1. Introduction

Microchips are part of almost all electronic devices: from smartphones and computers to cars and medical equipment. Generally, they are small flat pieces of silicon with a set of electronic circuits on top of them. Manufacturers use silicon because it is a semiconductor, meaning its conductive properties are increasable by mixing it with other materials. Contemporary state-of-the-art structures are smaller than 10 nanometres. As a comparison, a human red blood cell is approximately 7.000 nanometres wide. The advantage of even smaller designs is that more transistors fit on a chip, thereby increasing its performance. There are two major types of chips. Logic chips process information to complete tasks, whereas memory chips store information (ASML, n.d.).

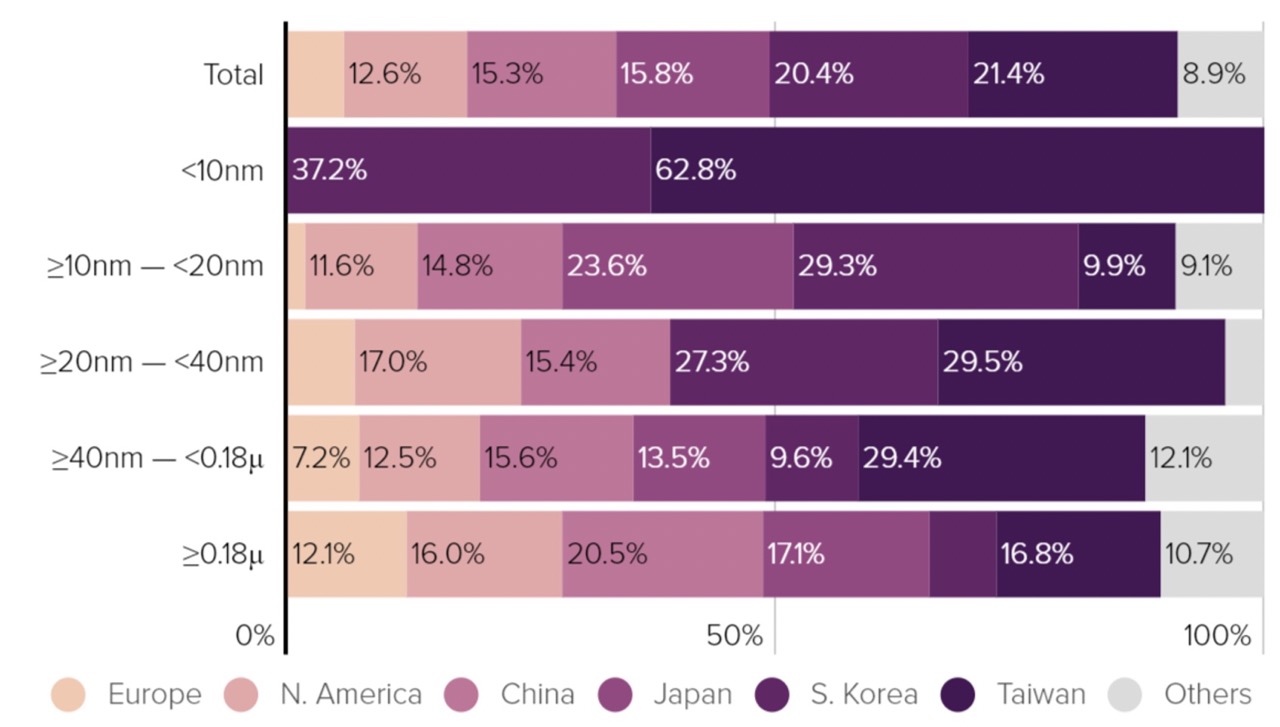

The microchip industry is extraordinary as it is an oligarchic market with only the most advanced countries able to produce them. Analysts project that the microchip industry will grow from “approximately $575 billion in 2022 into a trillion-dollar industry by 2030” (Starks, 2023, para. 3). The primary producers are Taiwan, South Korea, China, the United States, and Europe. However, only South Korea and Taiwan can economically produce the most advanced microchips. These designs are smaller than 10 nanometres. Noteworthy is the Taiwanese company TSMC, which is the world’s largest and most valuable semiconductor company. It has a market cap of $400.1 billion (Reiff et al., 2023). Due to its high market share, the output of Taiwanese production affects almost every high-end industry globally (Haeck & Westendarp, 2022). Figure 1 shows the world’s dependency on Taiwanese and South Korean advanced microchip production (smaller than 10 nanometres).

