28 JANUARY 2026

This issue arrives at a moment of profound strategic uncertainty, as the final pillars of the post-Cold War security architecture begin to crumble in real-time. From the stalled negotiations over the New START treaty—facing a terminal expiration on February 5—to the freezing landscapes of Ukraine where a systematic Russian campaign targeting energy infrastructure has left thousands without heat, the final week of January finds the West at a definitive crossroads. The stories we bring you this week reveal a global order in which the traditional “rules of the game” are being rewritten by the kinetic reality of power and the erosion of established diplomatic guardrails.

At the forefront, the diplomatic vacuum left by the collapse of strategic arms control is being filled by a new, more volatile brand of engagement. While President Trump introduces his “Board of Peace” initiative at Davos as a framework for ending the war in Ukraine, the disconnect between high-level rhetoric and the situation on the ground has never been sharper. In Kyiv, the EU has been forced to trigger its Civil Protection Mechanism to mitigate a humanitarian catastrophe, even as French and NATO leadership signal a new phase of Arctic resolve in response to U.S. pressure over the status of Greenland.

This is not theoretical; it is playing out on the ground and at sea. The Royal Navy’s tracking of Russian vessels through the English Channel and the formal motion to establish a Special Tribunal for the Crime of Aggression in Ukraine underscore that the struggle for European security is being fought across every domain—legal, maritime, and infrastructural. Simultaneously, we see a continent forced to find its own voice, with Mark Carney’s sharp rebuke of coercive economic tactics reflecting a broader European and Canadian pivot toward strategic autonomy.

In our Map of the Week, we visualize the geopolitical fault lines exposed by the “Board of Peace,” illustrating the stark divide between those accepting the new diplomatic framework and those resisting it. Our Analysis section provides a deep dive into the 2026 U.S. NDS, exploring how a shift toward homeland and hemispheric priorities is fundamentally altering the security assumptions of the European alliance.

As always, W.A.R. on the Horizon brings you the developments that matter most—not just as a digest of weekly news, but as a window into the strategic choices that will define Europe’s survival. Whether through the lens of nuclear stability or the enforcement of territorial sovereignty in the High North, the final week of January 2026 finds a continent asserting its agency in a darkening world.

- Key Developments

- Statistics of the Week

- Map of the Week

- Photo of the Week

- Infographic of the Week

- Analysis

Stalled New START Talks Expose Strategic Arms Control Vacuum

As the New START nuclear arms control treaty approaches its February 5, 2026 expiration, Moscow has reported no substantive negotiations with Washington on its future, highlighting a widening rift in U.S.–Russia strategic dialogue. Russian Foreign Minister Sergei Lavrov stated there are no specific contacts underway with the United States about extending or replacing the pact, the last major limitation regime on deployed strategic nuclear warheads between the two powers. President Vladimir Putin has floated a voluntary one-year mutual extension of the treaty’s terms, but Russia has yet to receive a formal response from the U.S. side. Meanwhile, President Donald Trump has signaled interest in broadening any successor framework to include China, a proposition Beijing repeatedly rejects due to its comparatively smaller arsenal.

The lack of engagement intensifies concerns that formal arms control may lapse completely, eroding predictability in the world’s most consequential nuclear dyad. New START’s limits — capping each side at 1,550 deployed strategic warheads and associated launchers — have long underpinned strategic stability, even as Russia suspended participation in 2023 amid broader geopolitical tensions. With no clear U.S.–Russian exchange on extending or replacing the treaty and China outside such frameworks, European security planners face increased ambiguity over nuclear risk reduction and deterrence dynamics on the continent.

Russian Missile & Drone Blitz Cripples Kyiv’s Utilities

Russian armed forces launched a coordinated drone and missile assault on Kyiv on January 20, targeting critical energy and utility infrastructure and causing widespread power and water outages across the capital. Kyiv Mayor Vitali Klitschko reported that strikes on the city’s east bank disrupted electricity and water supplies, leaving large swaths of the city’s more than three million residents in darkness and without running water. One non-residential building was struck and one person wounded, while unofficial channels shared images of high-rise blocks plunged into blackout. The disruption comes amid an intensified winter campaign to degrade Ukraine’s energy system, exacerbating civilian hardship in subzero temperatures.

The assaults reflect a sustained Russian strategy to exploit Ukraine’s energy vulnerabilities as a lever of pressure beyond the conventional battlefield. Kyiv’s energy infrastructure has been repeatedly hit this winter, leaving thousands of homes without heat, and authorities continue to struggle with restoration amid ongoing attacks. Beyond immediate human costs, the strikes complicate domestic resilience and raise broader strategic concerns about the durability of Ukrainian civil infrastructure under persistent aerial pressure. The attack underscores the challenges facing Ukrainian air defenses and the critical importance of continued Western support to mitigate both military and civilian impacts.

Davos Envoys Signal Optimism Amid Fragile Ukraine Peace Talks

On the sidelines of the World Economic Forum in Davos, envoys from U.S. President Donald Trump and Russian President Vladimir Putin described their bilateral discussions on the Ukraine conflict as “very positive” and “constructive,” despite offering no concrete breakthroughs toward ending the war. Special representatives—including Trump’s envoy Steve Witkoff and Putin’s Kirill Dmitriev—held closed-door talks about a potential peace framework, with both sides emphasizing the value of continued engagement. The Kremlin characterized the session as non-public negotiations, underscoring sensitivity around its content and the broader peace agenda.

This upbeat diplomatic framing comes amid deep skepticism from Kyiv and its European allies, who remain wary of U.S. efforts that could pressure Ukraine into territorial concessions. Subsequent trilateral talks in Abu Dhabi, which followed the Davos meeting, were also labelled constructive but ended without agreement, as core issues like territorial integrity and security guarantees remain unresolved. Russian military pressure continued in parallel, including renewed drone and missile strikes on Ukrainian cities, highlighting the stark gap between diplomatic messaging and battlefield realities.

European Leaders Push Back Against U.S. Pressure at Davos

At the 2026 World Economic Forum in Davos, European political leadership sought to demonstrate unity and resolve in response to mounting U.S. pressure over Greenland and associated trade threats, even as business figures cautioned against an overly emotional reaction. French President Emmanuel Macron explicitly rejected the “law of the strongest” as a basis for international order and underscored Europe’s preference for respect over coercion, framing the transatlantic friction as symptomatic of broader shifts in global power dynamics. European Commission President Ursula von der Leyen similarly called for advancing European strategic independence amid seismic geopolitical changes, while Belgium’s prime minister and Sweden’s deputy PM stressed the need for cohesive EU action rather than past conciliatory postures.

