect external demand to soften later in 2025 if higher tariffs resume and if growth slows in key markets. But so far in 2025, international trade has been a relative bright spot for China’s economy, partly buffering it from internal weakness.

Implications for Policy and Global Markets

China’s economic trajectory in the first half of 2025 carries significant implications for both its domestic policy choices and the broader global economy. Domestically, the H1 data present a policy dilemma. On one hand, the above-target 5.3% growth eases pressure on Beijing to unleash massive stimulus. As analysts noted, the strong first half means policymakers have “no urgency to launch broad-based, significant stimulus” immediately. Indeed, officials have so far opted for calibrated measures – fine-tuning interest rates, liquidity, and fiscal support – rather than any “bazooka” stimulus. This restraint aligns with the government’s longer-term goals of deleveraging and avoiding asset bubbles. On the other hand, cracks beneath the headline figures – weak consumer spending, youth unemployment, deflation – suggest that demand-side support is still needed. Top leaders have acknowledged that “effective demand is insufficient” and signaled more proactive policy if required. The late-July Politburo meeting was widely expected to shape a support package for the second half of 2025, potentially including measures to boost household consumption (vouchers or subsidies), stabilize the property market, and spur private investment. The government’s challenge is to bolster confidence and income growth for households so that the recovery broadens beyond exports and state-led industry. We may thus see a mix of targeted fiscal steps (such as infrastructure outlays or tax breaks for consumers) combined with continued monetary easing as needed to ensure the roughly 5% growth goal is met without a serious stumble.

For now, Chinese authorities appear committed to a stance of “incremental, targeted easing”. They will likely monitor data closely and add stimulus in measured doses if growth falters. Some economists warn that without stronger action – especially on fiscal stimulus – momentum could fade in the third quarter. The property downturn and export uncertainties (if U.S. tariffs ramp up after the temporary truce) are key swing factors. If exports indeed slow and domestic demand doesn’t pick up, Beijing might feel compelled to “roll out a sizable stimulus package”, as Nomura’s China economist cautioned. Thus, H1’s performance has bought policymakers time, but not eliminated the debate over how much support is “enough”. The coming months will test whether the economy can sustain itself on the current light-touch stimulus or whether authorities will intervene more aggressively to ensure a soft landing.

Global markets are watching China’s economic health and policy moves closely. As the world’s second-largest economy, China’s performance in H1 2025 provided a stabilizing force for global growth at a time when other regions faced headwinds. Strong Chinese demand for commodities earlier in the year (e.g. record crude oil import volumes) helped support global commodity prices. Likewise, China’s surprisingly resilient export machine supplied world markets with goods, albeit contributing to China’s trade surplus. If China had slowed drastically in H1, it could have pulled down export-dependent economies from Germany to Brazil. Instead, China’s steady ~5% expansion has been a relative bright spot that even led institutions like the IMF to upgrade forecasts for emerging economies in 2025.

Looking ahead, however, global investors are concerned about a potential slowdown in China in H2 2025. Weaker Chinese imports in the first half already foreshadow softness in internal demand that could hurt multinational companies and commodity exporters. For example, lower Chinese purchases of consumer electronics or automobiles would ripple through supply chains in Asia and Europe. Countries relying on exporting raw materials to China (from Australia’s iron ore to Chile’s copper) are particularly sensitive to China’s industrial cycle. If China’s investment and construction remain sluggish, it could dampen those commodity markets. On the flip side, China’s deflationary trends – with producer prices falling – might export disinflation globally, potentially easing inflation in other countries through cheaper goods. While good for consumers abroad, this could also be a sign of excess capacity and weaker global demand.

In conclusion, China’s economic data from the first half of 2025 tell a story of resilience under pressure. GDP growth exceeded expectations, powered by manufacturing and exports, and policymakers managed to avoid a sharp downturn through timely if moderate support measures. However, the reliance on external demand and industrial activity – as opposed to domestic consumption – reveals a vulnerability. For China to maintain stable growth, the second half of 2025 will need to see a hand-off toward stronger domestic demand, or else further policy easing may be unavoidable. The government’s ability to navigate this transition will not only determine China’s own economic trajectory and social stability, but also influence global economic conditions – from commodity market dynamics to supply chain flows – in the coming months. International observers will be watching whether China’s “steady improvement despite challenges” in H1 can be sustained, or whether global markets must brace for a potential downshift in the world’s second-largest growth engine.

Related Infographics