Figure 1 The geographical breakdown of microchip production by region and size in 2020. Retrieved from Haeck & Westendarp (2022).

The COVID-19 pandemic revealed the world’s high dependency on microchips as its shortage slowed down many other industries that require them for their functioning. For instance, the automotive industry lost $200 billion in 2021 due to microchip shortages (Banker, 2022). In other words, a stable microchip supply is crucial for the smooth functioning of the world economy (Burkacky et al., 2022a). Consequently, many countries desire higher self-sufficiency in key industries, such as microchips, to increase their industries’ resilience (Lewis, 2022). This global rethinking is accelerated by China’s repeated threat to conquer Taiwan, the global production leader. A potential war between these two countries would probably stop the production and distribution of microchips by Taiwan and consequently slow down or even collapse the world economy (Sacks, 2022). Another accelerator is Russia’s invasion of Ukraine, which shocked the global energy and food markets in 2022. These conflicts show the fragility and interdependence of the world economy. Therefore, more countries strive to enhance economic independence to improve their security and resilience (Maizland, 2022).

In 2022, the U.S. and EU announced substantial investments in the microchip sector. In August, the U.S. passed the CHIPS and Science Act, consisting of a $280 billion investment in high-tech industries, of which $52.7 billion are allocated to increase semiconductor manufacturing (Badlam et al., 2022). Already in February 2022, the EU announced the European Chips Act, a commitment to invest €45 billion in microchip manufacturing. The plan is to increase the European global production share from 9% in 2022 to 20% in 2030. Currently, Europe consumes 20% of the world’s chip supply, and the number is rising. The agenda also seeks to reduce Europe’s dependency on producers in Asia. However, the EU did not adopt this act yet (Cota, 2022). The following article assesses the position of the European microchip industry with its strengths and challenges, especially in light of its expansion strategy, the European Chips Act.

2. The European microchip industry

a. The strengths of the European microchip industry and its current expansion strategy

Europe’s main strength is the presence of manufacturers that produce the equipment needed to build microchips. These companies have unique competencies, and their products are in global demand. Noteworthy is ASML in this regard. The Dutch company has practically a 100% market share in EUV lithography machines, which are needed to produce cutting-edge chips. Another example is Carl Zeiss SMT in Germany. The company is the only producer of mirrors and lenses used in the most advanced chip-producing equipment (Li, 2022). In other words, without these two companies, it would be impossible to produce state-of-the-art microchips. Therefore, Europe’s advanced chip-producing equipment is its main strength in this industry.

In addition to the equipment, Europe produces microchips itself (see Figure 1). However, unlike in other regions, European manufacturers do not focus on size reduction but on material innovation. The companies on the continent mainly supply the large automotive and industrial sectors in Europe. There is only a low demand for leading-edge microchips as most electronic production left Europe and moved to Asia and the U.S. Thus, most European companies do not require these advanced microchips. South Korea and Taiwan produce these chips nowadays, where major tech companies are seated and require them (Slijkerman & Nijboer, 2022). Instead, the European market demands more “customary” microchips that do not need the same high-end practices as advanced chips. Luckily for Europe, it is expectable that semiconductor demand will have the highest growth in the automotive and industrial sectors until 2025 (ING, 2022; Omdia, 2022; Gartner, 2023). Consequently, Europe can profit from supplying two markets in the future that are naturally considered its strengths and expect high growth (see Figure 2).

![]()

Figure 2 Highest growth of semiconductors by worldwide end market between 2020-2025. Retrieved from Slijkerman & Nijboer (2022).

With the European Chips Act, the continent seeks to enhance its microchip manufacturing capacity again. The volume has steadily declined since the 2000s as many companies moved to Asia. Consequently, Europe’s current production share is below 10% of the global market (Timmers, 2022). The agenda addresses two main problems in the microchip industry. Firstly, China’s aggressive stance, Russia’s invasion of Ukraine, and COVID-19 revealed the instability of global supply routes. These developments force a reform of the current supply chain to guarantee more stable growth in the future. Therefore, the European Chips Act aims to ensure more resilient supply chains by growing a European microchip ecosystem less vulnerable to international politics outside Europe (SEMI, 2022).

