Key Takeaways

Economic Warfare via “China Shock 2.0”: Beijing is attempting to export its way out of domestic stagnation. By prioritizing state-directed manufacturing over consumption, China has generated a nearly $1 trillion trade surplus. This flood of subsidized, artificially cheap goods is causing “premature deindustrialization” in the Global South and threatening the viability of Western industries.

The Battle for “Foundational” Control: While the U.S. focuses on cutting-edge AI chips, China is rapidly monopolizing the market for “foundational” (legacy) semiconductors and critical minerals. This strategy aims to create a chokehold on the basic components required for global electronics, giving Beijing “escalation dominance” in a trade war.

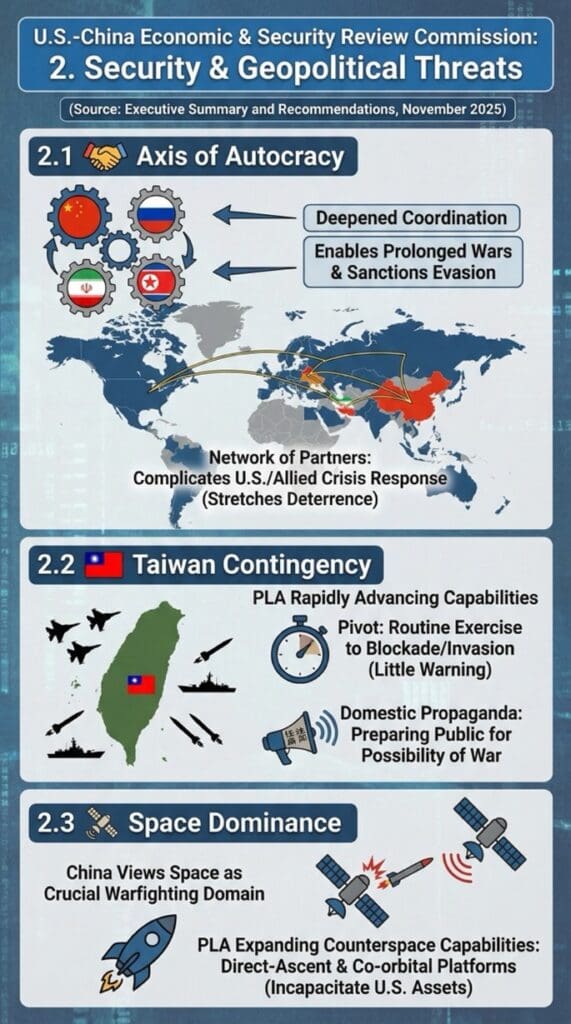

The “Axis of Autocracy”: China has solidified its role as the “decisive enabler” of a revisionist coalition including Russia, Iran, and North Korea. This loose but effective partnership allows these rogue states to survive sanctions and coordinate destabilizing activities, stretching U.S. strategic attention across multiple theaters.

From Exercises to Rehearsals: The PLA’s military posture toward Taiwan has shifted from signaling to operational preparation. Recent drills are described as “actual rehearsals” for invasion. Simultaneously, “gray zone” tactics—such as cutting undersea cables and maritime harassment—are normalizing coercion below the threshold of war.

The “Volt Typhoon” Threat: Chinese cyber operations have moved beyond espionage to pre-positioning. The “Volt Typhoon” campaign has infiltrated U.S. critical infrastructure (water, power, transport) with the specific intent of inducing panic and paralyzing U.S. mobilization in the event of a conflict.

A Call for Institutional Overhaul: The Commission concludes that the current U.S. approach is too fragmented to compete. It recommends the creation of a unified Economic Statecraft Agency to consolidate sanctions and export control authorities, alongside “bold action” to selectively decouple supply chains and subsidize domestic production in national security sectors.