CEOs and financial leaders attending the forum warned that Europe’s political response risked being driven more by emotion than pragmatic strategy, urging temperance and constructive negotiation with the United States to safeguard economic stability. This tension reflects deeper fractures within European policy circles over how to balance firm defence of principles and economic interests against the need to maintain essential cooperation with a pivotal partner on Ukraine support and broader security challenges. Amid these debates, Ukraine’s president conditioned his engagement in Davos discussions on firm commitments to Ukraine’s security and post-war reconstruction, highlighting the confluence of economic, diplomatic, and military imperatives confronting Europe’s leadership.

Carney’s Davos Rebuke of U.S. Tariffs and the “Rupture” in Global Order

At the 2026 World Economic Forum in Davos, Canadian Prime Minister Mark Carney delivered a striking address framing the post-Cold War rules-based international order as fundamentally fractured and warning that major powers were increasingly using economic integration as coercive leverage. Within that context, Carney explicitly opposed any U.S. tariffs linked to Washington’s controversial push regarding Greenland, affirming Canada’s support for Denmark’s sovereignty over the Arctic territory and calling for diplomatic engagement rather than punitive economic measures. His remarks resonated with many in the room and underscored a growing unease among middle powers about the use of trade policy as a tool of geopolitical pressure.

Carney’s speech — widely interpreted as a rebuke to U.S. policy under President Trump — also highlighted Canada’s pivot toward diversified partnerships and strategic autonomy, including recent trade arrangements with China and intensified outreach beyond traditional allies. By urging “middle powers” to act collectively, he sought to reframe Canada’s role from a passive beneficiary of global order to an assertive architect of new coalitions that uphold sovereignty, stability, and shared prosperity. The address has since fueled political support at home and drawn sharp reactions from Washington, illustrating the deepening diplomatic tensions over trade, Arctic security, and the future of multilateral cooperation.

Johnson Seeks to Stabilise UK–U.S. Ties Amid Greenland Dispute

Visiting London to mark the 250th anniversary of U.S. independence, U.S. House Speaker Mike Johnson sought to temper rising trans-Atlantic tensions, asserting that the United Kingdom and the United States can “work through our differences” and preserve their historic “special relationship.” Addressing the British Parliament, Johnson emphasised shared history and longstanding cooperation, underscoring confidence that current disputes — notably over U.S. tariff threats linked to Greenland and criticism of UK policy on the Chagos Islands — will be resolved through continued dialogue and mutual respect. His remarks came against a backdrop of sharp rhetoric from the U.S. presidency and concern in London about potential economic and diplomatic fallout.

While Johnson’s message aimed at reassurance, the underlying strategic tensions remain acute, reflecting broader shifts in U.S. foreign policy under President Trump that have unsettled long-standing alliances. The dispute over Greenland — a flashpoint that saw threats of tariffs on the UK and other European allies unless they acquiesce to U.S. ambitions — has tested NATO cohesion and raised questions about the durability of institutional ties that have anchored Western security since World War II. Johnson’s intervention, framed as a call for calm and continued cooperation, highlights the diplomatic effort required to navigate these strains without eroding the structural foundations of UK–U.S. relations.

France Pushes NATO Exercise in Greenland to Signal Allied Resolve

In response to escalating rhetoric from U.S. President Donald Trump over his interest in acquiring Greenland, France has formally urged NATO to conduct a military exercise on the Arctic island and signalled Paris is “ready to contribute” troops and resources, underscoring European concerns about alliance cohesion and Arctic security. French President Emmanuel Macron’s call reflects broader European efforts to reinforce collective defence and deterrence at a moment when Trump’s statements—seen by many in Europe as coercive—have strained transatlantic ties and triggered tariff threats against several NATO allies. The proposed exercise aims to reassure Denmark and Greenland of NATO’s commitment to mutual defence and to demonstrate allied unity in the face of unconventional pressure tactics.

The request comes amid a wider European military presence in Greenland, where multinational training and reconnaissance missions are underway under operations such as “Arctic Endurance,” intended to demonstrate readiness and resolve against any attempt to alter the island’s status by force or coercion. European NATO members have emphasised that Greenland’s sovereignty and territorial integrity are non-negotiable, with leaders framing military planning and exercises as essential to deterrence rather than escalation. However, the dynamic highlights growing fault lines within the alliance over strategy, burden-sharing, and the limits of U.S.–European cooperation under shifting U.S. foreign policy priorities.

NATO Reaffirms Greenland’s Central Role in Arctic Collective Defence

NATO Secretary General Mark Rutte hosted Denmark’s Defence Minister Troels Lund Poulsen and Greenland’s Foreign Minister Vivian Motzfeldt at NATO headquarters on January 19, underscoring the Alliance’s intent to anchor Greenland firmly within NATO’s collective security framework. The talks focused on the growing strategic importance of the High North, the Arctic’s role in wider Euro-Atlantic defence, and the need to maintain stability amid rising geopolitical competition. NATO said discussions highlighted Greenland’s relevance to allied early warning, maritime security, and broader deterrence posture.

The meeting comes against the backdrop of escalating transatlantic tensions triggered by U.S. pressure over Greenland’s status and renewed European efforts to reinforce Danish sovereignty through NATO mechanisms. By elevating Greenland to the centre of alliance consultations, NATO is signalling that Arctic security is a shared responsibility — not a bilateral issue — and that any changes to the region’s security architecture must occur within multilateral frameworks. The engagement also strengthens Copenhagen and Nuuk’s position by internationalising the issue, reinforcing that Greenland’s defence is now formally treated as an alliance-wide concern rather than a peripheral territorial matter.

NATO Flags Arctic as Strategic Front Against Russia and China

At the World Economic Forum in Davos, NATO Secretary General Mark Rutte echoed U.S. President Donald Trump’s emphasis on the Arctic’s strategic importance, declaring that the Alliance must act to “protect the Arctic against Russian and Chinese influence,” as activity by Moscow and Beijing in the region grows. Rutte highlighted that seven of the eight Arctic-bordering states are NATO members and that China, despite lacking Arctic territory, has increasingly been active through commercial and scientific ventures, which the Alliance views as part of broader geopolitical competition. This framing underscores NATO’s intention to broaden its security focus beyond Europe proper into the High North amid shifting great-power dynamics.