Secondly, it addresses the simple problem of limited global chip production capacity. The complexity of the microchip industry makes its expansion more difficult compared to other industries that can easily increase their output. Generally, it takes one year to improve the production capacity of an existing facility and three to five years to build a new facility (Burkacky et al., 2022b). Even worse, both options require extensive investment upfront, and it takes years until they pay themselves off. New facilities cost approximately $15 billion to $20 billion, and only eight chip companies can afford these costs at the moment (Farshchi, 2022). The European Chips Act will enable new public and private investments in these factories, thereby increasing the European global market share in the future. It includes support for research and development (R&D), workforce creation, subsidies to reduce the costs of new facilities, as well as new trade, tax, and investment policies (European Commission, 2022). Next to Europe and the United States, also Japan, Singapore, Taiwan, South Korea, and China heavily invest in this sector.

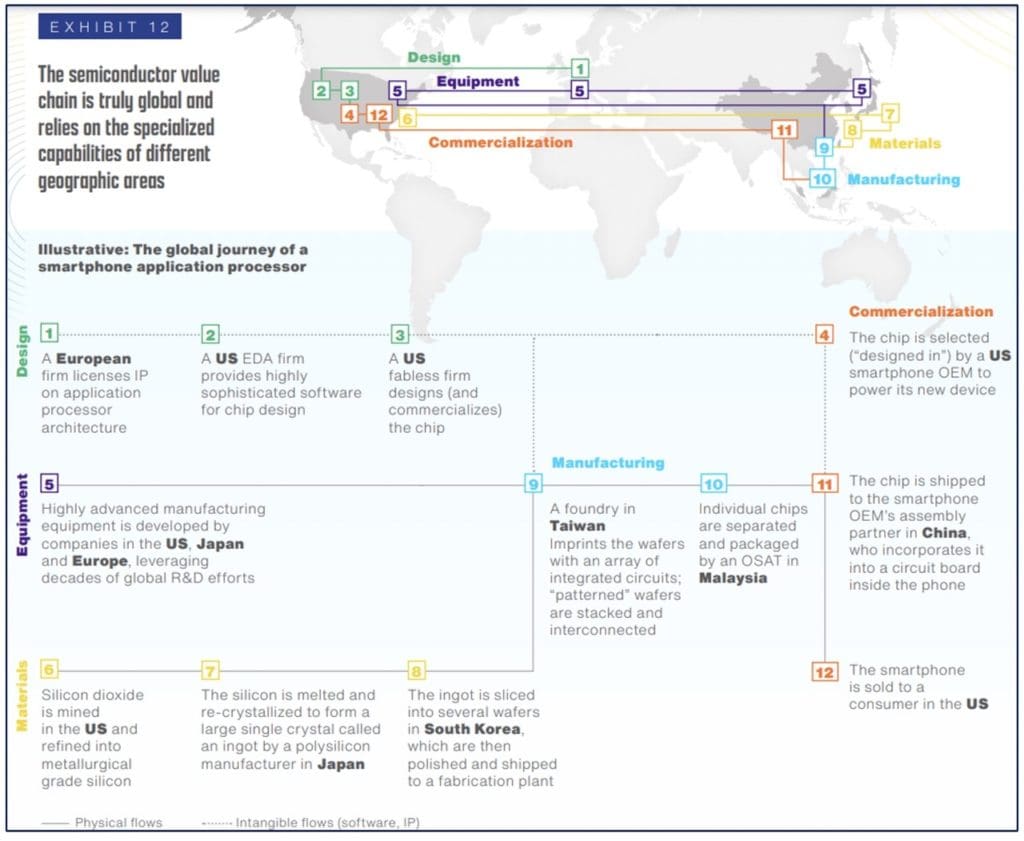

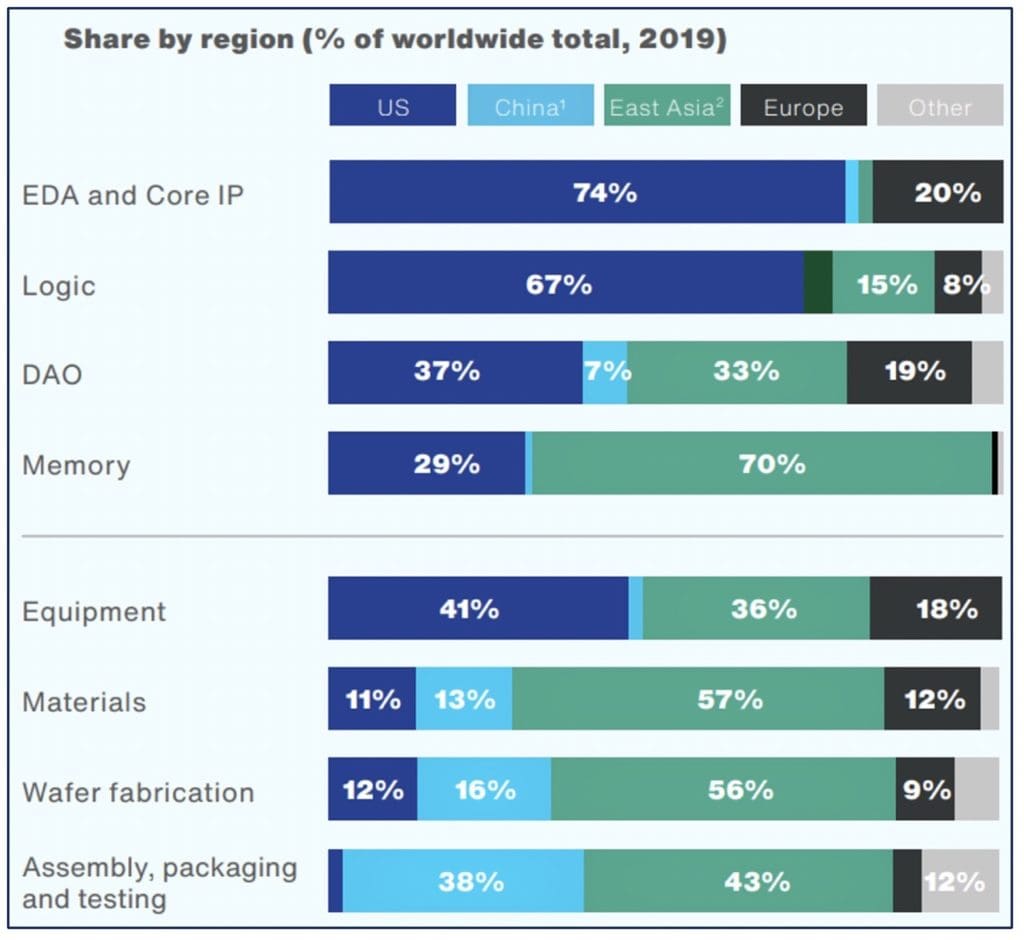

It is worth dedicating a separate section to China as it is the potential primary disturber of the European chip industry. On one hand, there are repeated threats to conquer Taiwan, on the other hand, China continues its predatory trade practices and espionage programmes. China has already done this in other industries to steal knowledge, aiming at “relatively” cheaply acquiring foreign expertise. This knowledge accretion is also done more legally via subsidies to attract international investments. Despite its billion-dollar investments in these practices, China could only establish a few microchip-producing companies so far (Lewis, 2022). However, Europe must carefully avoid indirectly investing in the Chinese market to slow down its growth. For instance, China plans to launch a cross-border semiconductor work committee with leading microchip companies such as Intel or AMD. Europe also seeks to increase cooperation with them (Liu, 2022). European countries identified this threat, and ideas circulate that the EU will pass new legislations to screen European companies’ investment in security-critical areas. This policy prevents companies from investing in Chinese programmes to ensure protection against China’s malpractices and threats to the microchip market. Similar steps are also observable in the U.S., which began to decouple its economy from China in some industries. This step is necessary as many high-tech companies are about to receive billions in government support. Therefore, a monitored cash flow by the EU is a sensible step, and the union should further pursue this idea. However, it is currently unclear how this balance between free-market economies and national security will work (Aarup, 2023). Figure 3 is an example of the microchip industry’s integrated structure based on geographic specialisation.