Introduction

The 2025 Annual Report to Congress by the U.S.-China Economic and Security Review Commission (USCC) represents a pivotal document in the landscape of American strategic thought. Arriving at a moment of heightened geopolitical volatility, the report provides a comprehensive and sobering assessment of the People’s Republic of China (PRC). It outlines a convergence of economic, technological, and military challenges that are no longer theoretical future risks but active, present-day disruptions.

The report details how Beijing’s ambitions have evolved from seeking participation in the global order to actively reshaping it. The report argues that China’s policies now threaten the foundational stability of global economics, the balance of power in the Indo-Pacific, and the integrity of democratic institutions worldwide. This analysis evaluates the report’s key themes—economic policy, technological competition, geopolitical strategy, security posture, and recommended U.S. responses—highlighting the data presented and the profound strategic implications identified by the Commission.

Economic Policy and Industrial Strategy: The “Zero-Sum” Shift

China’s economic trajectory has shifted from a model of rapid growth and integration to one of state-driven securitization and mercantilism. The report identifies 2025 as a milestone year, marking the conclusion of the Made in China 2025 (MIC2025) initiative. This ambitious industrial blueprint has largely succeeded in its primary goal: building a “hyper-charged, state-directed manufacturing base without historic parallel”.

Through years of heavy state subsidies, forced technology transfer, and protectionist policies, China has achieved massive scale in strategic industries. However, this success has come at a significant cost to the structural health of its own economy. The report describes a “two-speed economy” where cutting-edge manufacturing sectors—such as electric vehicles (EVs), renewable energy hardware, and advanced materials—surge ahead, while the broader consumer economy stagnates.

Structural Imbalances and the “China Shock 2.0”

The core of the Commission’s economic critique is the identification of a fundamental imbalance: China’s industrial capacity vastly exceeds its domestic consumption. Rather than rebalancing the economy toward household consumption—a promise Beijing has repeatedly broken—the state continues to prop up supply.

This dynamic has created a “China Shock 2.0.” unlike the initial integration of China into the WTO, which primarily affected low-end manufacturing in developed nations, this second wave is characterized by high-tech, high-value goods flooding global markets at artificially low prices. In 2024, China ran a merchandise trade surplus approaching

$1 trillion, a figure the report notes is on track to be surpassed in 2025.

The impact of this overcapacity is global and destabilizing:

- Global South Impact: Developing economies in Southeast Asia, Latin America, and Africa are suffering “premature deindustrialization.” The report notes that nations like Indonesia and Thailand are facing thousands of factory closures and significant job losses as their domestic industries cannot compete with dumped Chinese goods.

- Market Distortion: By late 2024, over 22% of Chinese industrial entities were loss-making, nearly double the rate from 2016. This statistic is crucial; it indicates that Chinese firms are not operating on market principles of profit, but are kept alive by the state to maintain employment and capture global market share.

The Commission views this not as accidental economic mismanagement, but as a deliberate strategy. Beijing appears willing to tolerate internal inefficiencies to export deflation and dependency, effectively hollowing out the industrial bases of rival nations, including the United States.

Technological Competition: The Battle for the Future

Technological leadership has become the central theater of U.S.-China strategic competition. The report dismantles the assumption that export controls alone can permanently stifle China’s progress. Instead, it highlights how Beijing’s “whole-of-nation” approach—specifically the strategy of Military-Civil Fusion (MCF)—has allowed it to circumvent restrictions and achieve breakthroughs.

The Innovation Flywheel

The report describes “interlocking innovation flywheels,” where China leverages its massive manufacturing dominance to accelerate R&D. Because China creates the hardware for the world, it possesses a unique feedback loop where production data fuels innovation, which in turn optimizes production.

- Semiconductors and “Foundational” Chips: While much Western attention focuses on cutting-edge AI chips (7nm and below), the Commission draws urgent attention to “foundational” or mature-node semiconductors. These are the workhorses of the modern economy, essential for everything from automobiles to medical devices and weapons systems.China is engaged in a “breakneck expansion” of legacy chip capacity. By dominating this sector, Beijing aims to gain coercive leverage—the ability to choke off the supply of basic components that Western industry requires to function.