The remarks align with allied concerns about enhanced Russia–China cooperation and joint military and economic activities in the Arctic, which NATO commanders have described as a source of strategic tension requiring collective counter-measures. European capitals, backed by NATO’s leadership, are now pushing for a stronger, multilateral defence posture in the Arctic, including stepped-up presence and planning, to maintain deterrence and secure key sea lanes and early-warning infrastructure as climate change opens new operational domains. Critics, however, question the empirical basis for the perceived threat from Beijing and Moscow, noting limited direct military activity near Greenland itself.

Trump’s Davos Speech Deepens Greenland Rift, Softens Tactics

At the World Economic Forum in Davos, U.S. President Donald Trump delivered an assertive and polarising address that reignited his campaign to bring Greenland under U.S. control — a proposal that has sharply strained relations with European and NATO partners. Trump repeated his claim that the Arctic island, geographically part of North America, should belong to the United States and criticised Denmark for retaining it, even as he explicitly ruled out the use of military force and sought immediate negotiations toward a future deal. His rhetoric included nationalist boasts about U.S. contributions to global defence and jabs at European leaders, framing Greenland as critical to U.S. and global security and a “lost opportunity” after World War II.

The speech generated a fierce diplomatic backlash across Europe, with leaders condemning territorial claims and coercive language that risk undermining NATO cohesion. Trump also backed away from previously threatened tariffs on several European allies, announcing what he described as a “framework of a future deal” on Greenland following talks with NATO Secretary General Mark Rutte — although details remain unresolved and Copenhagen has reiterated that Greenland is not for sale. European capitals have since bolstered defence postures in the Arctic and stressed respect for Danish sovereignty, while the broader episode has underlined deepening distrust between the United States and its closest allies over strategic priorities and norms.

EU Parliament Suspends U.S.–EU Trade Deal in Retaliation Over Greenland Tariffs

In a significant escalation of transatlantic economic tensions, the European Parliament has suspended the ratification of a major EU–U.S. trade agreement in direct protest against U.S. President Donald Trump’s threat to impose tariffs on European countries over their opposition to his Greenland ambitions. The deal — originally negotiated to eliminate most EU import duties on U.S. industrial goods while maintaining zero tariffs on select U.S. exports — was put on hold after lawmakers described Trump’s linking of territorial demands to trade talks as coercive blackmail that undermines European sovereignty. Parliament Trade Committee Chair Bernd Lange stated that until the tariff threats cease, there can be no progress on approving the pact.

The suspension reflects deep political resistance within the EU to perceived U.S. pressure tactics and highlights fractures in diplomatic and economic cooperation between long-standing partners. Lawmakers have also discussed using the EU’s anti-coercion instrument to counteract U.S. economic leverage, potentially including restrictive actions against American firms, although such measures carry risks of reciprocal escalation. While the suspension does not legally cancel the agreement, it sends a strong signal that European legislators are willing to use trade ratification as leverage to defend territorial integrity and the rules-based order — even at the expense of closer economic ties with the United States.

Davos Duel: Trump’s Assertive Greenland Pitch vs. Carney’s Vision of a Fragmenting Order

At the 2026 World Economic Forum in Davos, President Trump and Canadian PM Carney delivered divergent narratives that crystallised the broader geopolitical rupture over Greenland and the international order. Trump used his platform to restate his long-running push for the United States to negotiate control or privileged rights over Greenland — framing it as indispensable for U.S. security and global strength, while claiming he would not use force to take the territory. He also announced a vague “framework of a future deal” with NATO’s secretary-general, signalling a tactical retreat from explicit tariff threats against Europe but maintaining the core strategic demand. Trump’s remarks, laced with nationalist rhetoric and critiques of NATO allies’ defence contributions, starkly underscored his transactional view of alliances.

Carney’s speech, by contrast, characterised the current global landscape as a “rupture in the world order,” arguing that the post–Cold War rules-based system is actively eroding under economic coercion and unilateralism from great powers. He urged middle powers to collaborate on strategic autonomy rather than acquiesce to bilateral pressures, a call that resonated strongly with European and international audiences and was seen as a direct rebuke to Trump’s approach. The juxtaposition of the two addresses highlighted a deepening transatlantic divide: one leader doubling down on disruptive assertiveness, the other warning of structural shifts that require new multilateral responses beyond traditional Western frameworks.

U.S. Soften Greenland Stance, But Strategic Impasse Remains

At the 2026 Davos forum, U.S. President Donald Trump significantly dialed back the most aggressive elements of his Greenland gambit, prompting a wave of relief among European and NATO partners. Facing sustained diplomatic pushback — including from close allies like Canada, Denmark, and the European Parliament — Trump dropped explicit tariff threats tied to Greenland and framed his comments more as an expression of interest in negotiations than a demand for acquisition. European capitals and NATO officials welcomed the less confrontational tone, interpreting it as a tactical shift rather than a resolution on Greenland’s future.

Despite the rhetorical retreat, no concrete pathway for cooperation, negotiation, or shared governance has emerged, leaving the underlying strategic dispute unresolved. Trump’s message — that the United States remains deeply invested in Arctic security — still resonates uneasily with Europe, especially given his insistence that allies “pay their fair share” and his broader transactional diplomatic posture. Analysts point out that the episode has exposed deeper structural tensions in transatlantic relations, with Greenland as a symbolic flashpoint that underscores divergent views on sovereignty, alliance norms, and the use of economic leverage in geopolitics. The “relief” in Brussels and Copenhagen is thus fragile and conditional, contingent on sustained diplomatic engagement rather than unilateral assertions of interest.

NATO Chief Rebuffs Greenland Sovereignty Question, Focuses on Alliance Unity

NATO SG Rutte publicly distanced the alliance from any discussion of Greenland’s sovereignty during the 2026 Davos forum, stating that the question of whether Greenland “stays with Denmark” never came up in talks with U.S. President Trump. Rutte emphasised that Greenland’s status as part of the Kingdom of Denmark is a matter for Denmark and Greenland themselves, reaffirming that NATO has no role in territorial transfers or sovereignty disputes. His remarks were aimed at quelling fears that alliance leaders were entertaining Trump’s prior suggestions about U.S. interest in the Arctic island, and underscored NATO’s desire to avoid being drawn into bilateral diplomacy that could fracture the alliance.