Figure 3 An example of the microchip industry’s integrated structure based on geographic specialisation. Retrieved from Varas et al. (2021).

b. The challenges of the European microchip industry and its current expansion strategy

The global competition puts great pressure on Europe, despite the EU’s future investment in the microchip sector. The union lacks production capacity and a consumer base for the most advanced microchips. Figure 1 shows that the continent does not produce microchips smaller than 10 nanometres. The knowledge and expertise gap between Europe and the U.S., South Korea and Taiwan in this category will only grow further if there is no investment in this area. This development began two decades ago when the consumer base moved away from Europe as mentioned previously. Consequently, it implies that the EU must grow a new consumer base instead of just focusing on producing advanced microchips, in other words, establishing companies that require these chips. Increasing the supply without the demand does not make much sense (Kleinhans, 2021).

The unattractiveness of the European market in this sector discouraged Taiwanese and South Korean advanced microchip producers from investing there. Instead, other regions elbowing for the companies’ assets received investment from them. Global leader TSMC from Taiwan will invest $40 billion in the U.S. and more than $10 billion in Japan. Both regions have a high consumer base for advanced microchips due to their electronic companies. Therefore, these countries are more profitable than Europe (Takenaka et al., 2022). As TSMC president Mark Liu declared, the company does not have enough European customers to justify such an investment (Scimia, 2022). The practice of attracting leading chip companies to invest in someone’s manufacturing capacity is known as “fabless” production. The investing company designs the chips but outsources the manufacturing to other companies. So far, most of these factories are in Asia, with its relatively large and cheap skilled workforce in this sector. Despite that, Europe wishes to become a manufacturing hub to reduce its reliance on trade routes from Asia to produce its own cutting-edge microchip stockpile (Ciani & Nardo, 2022).

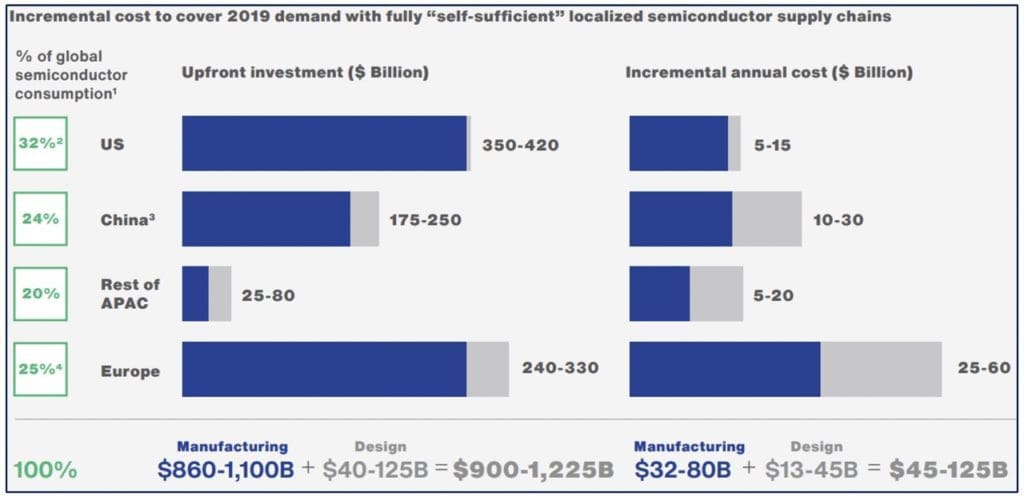

Intel, a leading chip-producing company from the U.S., decided to invest in Europe. Intel will allocate $80 billion in Europe over the next decade to strengthen research & development (R&D) and manufacturing capacity there (Intel, 2022). It is unclear whether this investment will meet the expectations as Intel does not have the same capabilities as Samsung or TSMC to produce the most advanced microchips (Kharpal, 2022). Either way, Europe requires more investments and subsidies to catch up with other chip-producing regions. Figure 4 shows how much investment is theoretically needed per region to become self-sufficient in microchip production, thereby showing the regional production maturity.

Figure 4 The theoretical investments needed per region to create self-sufficient microchip production lines. Europe and the U.S. would require the most investments. Retrieved from Varas et al. (2021).