- Artificial Intelligence and Quantum Computing: The report frames AI and Quantum technologies not merely as commercial tools, but as the keys to future intelligence and military dominance.

- AI: Despite export controls, Chinese firms like Baidu and Tencent are rapidly advancing, aided by access to vast data pools and a lack of privacy constraints.

- Quantum: The stakes here are existential. The report states bluntly: “whoever leads in quantum (and AI) will control the encryption of the digital economy… and gain persistent advantage in intelligence and targeting”.The Commission warns that China may be concealing its most advanced quantum progress, racing to develop a “Q-Day” capability—the ability to break current encryption standards—before the U.S. can transition to quantum-resistant algorithms.

Weaponizing Supply Chains

The analysis extends to the raw materials of technology. China has demonstrated a willingness to “weaponize chokepoints,” exemplified by its restrictions on gallium, germanium, and rare earth elements.

This moves the competition from purely “who can invent the best tech” to “who controls the inputs.” The report warns that the U.S. lacks “escalation dominance” in this arena; if a trade war escalates to a raw materials embargo, the U.S.defense industrial base could be paralyzed.

Geopolitical Strategy: A Revisionist Order

China’s ambitions extend well beyond its borders. The USCC report details a sophisticated geopolitical strategy designed to displace U.S. influence and construct a network of tributary states and authoritarian partners.

The “Inside-Out” Influence Model

In the Indo-Pacific, specifically Southeast Asia and the Pacific Islands, Beijing is deploying a comprehensive toolkit of coercion and co-optation. The report highlights an “inside-out” approach to influence. Rather than just building roads (traditional Belt and Road Initiative projects), China is now embedding itself in the security architecture of partner nations.

- Law Enforcement: By providing training, surveillance technology, and anti-riot gear to local police forces, China insulates friendly regimes against domestic dissent while creating dependency on Chinese security solutions.

- The Scam Center Pretext: A striking example cited is Beijing’s use of combating criminal scam centers as a justification to deploy Chinese law enforcement personnel into Southeast Asia, effectively normalizing the presence of Chinese security forces abroad.

Economically, this strategy is buttressed by the sheer weight of Chinese trade. As ASEAN’s trade deficit with China doubles, these nations find themselves “chained” to the Chinese economy, making political defiance increasingly costly.

The “Axis of Autocracy”

Perhaps the most concerning geopolitical development is the consolidation of a loose but effective coalition of revisionist powers: China, Russia, Iran, and North Korea. The Commission is careful to note that this is not a NATO-style alliance built on trust or shared values. Instead, it is a transactional partnership driven by a shared adversary: the United States.

China serves as the “economic hinterland” for this axis. By purchasing Russian energy and shielding Pyongyang and Tehran at the UN, Beijing enables these rogue states to survive sanctions and sustain aggressive actions.

- The “Decisive Enabler”: The report identifies China as the linchpin. Without Chinese support, Russia’s war machine in Ukraine would likely stall, and Iran’s economy would face deeper crises.

- Battlefield Testing: The collaboration allows these nations to “refine methods of sanctions evasion and battlefield coordination,” providing the PLA with vicarious experience in modern warfare and logistics that could be applied to a Taiwan scenario.

Security and Defense: The Gray Zone and the Red Line

The report’s assessment of the security landscape is stark: China is preparing for war while simultaneously perfecting the art of winning without fighting.

The Threat to Taiwan

The People’s Liberation Army (PLA) has fundamentally altered the status quo across the Taiwan Strait. The report notes that PLA exercises are no longer symbolic posturing but “actual rehearsals” for invasion or blockade. The introduction of new amphibious platforms and the normalization of median-line crossings suggest that Beijing aims to erode Taiwan’s psychological resilience and reduce the warning time for U.S. intervention to near zero. The internal rhetoric in China has hardened, with state media conditioning the domestic population for the necessity of force, a divergence from its external “peaceful” messaging.