In parallel, Denmark and NATO announced plans to strengthen Arctic security cooperation in response to heightened regional tensions triggered by the Greenland crisis and broader great-power competition. Copenhagen and alliance headquarters outlined enhanced patrols, surveillance, and joint planning aimed at bolstering deterrence across the High North, including increased focus on early warning, maritime domain awareness, and interoperability among Arctic member states. Denmark’s defence leadership framed these efforts as necessary to reaffirm sovereignty, stability, and multilateral cooperation in a region of growing strategic importance, particularly given increased Russian military activity and China’s expanding economic footprint.

China Keeps Distance From Greenland Dispute, Urges Reduced U.S. Dependence

Amid the transatlantic controversy over U.S. interest in Greenland, China has deliberately distanced itself from the sovereignty dispute, asserting that it has no territorial claims or direct involvement in the Arctic island’s status. Beijing’s foreign ministry spokesman emphasised that China respects the sovereignty and legal framework of the Kingdom of Denmark, and reiterated that it does not seek a “seat at the table” in discussions about Greenland’s future. Instead, China’s public positioning reflects a calibrated effort to appear a neutral stakeholder in Arctic affairs while subtly warning against over-reliance on the United States.

In the same statements, Beijing used the platform to criticise global dependence on U.S. leadership, framing the Greenland episode as symptomatic of broader instability in the current international system. Chinese officials urged smaller states to diversify economic and security partnerships rather than leaning solely on Washington, implicitly leveraging the diplomatic moment to advance China’s narrative of multipolar cooperation and strategic autonomy. While China continues significant Arctic engagement through economic, scientific, and infrastructure channels — including shipping routes and resource interests — its diplomatic message on Greenland underscores a cautious approach to avoid alienating European partners while still pushing for a re-balancing of global influence away from U.S. dominance.

Trump’s “Board of Peace” Initiative Attracts Global, Ambiguous Support

U.S. President Trump has launched a “Board of Peace” initiative, a diplomatic forum aimed ostensibly at fostering negotiations to end the Ukraine war and other global conflicts. The concept — described by Trump as a group of nations seeking peaceful resolutions — has drawn support from a set of U.S. partners outside traditional Western alliances, including Saudi Arabia, Türkiye, Egypt, Jordan, Indonesia, Pakistan, Qatar, and the United Arab Emirates, reflecting a broad geographic mix of Middle Eastern and Asian states that have signed on to the framework. Trump portrayed the initiative as an inclusive platform for conflict mediation, claiming that its supporters reflect global demand for alternative diplomatic mechanisms amid protracted wars.

The initiative’s credibility, however, remains deeply uncertain and contested. Russian President Putin has said Moscow is studying the proposal after Trump claimed Russia had agreed to participate — an assertion that Russia has not confirmed, leaving ambiguity about genuine Russian engagement. The “Board of Peace” lacks clear institutional structure, enforcement mechanisms, or coherent strategic objectives, and interpret its burgeoning list of members as opportunistic rather than indicative of substantive conflict resolution capacity. European and Ukrainian officials have been skeptical, viewing the initiative as a parallel diplomatic track that could undercut established negotiations and legitimize actors with divergent interests, rather than deliver tangible progress on core issues like territorial integrity or effective ceasefires.

EU–India Security & Defence Partnership Advances

The European Union and India have agreed to finalise a comprehensive Security and Defence Partnership as early as next week, marking a substantial deepening of strategic cooperation between Brussels and New Delhi. Estonian Prime Minister Kaja Kallas confirmed that EU leaders have decided to proceed with the pact, which is set to be signed during an upcoming EU–India summit. The agreement aims to broaden collaboration on defence-industrial issues, joint exercises, cybersecurity, and capacity building, reflecting shared concerns over regional stability amid China’s assertiveness and Russia’s war in Ukraine.

The pact signifies a strategic alignment rooted in mutual interest rather than formal alliance structures, positioning India as a key partner in the EU’s emerging security architecture. Beyond traditional trade ties, the defence framework will facilitate information-sharing, defence procurement cooperation, and maritime security coordination — areas of growing importance given Indo-Pacific tensions and threats to global supply chains. European officials have framed the move as part of a broader shift toward “coalitions of like-minded partners” capable of upholding a rules-based order, while Indian leaders see it as reinforcing India’s role as a central security provider in the Indo-Pacific without formal defence commitments. The agreement also underscores a geopolitical calculation by both sides to diversify security partnerships beyond NATO and the Quad, expanding operational linkages across continents.

EU–India Trade Deal Nears Completion After Years of Talks

After more than a decade of negotiations, the European Union and India are poised to conclude a landmark trade agreement within the next few days, Spanish Foreign Minister José Manuel Albares announced on January 21. The deal — aimed at significantly reducing tariffs on goods and harmonising regulatory standards — represents one of the most consequential economic partnerships both parties have pursued outside their respective regional blocs. Negotiators have reportedly resolved outstanding issues related to market access for key agricultural and industrial sectors, clearing the way for formal endorsement by EU capitals and New Delhi. (reuters.com)

Finalising the agreement would mark a major shift in global trade dynamics, strengthening economic ties between the world’s two largest democratic blocs and offering a counterweight to China’s expanding commercial footprint in Asia and Africa. The pact is expected to boost bilateral trade by lowering barriers on both sides, improve regulatory cooperation, and enhance investment protections — framing EU–India relations as a cornerstone of each side’s broader strategic engagement. However, implementation will face political scrutiny in both markets, particularly over sensitive industries such as dairy in the EU and automobiles in India, meaning smooth ratification is not guaranteed. The imminent conclusion nonetheless signals renewed momentum in global trade diplomacy following years of paralysis and geopolitical uncertainty.

U.S. Pushes Ukraine Peace Talks, Zelenskyy Meeting in Sight

U.S. President Donald Trump announced plans to meet Ukraine’s Volodymyr Zelenskyy, asserting that a peace deal to end the Russia–Ukraine war is “reasonably close.” Speaking after Davos engagements, Trump signalled that U.S. envoys had made progress in negotiations with Kyiv but stressed that key issues remain unresolved. The Ukrainian presidency confirmed the planned high-level talks, underscoring Kyiv’s conditional willingness to engage in diplomacy as long as territorial integrity and sovereignty remain central. Trump’s push reflects a broader U.S. emphasis on expedited settlement efforts, even as battlefield dynamics and allied cohesion complicate the diplomatic landscape.