Figure 4 also shows how difficult it is for Europe to expand in this competitive market. Currently, there are plans to build 81 new chip facilities by 2025 around the globe, 10 of these in Europe, 14 in the U.S., and 21 in Taiwan alone. Additionally, Europe’s expansion scale is bound to the availability of a qualified workforce (Li, 2022). Compared to Asia, the limited number of skilled workers in this sector in Europe results in higher production costs for Europe, where people usually earn higher wages. Growing a skilled workforce for microchips to meet the European expansion demands will take years (Bish et al., 2022). Additionally, Europe is only slowly increasing support for regional chemical and material suppliers. These are essential to produce microchips but are unheeded by the European chips agenda (Lewis, 2022).

The European Chips Act aims to push Europe into the most advanced chip sector. Due to the lack of European-designed chips in this category, it is questionable whether this is the right approach. The low demand in the European market means that consumers must be found elsewhere, for instance, the in U.S. and Asia. This circumstance raises the question of why companies in these two regions should buy European chips instead of those from their immediate environment, cheaper and already leading the industry. As previously mentioned, manufacturing is generally more favourable in these regions due to lower wages compared to Europe (Baraniuk, 2022).

The current microchip landscape shows the EU must carefully assess where to invest. The European Chips Act reveals that the EU mainly focuses on establishing a new state-of-the-art microchip ecosystem in Europe that can meet the U.S. and Asian markets (Chee, 2022). However, the assessment of the European microchip industry, with its strengths and challenges, revealed that this might be a misguided approach. The following section outlines the most efficient positioning of Europe in the global microchip industry. The allocation of resources should match this regime.

3. Balancing the future development of the European microchip industry

Section 2a showed that the European strengths in the microchip industry are the presence of equipment-producing companies, research institutes, and the region’s production of microchips for the automotive and industrial sectors that will grow in demand. Section 2b showed that Europe’s challenges are the production capacity, limited and expensive workforce, and potentially threatened supply routes. The European Chips Act, which guides the progress in Europe, does not seem to adequately address these issues as it focuses solely on developing a state-of-the-art industry that is futile in Europe. It also does not go beyond manufacturing and lacks investments in chemical and material suppliers. A long-sighted EU agenda should be all-encompassing and address all aspects of the production chain. Therefore, the EU’s chip act should be considered more of a stepping stone in a broader development instead of a ne plus ultra. The overall two goals, increasing Europe’s market share and securing the chip supply chain, can be achieved differently.

Based on the current microchip landscape in Europe, three main questions need to be resolved. Firstly, in which parts of the semiconductor chain should the EU invest? Secondly, how should the EU balance between securing the supply chain in Europe and cooperating with external countries and companies? And lastly, how should the resources be distributed across Europe?

The most sensible approach is to increase European investment in existing companies to increase their research and production output. This proposal means focusing more on customary chip production instead of the most advanced chips. Europe already has these production lines and could profit from supplying the growing automotive and industrial industries. Furthermore, Europe is home to excellent research institutes for chip prototypes. To name some of them, there is IMEC in Brussels, the Frauenhofer Institute in Germany and CEA-Leti in France (Li, 2022). It is undeniable that Europe will need more advanced chips in the future. However, it would be more economical to strengthen the research and development (R&D) of these chips in Europe and leave large manufacturing to the U.S. and Asia, or even regions like Mexico, in the future. It is noteworthy that in the long run, the main threat to stable chip supply is China, as explained before, not the U.S., Japan, or South Korea. Therefore, the EU should see them as allies and not compete with them for manufacturing cutting-edge chips, but rather increase the supply of its strengths. Europe can increase its market share and improve its global competitiveness by enhancing “customary” chip production, increasing microchip equipment/machine production, and R&D. The EU should monitor these investments to prevent sponsoring Chinese programmes indirectly until the government changes to a more cordial stance.