“Gray Zone” Aggression

Short of war, China has mastered “gray zone” tactics—coercive actions that fall below the threshold of armed conflict to avoid triggering U.S. mutual defense treaties.

- Maritime Harassment: The report cites aggressive maneuvers against Philippine vessels and unannounced live-fire drills in the Tasman Sea.

- Infrastructure Sabotage: The severing of undersea cables near Taiwan represents a new frontier of hybrid warfare, targeting the digital lifelines of modern societies.

Cyber Pre-positioning: “Volt Typhoon”

A particularly chilling section of the report details the “Volt Typhoon” cyber campaign. Unlike traditional espionage aimed at stealing secrets, this operation involves pre-positioning malware within critical U.S. infrastructure—water treatment plants, power grids, and transportation hubs. The strategic intent is clear: in the event of a conflict over Taiwan, China intends to unleash cyber chaos on the U.S. homeland, inducing panic and delaying American military mobilization.

Strategic Response: A Call for Economic Statecraft

The USCC report concludes that the current U.S. approach is insufficient to meet the scale of the Chinese challenge. It calls for a paradigm shift from reactive measures to a proactive, integrated strategy. The core of this response is the modernization of Economic Statecraft.

The Proposed “Economic Statecraft Agency”

Recognizing that economic tools (sanctions, export controls, investment screening) are now central to national security, the Commission recommends a radical bureaucratic overhaul. It proposes a unified Economic Statecraft Agency,consolidating authorities currently scattered across the Departments of Commerce, Treasury, State, and Defense.

- The Logic: The current fragmented system leads to enforcement gaps. China exploits these seams, using shell companies and third-party transshipment to evade controls. A single agency with law enforcement powers and intelligence integration could “aggressively pursue violators” and harmonize policy.

- New Tools: The report suggests moving beyond simple sales bans. For high-end AI chips, it proposes a “Cloud Rental” model, where access to computing power is metered and monitored remotely, preventing diversion for military use.

Decoupling and Resilience

The report advocates for “bold action” to de-risk supply chains. It acknowledges that total decoupling is impossible, but “selective decoupling” in national security sectors is imperative.

- The “Quantum First” Initiative: To prevent a catastrophic loss of cryptographic security, the Commission recommends a Manhattan Project-style national goal for 2030 to ensure U.S. leadership in quantum computing.

- Subsidizing Independence: To break the reliance on cheap Chinese components, the report suggests Congressional funding to reimburse U.S. companies for the cost differential of using non-Chinese foundational chips and PCBs.

Strengthening Alliances

Finally, the report emphasizes that the U.S. cannot win a sheer volume contest against China alone. It calls for a “Pacific Islands Security Initiative” and stronger coordination with allies to create a unified economic front. If China weaponizes its market access against one ally, the collective bloc must have mechanisms to absorb the economic blow.

Conclusion: The Era of Total Competition

The 2025 USCC Annual Report serves as a wake-up call, stripping away any lingering illusions about a “responsible stakeholder” integration of China into the liberal order. The Commission portrays a China that is revisionist, risk-tolerant,and increasingly coordinated with other authoritarian regimes.

The key takeaway is that the distinction between “economic competition” and “national security” has effectively evaporated. China’s export of electric vehicles is not just trade; it is the destruction of Western industrial capacity. The export of port cranes to the U.S. is not just logistics; it is a potential vector for surveillance and sabotage.

The report’s recommendations reflect a transition to a war-footing in policy, if not in kinetics. By advocating for a consolidated Economic Statecraft Agency, aggressive supply chain decoupling, and a “Quantum First” national mobilization, the USCC is arguing that the United States must rebuild its state capacity to wage a long-term, systemic competition. As the report concludes, the challenge is not merely to defend the status quo, but to “proactively rebuild U.S.industrial strength, shape international rules, and lead coalitions.” The warning is clear: without a synchronized, all-of-government response, the United States risks ceding the economic and technological high ground of the 21st century.