Concurrently, Russian President Vladimir Putin said he would meet U.S. envoys Steve Witkoff and Jared Kushner, underscoring Moscow’s engagement with the nascent peace initiative. Putin’s decision to enter direct talks with Trump’s representatives — while offering little clarity on substantive concessions — suggests Russia’s interest in shaping any deal on its own terms. However, significant gaps remain between Kyiv’s demands and Moscow’s red lines, particularly around territorial status and security guarantees. European partners have expressed deep skepticism about the U.S. framework, warning that rushed negotiations could pressure Ukraine into unfavorable compromises. The parallel diplomatic tracks — one anchored by Washington, the other contested by Brussels and Kyiv — illustrate the fracturing of allied consensus on how to achieve a sustainable and just peace.

EU Warns Transatlantic Relations Strained but Enduring

European Union Foreign Policy Chief Kaja Kallas acknowledged that transatlantic relations have “taken a big blow” in recent days, driven by tensions over U.S. pressure regarding Greenland’s status and threats of tariffs that alarmed EU capitals. Speaking ahead of an informal EU leaders’ meeting in Brussels, Kallas described the relationship with the United States as unpredictable, a significant departure from the stability that characterised decades of cooperation since World War II. Despite these strains, she underscored that Europe is not prepared to “junk 80 years of good relations” with Washington and is committed to working to maintain the partnership, particularly as shared security challenges — from Russia to China — persist.

Kallas also warned that visible discord between Europe and the United States benefits strategic competitors such as Moscow and Beijing, suggesting that open divisions could be exploited to weaken Western cohesion. EU leaders, while expressing relief at recent tactical de-escalation from Washington, noted that the alliance will require continued engagement and mutual respect to navigate current geopolitical complexities without sacrificing the foundational transatlantic bond.

Trump Envoys Hold Late-Night Talks With Putin as Ukraine Diplomacy Intensifies

In a dramatic diplomatic push, Russian President Vladimir Putin met late at night on January 22 with U.S. envoys Steve Witkoff and Jared Kushner for talks focused on the Ukraine conflict, marking one of the highest-level engagements between Moscow and the United States since the peace initiative was launched at Davos. The session came after U.S. President Donald Trump said he expected progress on a negotiated settlement and had arranged discussions with both Kyiv and Moscow representatives. While officials described the meeting as substantive, no definitive breakthroughs were announced, and core disagreements over territorial control, security guarantees, and the sequencing of a ceasefire remain unresolved.

The talks underscore Washington’s ambition to position itself as the central broker in Ukraine peace efforts, but they also expose deep diplomatic fault lines. Kyiv has expressed reservations about the U.S. track, warning that any negotiated settlement must uphold Ukraine’s territorial integrity and not reward Russian aggression. European leaders and NATO partners have voiced scepticism as well, fearing that truncated negotiations could sideline allies and undercut the unified stance that has underpinned support for Ukraine. Putin’s readiness to engage with U.S. envoys yet stagnation on substantive concessions highlights the fragility of current diplomatic momentum and the persistent gulf between rhetoric and actionable compromise.

UK Condemns Trump’s NATO Front-Line Remarks as Undermining Alliance Cohesion

A senior UK defence minister has publicly rebuked U.S. President Donald Trump’s comments questioning whether frontline NATO states would defend others under attack, describing the remarks as “deeply disappointing” and damaging to alliance solidarity. Trump’s comments — made during discussions about burden-sharing and defence contributions — appeared to cast doubt on the U.S. commitment to Article 5 mutual defence guarantees, which obligate all NATO members to respond if a fellow ally is attacked. The British government responded by reaffirming its unwavering support for collective defence, emphasising that any suggestion otherwise “undermines trust” among allies and emboldens adversaries like Russia. (reuters.com)

The criticism reflects broader European anxiety over U.S. predictability and the future of NATO’s transatlantic bond amid Trump’s transactional rhetoric on defence spending. UK officials stressed that strong and credible deterrence depends on unequivocal assurances that Article 5 is non-negotiable, warning that wavering language could weaken NATO’s deterrent posture on its eastern flank. The dispute over Trump’s framing has sparked intense diplomatic engagement behind the scenes, as European capitals work to reaffirm shared commitments while navigating Washington’s evolving strategic messaging — a dynamic that could reshape alliance politics if left unaddressed.

NATO Military Leaders Reaffirm Unity Amid Intensifying Threat Landscape

At the 194th NATO Military Committee meeting in Brussels, the alliance’s most senior uniformed leaders convened on January 21–22 to address escalating global security challenges and to send a clear signal of cohesion and adaptability. Chair Admiral Giuseppe Cavo Dragone emphasised that despite diverse national perspectives, the alliance remains “united, resilient, and dynamic,” determined to adapt NATO’s deterrence and defence posture in response to Russia’s war in Ukraine, hybrid threats, and broader strategic competition. Discussions focused on readiness assessments, capability development, and the integration of innovation across multidomain operations.

The committee also spotlighted expanding partnerships and public engagement as essential components of collective security, including cooperation through the NATO-Ukraine Council and enhanced ties with Indo-Pacific partners. Leaders stressed that security “involves everyone” — requiring support not only from military and political authorities but also from the populations the alliance defends. Amid contemporary strains within the alliance, the public reiteration of unity and shared strategic direction was designed to reinforce deterrence credibility and reassure allies that NATO’s core tasks — collective defence, crisis management, and cooperative security — remain central to its evolving mission.

U.S. Defence Strategy Reorients Priorities, Pressures European Responsibilities

The 2026 U.S. National Defense Strategy marks a striking recalibration of American military priorities by elevating homeland defence and the Western Hemisphere — including key terrain like Greenland — above traditional overseas commitments. The Pentagon’s doctrine assigns defending the U.S. homeland and deterring China in the Indo-Pacific as its principal missions, while urging NATO and other allies to assume primary responsibility for regional defence with only “critical but more limited” American support. This approach reflects a broader “America First” posture that strips the strategy of previous integrated deterrence language and de-emphasises long-standing global order frameworks.