Overall, in the long term, it is wiser to strengthen a multinational approach of chip-making democracies instead of pursuing autarkic self-reliance and forced hostility between these democracies. As Lewis (2022) advocates, “An industrial policy among allies and partners could usefully focus on rebuilding microelectronic capacity and other segments of the chip industry, such as testing and packaging, rather than on the more glamorous fabs” (para. 31). This also leads to an answer to the third and final question. The investment in microchips is a chance for the EU to improve its allocation of resources across the bloc. Critics argued that programmes such as the European Chips Act mainly enrich the union’s dominant powers, such as France, Germany, and the Netherlands, whereas economically weaker countries are left standing. However, as Lewis (2022) proposes, the EU could establish relatively less complicated parts of the production line in, for instance, Eastern Europe. The lower-wage labour market can be used for steps such as the assembly, packaging & testing of microchips, “which is relatively less skill- and capital-intensive” (Varas et al., 2021, p.4). This step would take some of the production processes back to Europe and improve the supply resilience of the continent (see Figure 5).

Figure 5 The share of the microchip production process per region. Retrieved from Varas et al. (2021).

4. Conclusion

Europe has lost ground to other chip-producing regions over the past two decades. However, the presence of key companies in the chip production chain, such as ASML or Zeiss among others, together with Europe’s financial resources and growing demand for “customary” chips provide a good basis to re-strengthen Europe’s position in the microchip industry. The EU investments should capitalise on Europe’s strengths to increase its competitiveness and market share. Furthermore, the reliance on China must be lowered and cooperation with reliable trade partners such as the U.S., South Korea, Taiwan, and Japan improved to secure the supply routes. The European Chips Act seems counterintuitive to this process as it solely focuses on establishing a cutting-edge industry that seems unprofitable on the continent. However, it will undeniably enhance the growth of a European microchip ecosystem, which is beneficial to grow the whole production chain. In other words, it will lead to a larger workforce and better infrastructure in the microchip sector. Therefore, it should be seen as a first step in a larger economic development in Europe. The EU’s approach needs to be more all-encompassing and not just focus on the manufacturing aspect. The union must invest in the producers of customary chips, R&D, design, and suppliers of microchip material, chemicals, and equipment. However, unlike for research and development, Europe’s role is not to become a large-scale manufacturing hub of state-of-the-art microchips.

Jannis Figura is a research assistant intern at Beyond the Horizon ISSG. He currently follows a master’s program in Crisis and Security Management with a special focus on “Governance of Crisis” at Leiden University

References

Aarup, S.A. (2023, January 3). China beware! Europe eyes closer control over how firms invest abroad. Politico. https://www.politico.eu/

ASML. (n.d.). The basics of microchips. https://www.asml.com/

Badlam, J., Clark, S., Gajendragadkar, S., Kumar, A., O’Rourke, S., & Swartz, D. (2022, October 4). The CHIPS and Science Act: Here’s what’s in it. McKinsey & Company. https://www.mckinsey.com/

Banker, S. (2022, September 2). Qualcomm’s answer to the chip shortage? A digital transformation. Forbes. https://www.forbes.com/

Baraniuk, C. (2022, April 1). Chip shortage: has Europe’s plan arrived too late? BBC. https://www.bbc.com/news/business-60554228

Bish, J., Stewart, D., Ramachandran, K., Lee, P., & Beerlage, S. (2022, November 3). A new dawn for European chips. Deloitte. https://www2.deloitte.com/us/en/insights/industry/technology/semiconductor-chip-shortage-supply-chain.html

Burkacky, O., Dragon, J., & Lehman, N. (2022a, April 1). The semiconductor decade; A trillion-dollar industry. McKinsey & Company. https://www.mckinsey.com/

Burkacky, O., de Jong, M., & Dragon, J. (2022b, April 15). Strategies to lead in the semiconductor world. McKinsey & Company. https://www.mckinsey.com/industries/semiconductors/our-insights/strategies-to-lead-in-the-semiconductor-world

Chee, F.Y. (2022, October 14). Some EU countries want billion-euro chip plan to also fund current chips. Reuters. https://www.reuters.com/technology/some-eu-countries-want-billion-euro-chip-plan-also-fund-current-chips-2022-10-14/

Ciani, A., & Nardo, M. (2022). JRC technical report: The position of the EU in the semiconductor value chain: evidence on trade, foreign acquisitions, and ownership. European Commission. https://joint-research-centre.ec.europa.eu/system/files/2022-04/JRC129035.pdf

Cota, J. (2022, March 7). The European Chips Act: A strategy to expand semiconductor production resiliency. Center for Strategic & International Studies. https://www.csis.org/blogs/perspectives-innovation/european-chips-act-strategy-expand-semiconductor-production

European Commission. (2022). European Chips Act. https://commission.europa.eu/

Farshchi, N. (2022, March 22). Who’s going to pay for American-made semiconductors? Builtin. https://builtin.com/hardware/american-made-semiconductor-costs

Gartner. (2023, January 17). Gartner says worldwide semiconductor revenue grew 1.1% in 2022. https://www.gartner.com/.