For Europe, this shift carries significant geopolitical implications. U.S. willingness to tie its security guarantees more closely to burden-sharing — rather than maintaining extensive forward force presence — intensifies pressure on EU and NATO members to boost defence capacity and autonomy or risk a diminished American role in the continent’s defence architecture. European leaders have reacted with mixed signals: calls for strategic autonomy have gained traction, yet NATO’s secretary-general has warned that fully independent defence without U.S. support would be prohibitively costly and complex. The strategy thus underscores an inflection point in transatlantic security, where European defence policy must adapt to a U.S. posture that is more transactional and homeland-centric than at any point since the Cold War.

Royal Navy Monitors Russian Warships Crossing English Channel

The UK’s Royal Navy tracked multiple Russian naval vessels as they transited the English Channel on January 23, underscoring continued Russian naval activity near Western European waters. British defence officials said the sovereign-territory passage was monitored by Royal Navy ships and aircraft, consistent with standard procedures to ensure maritime safety and compliance with international law. The Russian group — reportedly including an Admiral Gorshkov-class frigate and support ships — was not challenged directly but was kept under constant surveillance, reflecting London’s vigilance toward Moscow’s expanding naval operations.

The transit occurs against a broader backdrop of heightened NATO maritime awareness and concerns over Russia’s use of sea power to project influence and test alliance readiness. While passage through the English Channel is permitted under the United Nations Convention on the Law of the Sea (UNCLOS), Western capitals interpret increased Russian naval movements near strategic chokepoints as part of a wider pattern of assertive military posture since the invasion of Ukraine. For European security planners, such deployments reinforce the imperative of sustained maritime domain awareness, forward patrols, and interoperability among NATO navies to deter destabilising behaviour and reassure coastal states from the Baltic to the North Atlantic. The incident also feeds into ongoing debate in London and Paris about boosting naval capacity and air defence assets in the region to counter a resurgent Russian fleet.

Rutte Rejects European Army Push, Reasserting NATO Framework

NATO SG Rutte forcefully dismissed recent calls by some European policymakers to create a standalone European army, arguing that such a force would weaken rather than strengthen the continent’s defence posture and duplicate existing structures within NATO. Speaking to the European Parliament in Brussels, Rutte said that moving toward an independent European military was “pie in the sky” and risked diluting resources across overlapping institutions instead of enhancing collective capability. He explicitly warned that a separate force would require vastly higher defence spending and even a nuclear component to substitute for the U.S. nuclear umbrella, a prospect he suggested would play into Russian strategic interests rather than deter them.

Rutte’s intervention is significant in the context of European debates over “strategic autonomy”, which have gained traction amid recent transatlantic strains including the Greenland row and broader questions about U.S. predictability. By rejecting the idea of a European army outside NATO, Rutte effectively reaffirmed the Alliance as the bedrock of European security while still urging greater European responsibility within that framework. His stance reflects concerns among many capitals that fragmentation of defence efforts could erode collective deterrence and undermine interoperability with U.S. forces — even as Europeans explore ways to bolster defence industries and capabilities in response to evolving threats from Russia and other actors.

EU Gives Final Approval to Phase Out Russian Gas Imports

European Union member states have formally adopted a ban on imports of Russian natural gas, completing legislation that bars almost all purchases of pipeline and liquefied natural gas (LNG) from Russia as of 2027. The measure, agreed by national governments and the European Parliament, represents one of the most consequential steps in decoupling the EU’s energy system from Moscow since the invasion of Ukraine. Officials from Brussels emphasised that the ban is designed to deprive Russia of a significant revenue source while accelerating the bloc’s transition to diversified supplies and renewable alternatives. Preparations are already underway to expand infrastructure for non-Russian gas, hydrogen, and renewable energy capacity.

The move underscores a strategic shift in European energy policy driven by the war in Ukraine and the recognition that dependence on Russian hydrocarbons poses systemic political and security risks. The ban is projected to reduce Russia’s gas export revenues — a critical pillar of its state finances — and signals to Moscow that Europe is prepared to sustain economic pressure over the long term. While Brussels anticipates short-term challenges, including higher energy costs and supply realignment, policymakers argue this is outweighed by gains in energy sovereignty and resilience. The phase-out also tightens the linkage between European energy and foreign policy, embedding energy sanctions as a core tool of geopolitical leverage against Russia.

EU and Council of Europe Launch Advance Team for Ukraine Aggression Tribunal

The European Union and the **Council of Europe have signed an agreement to finance and establish an advance team tasked with laying the institutional, logistical, and organisational groundwork for a Special Tribunal for the Crime of Aggression against Ukraine. This preparatory team will support drafting the tribunal’s rules of procedure and evidence, setting up court management systems, and facilitating the selection of judges and a prosecutor. The effort is part of a broader initiative to create a specialised international judicial body capable of prosecuting senior political and military leaders for the crime of aggression — a legal category not currently within the jurisdiction of the International Criminal Court for this conflict. The EU has committed an initial €10 million toward the project, which is managed under the Council of Europe framework and expected to operate for up to 24 months as foundations are built.

For Europe, this development marks a significant institutional step in accountability and deterrence linked to Russia’s full-scale invasion of Ukraine. It signals that European institutions are moving from declarations of intent toward concrete mechanisms that could hold high-level actors criminally responsible for initiating and executing unlawful war. By embedding the tribunal initiative within established European legal structures, Brussels and Strasbourg aim to bolster the credibility and legitimacy of international justice efforts while reinforcing the principle that aggression carries enforceable consequences — a message intended to strengthen the rules-based order amidst persistent geopolitical tensions.

EU Sends Emergency Power Generators as Russia’s Strikes Knock Out Ukrainian Electricity

The European Union has deployed emergency electricity generators to Ukraine after relentless Russian missile and drone attacks left over one million citizens without power amid sub-freezing temperatures, the European Commission’s Civil Protection and Humanitarian Aid department announced on January 23. The high-capacity generators are part of a broader EU humanitarian response supporting local authorities’ efforts to restore essential services disrupted by strikes targeting critical energy infrastructure. The initiative comes as Ukrainian regions contend with temperatures as low as -20 °C, heightening humanitarian risk for civilians enduring extended outages and complicating relief operations.

The EU’s intervention demonstrates rapid disaster response coordination under the Union Civil Protection Mechanism, mobilising resources from Member States to address acute civilian needs. By supplying generators, technical experts, and logistical support, Brussels aims to mitigate immediate hardships — particularly for hospitals, shelters, and water pumping stations cut off from power — while reinforcing Ukraine’s resilience against sustained Russian attacks on its electricity grid. The deployment also signals a political commitment from the EU to sustain civil infrastructure under wartime conditions, underscoring the broader integration of humanitarian support into Europe’s strategic response to Russia’s campaign of energy coercion.

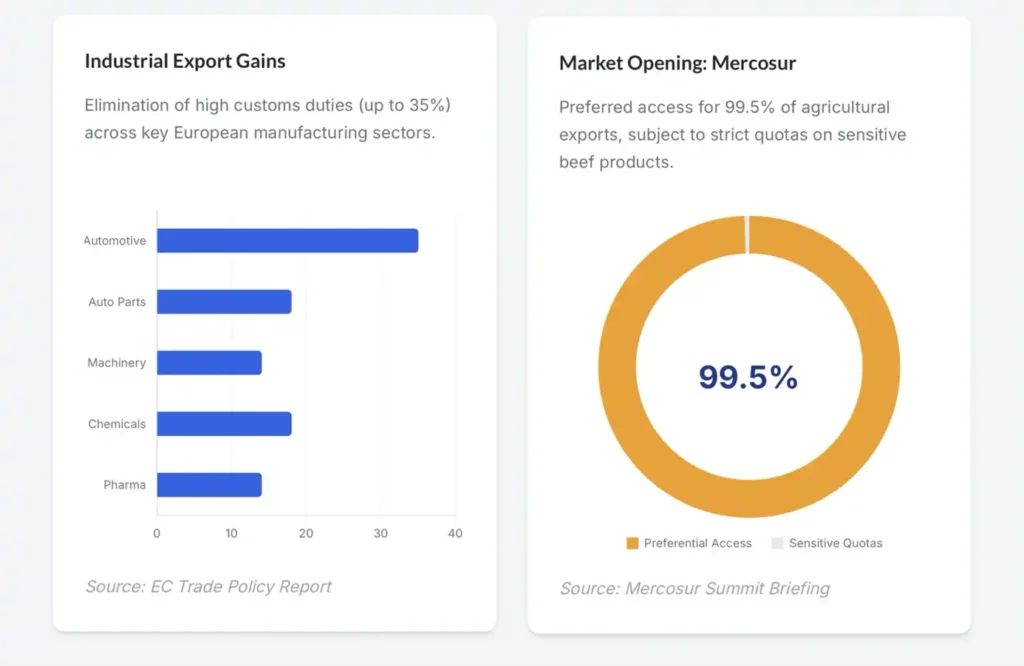

The EU–Mercosur Trade Asymmetry

The EU–Mercosur Partnership Agreement delivers clear, front-loaded gains for European industry, particularly in manufacturing sectors long constrained by South American tariff barriers. According to Commission data, the deal eliminates customs duties of up to 35% across core European exports, with the automotive sector the largest beneficiary, followed by auto parts, chemicals, machinery, and pharmaceuticals. For the European Union, this represents a decisive export-competitiveness boost in high-value industrial goods, reinforcing Europe’s position as a manufacturing and standards-setting power rather than a commodity supplier.

By contrast, market access concessions granted to Mercosur are far broader in headline terms but tightly constrained in practice. While 99.5% of agricultural exports receive preferential access, the most politically sensitive products — particularly beef — remain subject to strict quota ceilings, limiting their real market impact. The asymmetry is deliberate: Brussels secures near-total tariff elimination for industrial exports while containing domestic political fallout in agriculture. Strategically, the statistics reveal the agreement less as a balanced liberalisation exercise and more as a geoeconomic hedge — locking in industrial access and supply-chain diversification at a time of rising transatlantic and global trade uncertainty.

Who’s In, Who’s Hesitating, Who’s Out—Trump’s “Board of Peace” Mapped

This week’s map visualises the geopolitical fault lines exposed by the rollout of President Donald Trump’s “Board of Peace” at Davos. The colour coding is blunt. Green marks states that have accepted participation—predominantly in the Middle East and parts of the Global South. Yellow captures those reviewing invitations, hedging behind procedural, legal, or political caveats. Red signals outright rejection, concentrated across much of Europe and extending to Canada. The pattern is unmistakable: the initiative draws energy from outside the Euro-Atlantic core while meeting resistance inside it.

For Europe, the hesitation is not cosmetic—it is structural. Many European governments argue the Board risks bypassing established multilateral mechanisms, particularly the United Nations, and blurring lines of accountability in post-conflict governance. The unresolved role of Russia is the central blocker: without clarity on Moscow’s status, European capitals fear legitimising parallel diplomacy that could dilute legal norms around aggression and reconstruction. Supporters frame the Board as pragmatic, action-oriented, and tied to a UN-adopted 20-point plan on Gaza’s reconstruction; critics see an end-run around institutions Europe has invested decades—and political capital—in upholding. In short, green reflects willingness to experiment, yellow reflects risk management, and red reflects institutional red lines. The map captures a world not divided East–West, but process-first versus outcome-first—with Europe firmly on the former side.

NATO’s Military Leaders Signal Unified Resolve

his week’s featured image captures the Chiefs of Defence from NATO member states alongside senior allied commanders as they convened in Brussels on January 21–22. The photograph vividly illustrates the collective dimension of alliance leadership, bringing together the top uniformed military authorities responsible for planning, readiness and operational coherence across the Euro-Atlantic area — from the High North to NATO’s southeastern flank. Their presence underscores that, despite political headwinds and heated debates over burden-sharing and strategic direction, NATO’s core military apparatus remains actively engaged in synchronising deterrence and defence priorities.

The backdrop for this meeting — and the photo — is an evolving security environment marked by Russia’s war in Ukraine, increased maritime activity near European waters, and pressure for European partners to enhance capability contributions. By visually foregrounding the alliance’s military cohesion, the image reinforces a central message from the session: allied forces must remain interoperable, adaptive and mutually reinforcing. In a period of contestation over NATO’s future posture and transatlantic commitments, this photo conveys an unequivocal narrative of unity among the professionals charged with operationalising Europe’s collective defence.