Haeck, P., & Westendarp, L. (2022, October 19). Absolutely fab-ulous – Europe’s microchips success is also its pitfall. Politico. https://www.politico.eu/article/europe-microchip-intel-investment-magdeburg-commission-technology/

Intel. (2022, March 15). Intel announces initial investment of over €33 Billion for R&D and manufacturing in EU. https://www.intel.com/content/www/us/en/newsroom/news/eu-news-2022-release.html#gs.nc47uz

Kharpal, A. (2022, February 10). Europe wants to become a leader in chips. But it’s going to need help. CNBC. https://www.cnbc.com/

Lewis, J.A. (2022, June 2). Strengthening a transnational semiconductor industry. Center for Strategic & International Studies. https://www.csis.org/analysis/strengthening-transnational-semiconductor-industry

Li, L. (2022, December 13). The global microchip race: Europe’s bid to catch up. Financial Times. https://www.ft.com/content/b31e27fd-0781-4ffd-bb69-9af985abff41

Liu, Z. (2022, February 2). China plans to create committee to collaborate with Intel, AMD. Tom’s Hardware. https://www.tomshardware.com/news/china-creates-committee-collaborate-intel-amd

Maizland, L. (2022, June 14). China and Russia: Exploring ties between two authoritarian powers. Council on Foreign Relations. https://www.cfr.org/backgrounder/china-russia-relationship-xi-putin-taiwan-ukraine

Omdia. (2022, February 15). Omdia: Surging automotive semiconductor industry to grow at 12.3% CAGR through 2025. https://omdia.tech.informa.com/.

Reiff, N., Murry, C., & Schmitt, K.R. (2023, January 5). 10 biggest semiconductor companies. Investopedia. https://www.investopedia.com/articles/markets/012216/worlds-top-10-semiconductor-companies-tsmintc.asp

Sacks, D. (2022, November 14). How Taiwan is assessing and responding to growing threats from China. Council on Foreign Relations. https://www.cfr.org/blog/how-taiwan-assessing-and-responding-growing-threats-china

Scimia, E. (2022, September 6). Microchip cooperation between the EU and Taiwan still stalled. PIME Asia News. https://www.asianews.it/news-en/Microchip-cooperation-between-the-EU-and-Taiwan-still-stalled-55997.html

SEMI. (2022, January 12). SEMI issues recommendation for European Commission to bolster Europe’s chip ecosystem resilience and competitiveness. https://www.semi.org/

Slijkerman, J.F. & Nijboer, F. (2022, February 8). EU Chips Act to boost Europe’s technological prowess and strengthen economy. ING. https://think.ing.com/articles/eu-chips-act-to-strengthen-europes-economy/

Starks, R. (2023, January 2). Semiconductors are a trillion-dollar industry: Now is the time to buy advanced micro devices. NASDAQ. https://www.nasdaq.com/articles/semiconductors-are-a-trillion-dollar-industry%3A-now-is-the-time-to-buy-advanced-micro

Takenaka, K., Sakoda, M., Anantharaman, M., & Klamann, E. (2022, December 23). Japan lawmaker says TSMC is considering second plant in Japan. Reuters. https://www.reuters.com/technology/japan-lawmaker-says-tsmc-is-considering-second-plant-japan-2022-12-23/

Timmers, P. (2022, August 9). How Europe aims to achieve strategic autonomy for semiconductors. Brookings Tech Stream. https://www.brookings.edu/techstream/how-europe-aims-to-achieve-strategic-autonomy-for-semiconductors/

Varas, A., Varadarajan, R., Goodrich, J., & Yinug, F. (2021, April). Strengthening the global semiconductor supply chain in an uncertain era. BCG & SIA. https://www.semiconductors.org/wp-content/uploads/2021/05/BCG-x-SIA-Strengthening-the-Global-Semiconductor-Value-Chain-April-2021_1.pdf