EU–India Security Without Entanglement

This week’s infographic captures the strategic logic underpinning the imminent EU–India Security and Defence Partnership: alignment without alliance, cooperation without binding guarantees. Framed explicitly by Brussels as a response to geopolitical disruption, the agreement prioritises non-kinetic but strategically sensitive domains — notably maritime security, cyber cooperation, supply-chain resilience, and information-sharing. The visual emphasis on open sea lanes in the Indo-Pacific underscores a shared concern: safeguarding global trade arteries amid intensifying great-power competition, without importing formal defence obligations.

Crucially, the infographic also illustrates what the partnership is not. There are no mutual defence clauses, no automatic commitments, and no institutionalised force integration. For both the European Union and India, the value lies in strategic flexibility — political signalling, coordination, and resilience-building rather than entanglement. As articulated by senior EU officials, including Kaja Kallas, the partnership reflects a broader European shift toward networked security arrangements: hedging risk, diversifying partners, and extending influence eastward without replicating NATO-style commitments. The infographic distils this logic cleanly — cooperation as leverage, not obligation.

🇪🇺🤝🇮🇳 EU–India Move Toward New Security & Defence Partnership

India and the European Union are set to sign a new Security and Defence Partnership next week, marking a step forward in bilateral cooperation amid growing global uncertainty.

Announced by Kaja Kallas, the… pic.twitter.com/4D5teTTPPT

— Beyond the Horizon (@BehorizonOrg) January 22, 2026

Europe and the 2026 U.S. National Defense Strategy—A Transatlantic Inflection Point

Introduction

The U.S. Department of War’s 2026 National Defense Strategy (NDS) represents a pivotal recalibration of American military priorities with profound implications for European security policy. For the first time since the end of the Cold War, Washington has elevated homeland defense and the Western Hemisphere over traditional forward posture commitments in Europe and Asia, signalling a more insular prioritisation of U.S. strategic interests. While the strategy nominally acknowledges global competition, its operational emphasis on homeland resilience and defence of the Western Hemisphere explicitly reshapes the expectations for how and where U.S. military power will be applied. This marks a significant departure from the integrated deterrence framework that underpinned U.S. policy toward European security post-2014 and especially since Russia’s full-scale invasion of Ukraine.

For European capitals, this repositioning is both unsettling and strategically significant. Europe’s security architecture has been built over decades on the sturdy assumption of U.S. capability and commitment through NATO’s Article 5 collective defence guarantee. The 2026 NDS reframes that commitment not as unconditional or geographically boundless, but as contingent on burden-sharing and reciprocal engagement. By placing a greater premium on defending U.S. territory and hemispheric approaches, Washington sends a clear signal: the default backstop for European defence is no longer a given without parallel increases in European capacity. This signal arrives at a time of heightened political and operational pressure over allied contributions, complicating Brussels’ efforts to sustain transatlantic unity while managing domestic pressures over defence spending.

Shifting U.S. Priorities: Homeland First?

The NDS, together with supplementary statements from senior U.S. officials, emphasises a homeland-centric defence posture that allocates a disproportionate share of resources toward protecting the U.S. mainland and proximate regions. This shift is partly rooted in evolving threat perceptions, particularly the spectre of strategic competition with China, cyber and space threats, and asymmetric attacks on American infrastructure. But by prioritising Hemisphere defence, including areas like Greenland and the Arctic, the strategy implicitly suggests that European theatres of operation are becoming secondary unless European allies themselves step up materially.

The consequence for Europe is a strategic muscle-flexing test: can European states, individually and collectively, compensate for a perceived contraction of U.S. forward presence and initiative? The NDS explicitly leaves room for continued cooperation with allies, but it does so under a rubric that emphasises cost-sharing, interoperability, and mutual benefit. It no longer assumes a U.S.-led, Europe-first orientation.

European Responses and Strategic Autonomy

In Brussels and across EU capitals, reactions to the new U.S. defence calculus have been measured but pointed. European leaders have increasingly spoken of the need for “strategic autonomy” — a more self-sufficient defence posture that reduces dependency on external actors while preserving the benefits of partnership with the United States. The logic is straightforward: if the United States intends to prioritise its own defences and recalibrate its global footprint, Europe must fill gaps in its own neighbourhood that Washington may no longer be prepared to underwrite as a default.

This autonomous drive is visible in policy initiatives such as the EU’s Permanent Structured Cooperation (PESCO), increased defence budget commitments under national and EU-level frameworks, and expanding partnerships beyond NATO — for example with Indo-Pacific partners like India and Japan. These reflect a pragmatic European recognition that the era of reliant deterrence, where Europe could deflect existential threats predicated on U.S. engagement, is being supplanted by a more self-responsibilised model of defence.

NATO, Burden Sharing, and Alliance Confidence

Crucially, Europe’s response does not equate to a rejection of NATO or the transatlantic bond. Instead, the reaction reflects a nuanced calculus: the alliance remains indispensable, but its internal dynamics must evolve to reflect the geopolitical reality introduced by the 2026 NDS. European states have reaffirmed their commitment to NATO’s collective defence while pressing for greater allied capacity and a more balanced distribution of operational roles.

The challenge lies in calibrating these ambitions against political realities. Public appetite for higher defence spending varies widely across Europe, and coalition governments in key states remain sensitive to economic pressures and domestic priorities. NATO has responded by reiterating the centrality of collective defence even as it supports European capability development. However, the underlying tension — a U.S. strategy that signals conditional engagement and a European impetus toward autonomy — will continue to shape alliance politics.

Conclusion: A Transatlantic Crossroads

The 2026 U.S. National Defense Strategy is more than a doctrinal update; it is a strategic inflection point that forces Europe to rethink its defence assumptions. By prioritising homeland and Hemisphere defence, the United States has inadvertently accelerated European efforts to assume greater responsibility for its security environment. For Europe, this is a moment of both pressure and opportunity: pressure to bolster defence capabilities in the face of an assertive Russia and uncertain U.S. posture, and opportunity to construct a more resilient and self-directed security framework that can stand independently while still engaging constructively with the United States.

What emerges is not a weakening of the transatlantic link, but a transformation — from one of dependency to one of mutual, calibrated partnership where European strategic capability is not a substitute for U.S. engagement, but a necessary complement. Whether Europe can translate this strategic imperative into coherent policy and sustained capability investment will be one of the defining tests of the next decade.